|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#3061 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

Quote:

One company that still has a lot of room to run and pays a dividend is VIAC. With sports coming back, it should continue to streak. Q1 earnings were excellent and surprised everyone, and it continues to grow its streaming arm. Not a huge dividend, but there is growth there. The banks also provide a fair amount of value at the moment and have decent dividends. I'm in C and JPM. And here's a dividend article from Motley Fool today: https://www.fool.com/investing/2020/...etirement.aspx

__________________

|

|

|

|

|

|

|

#3062 | |

|

"TRF" Member

Join Date: May 2015

Location: DC

Posts: 829

|

Quote:

|

|

|

|

|

|

|

#3063 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#3064 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

Possible rotation away from travel stocks and everything else non-tech that has gone up recently into the tech stocks.

Airlines getting hammered.

__________________

|

|

|

|

|

|

#3065 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

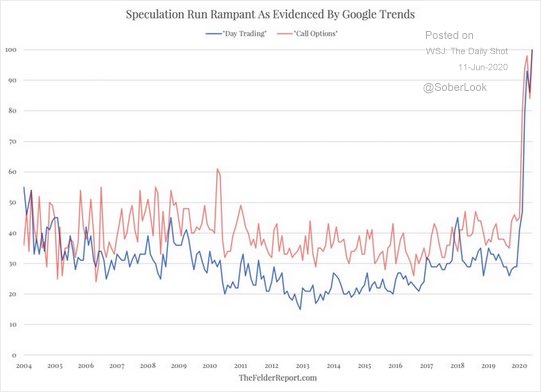

Too much froth like this for me, I am steering clear at the moment, we have run too far too fast. Robinhood is listing all of the retail crowded trades, airlines and travel and bankrupt stocks . . .

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#3066 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

Quote:

I cannot believe what's happening with the companies going bankrupt and their stocks. Same thing with LK. https://www.cnbc.com/2020/06/09/the-...-bankrupt.html

__________________

|

|

|

|

|

|

|

#3067 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

Quote:

|

|

|

|

|

|

|

#3068 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

What was being bought yesterday is usually indicative of tops at least in the short term

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#3069 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

Quote:

|

|

|

|

|

|

|

#3070 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

AMZN going strong today on the price target adjustment. Worth adding here to ride the news train or hold out for a dip below 2500?

|

|

|

|

|

|

#3071 |

|

Banned

Join Date: Sep 2018

Location: California

Posts: 802

|

Anyone speculating in some of the SPACs such as FMCI and OPES?

|

|

|

|

|

|

#3072 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

No

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#3073 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

I added to my positions in AMZN and MSFT yesterday morning - I'm not so sure that I would do that today with Amazon.

__________________

|

|

|

|

|

|

#3074 | ||

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

Quote:

I would not be surprised to see it come back down but this stock can be volatile

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

||

|

|

|

|

|

#3075 | ||

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

Quote:

Quote:

AMZN is just so expensive per share as well; contemplating the options play here for long term to stretch my dollar further, but Iíll sit on that idea for a bit and contemplate. |

||

|

|

|

|

|

#3076 |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Still new to Spac's but been watching and buying here and there FMCI ARYA and MFAC... VTIQ and DEAC made out pretty well so I am hoping these do the same for me (altho i dont own NKLA anymore because I think its too much hype and will deflate so I took my profits.. still holding DKNG because I think they will be very popular)

For some reason I love FMCI's LOI for the plant food based but price is getting further up and even the warrants have become pretty pricey. Of course none of this is guaranteed but I do believe they have a backstop at $10. |

|

|

|

|

|

#3077 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Other than the Fed not much news so far, increasing signs of a top forming

https://www.bloomberg.com/news/newsl...?sref=Hny5JH2p  Quote:

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#3078 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

Quote:

https://www.cnbc.com/2020/06/10/5-th...ne-10-2020.htm On the one hand, we've got a spike in cases across 20 states. On the other hand, Vegas casinos are seeing a larger demand than initially anticipated and are opening up more hotels sooner than initially planned. MGM and others look to shoot today. As has been the case with the rally, good news with maybe even worse foreboding news that many seem to disregard. Very difficult time to navigate the waters.

__________________

|

|

|

|

|

|

|

#3079 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Traders waiting for the Fed and speculators getting slaughtered in the high flying bankrupt names . . .

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#3080 | |

|

"TRF" Member

Join Date: May 2013

Location: Vain

Posts: 5,951

|

Quote:

I wish I bought more Apple |

|

|

|

|

|

|

#3081 |

|

"TRF" Member

Join Date: Nov 2014

Real Name: Kristofer

Location: Los Angeles, CA

Watch: my feet.

Posts: 2,364

|

Really glad I added some extra Tesla stock at the slump! Also bought some Zoom just after stay at home began for shits n giggles, which actually turned out surprisingly awesome.

My weed stocks pooíd up my portfolio really badly but those two choices have brought me back to black!

__________________

No sticker left behind. "Better three hours too soon, than a minute too late." "All we have to do is decide what to do with the time that is given to us." ref. 116520 Daytona - 10/2014 |

|

|

|

|

|

#3082 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Fed says no rate increases through 2022 and stocks take off

Not really sure what this does to fair value but I am not buying anything here, tech is really moving and I am holding onto my positions

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#3083 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,557

|

Quote:

Also not buying at the moment.

__________________

|

|

|

|

|

|

|

#3084 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,116

|

Silly stock market. Rationality has flown out the window.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#3085 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

Not sure how todayís events at the Fed suddenly drive a big trade swing to be honest. Itís basically what has already been anticipated, and Fed further reiterated recession and added that tremendous risk to the economy still exists. To me, Iím not sure how that translates into a huge buy signal for select FOMO stocks that still face big challenges.

|

|

|

|

|

|

#3086 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#3087 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,306

|

|

|

|

|

|

|

#3088 |

|

"TRF" Member

Join Date: May 2018

Real Name: Jared

Location: Westchestah

Watch: 116200

Posts: 814

|

With many casinos closed people need to gamble somewhere. I’m fine riding this market’s trend, until it ends.

|

|

|

|

|

|

#3089 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Quote:

With a spouse in the medical field & my job in pharma, our prospective is different about COVID than many. Death was seen often (mostly elderly & people w/ existing issues) but times were improving noticeable until 1-2 weeks ago. Then add 1-2 weeks of protesting. currently, hospital admissions have been increasing for 1 week in our region and asymptomatic people coming in for checkups and procedures are testing positive. It is spreading kinda fast again. It's a tricky beast as 90 people can be fine, 5 get really sick and 5 die. No rhyme or reason. Now, I have no idea if it will even get the general public's attention but the market Is starting to notice for recreational industries / sectors. I do wonder if DIS will rethink opening next month Or after their opening plans. No idea but that is a Greta litmus. It seems logical is bear down again on some sectors and ride the others that can ride out another possible wave, or set some stop orders to lock in profits and ride out XYZ duration to find value easy again like March & April, or just hold long term. Def a tough call. |

|

|

|

|

|

|

#3090 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

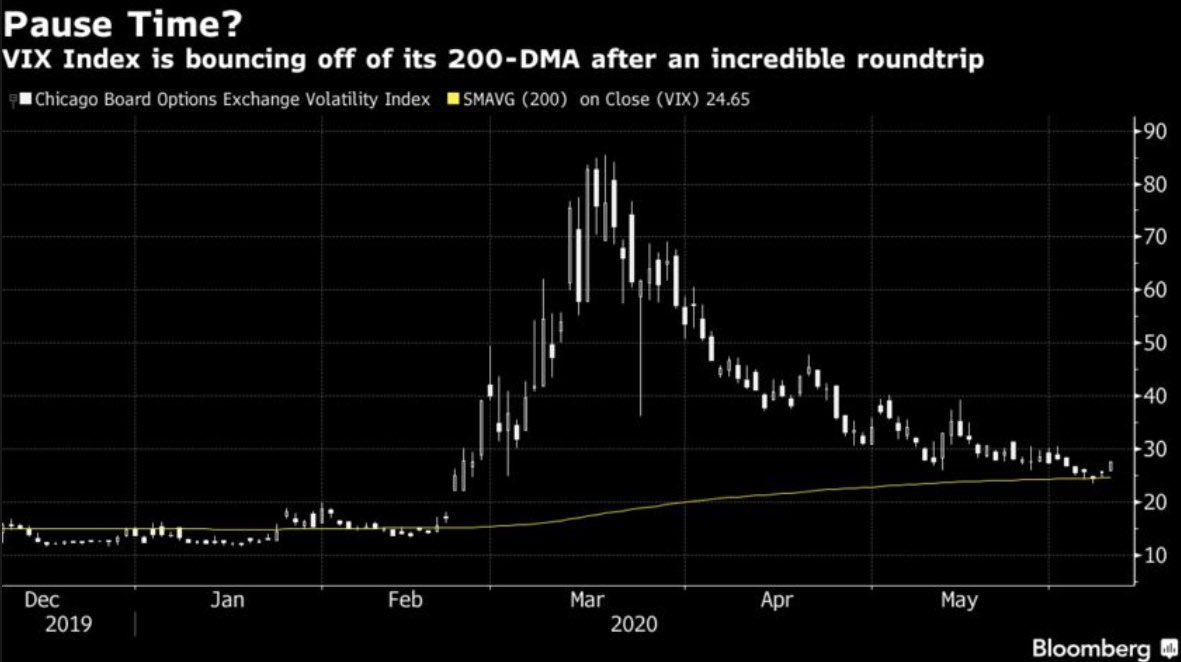

https://www.thestreet.com/markets/5-...hursday-061120 Futures down -562 at 7:00 Clear sign of a top  Interesting chart for technicians

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 2 (1 members and 1 guests) | |

| BraveBold |

|

|

*Banners

Of The Month*

This space is provided to horological resources.