|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#8131 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,243

|

Quote:

I'll be watching closely going into OPEX this week. A close above 20 is going to cut my position in half. |

|

|

|

|

|

|

#8132 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

some interesting possible news on sofi found on reddit

they hired Chad Borton who was previously the bank president at USAA, head of consumer and business banking at fifth third bank and head of branch administration at jpm. possible bank charter around the corner? Chad Borton President, SoFi Bank at SoFi https://www.linkedin.com/in/chad-borton-b520346/ other employees are updating their profiles to include "SoFi Bank" as well also Mizuho bank came out with a $28 price target today |

|

|

|

|

|

#8133 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Gotta love the games analysts play.

Maybe Morgan Stanley has a short position on LCID? 1 day after MS' Adam Jonas puts a $12 w/ underweight target, BoA puts a $30 w/ buy rating. 3 days before Jonas put his $ target, Citigroup put a $28 and buy target . Reminds me of PLTR, DKNG, and others during the last 12 months with 1 2 days apart ratings. https://www.benzinga.com/stock/lcid/ratings |

|

|

|

|

|

#8134 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Quote:

Max pain for options expiring this week is $20 with significant 10,000+ OI. I suspect MM's will try to pin under $20 going into tomorrow, would be great to see $19 hold. I am holding my position until next year at the least, or until A2 data is released and we become SoC. Ideally BO would be great but I believe the stock can organically hit the $30s in time.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8135 |

|

"TRF" Member

Join Date: Oct 2017

Real Name: Eric

Location: San Diego

Watch: Audemars Piguet

Posts: 1,547

|

Finally catching up on all this finance bro activity. Been actively trimming LTC gains to fund my weekly index investments while looking at a select few opportunities to deploy and ride all over again.

Forever long ATEC.

__________________

Instagram: @rough.af |

|

|

|

|

|

#8136 |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,145

|

7sins - do you think the China Evergrande stuff will spill over into our market or will they properly be able to mask it from their side?

|

|

|

|

|

|

#8137 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,243

|

|

|

|

|

|

|

#8138 |

|

"TRF" Member

Join Date: Jul 2021

Real Name: Joe

Location: orange county

Posts: 62

|

BABA stock is a good risk/reward stock if you can stomach the appetite for china's decision making on policies. Fundamentals are great.

|

|

|

|

|

|

#8139 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

FYI…

6:21a ET 9/20/2021 - MarketWatch All 30 Dow stocks fall as Evergrande default fears spark selloff Shares of all 30 components of the Dow Jones Industrial Average are trading lower in Monday's premarket, led by financials, as part of a global equity selloff sparked by concerns over the collateral damage from the potential default by China-base real estate developer Evergrande Group. ————— Michael Burry also posting on Twitter. Not saying I agree with all his views but always interested in knowing the opinions. Note: he deletes tweets every 24 hours or so. This account archives him. https://twitter.com/burryarchive?s=21

|

|

|

|

|

|

#8140 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,131

|

I swore off buying Chinese equities earlier this year. However, if China tanks, the contagion could spill into our market.

|

|

|

|

|

|

#8141 |

|

"TRF" Member

Join Date: May 2018

Real Name: Jared

Location: Westchestah

Watch: 116200

Posts: 814

|

Yeah this definitely feels different than all the other things that seem to spook the market every couple weeks or so. People having been talking about the overheated Chinese property and development market for quite some time. Maybe chickens are finally coming home to roost so to speak. This may be their ‘08. If it is, will surely have knock on effects globally.

|

|

|

|

|

|

#8142 |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,145

|

Jim Thanos and others were talking about the way you actually invest in the West is a farce. You're basically investing in a piece of paper in the Caribbean that is a holding company for the actual Chinese stock. You never truly own the underlying asset of the company. I guess my previous question is coming to fruition with the market literally on a week delay with Evergrande.

|

|

|

|

|

|

#8143 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

|

|

|

|

|

|

|

#8144 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

|

|

|

|

|

|

#8145 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Quote:

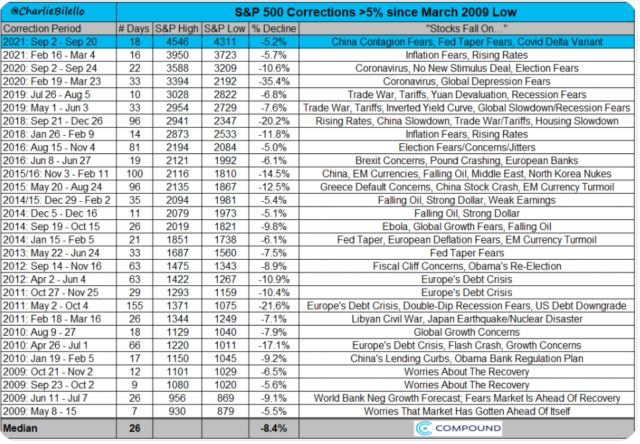

The last point is being the most important with the level of transparency. The market has known for weeks/months now regarding Evergrande's approaching delinquency and debt issues, hence why their bonds were trading for 20c on the dollar. The entire real estate sector is of importance to the Chinese gov, no single company would be viewed as systemically important and so individual company defaults and debt restructuring are highly possible. This also creates some distressed debt opportunities since some of these bonds are pricing in high chance of default (like AMC bonds earlier this year). The owners of this debt are in higher concentration and not widespread with absolutely little to zero impact on American Banks nor the american banking system. I do believe you will see continued volatility but this was an easy catalyst for a pullback in an overheated market looking for excuse. Not to mention the upcoming debt ceiling and rising corporate/personal taxes, the latter being my bigger concern. Good chart below showing any 5% corrections and the number of days along with respective rationale. Notices how the number of days is getting smaller and smaller. This is why I always suggested having LEAPS puts when market is at all time highs and having cash to buy on dips like yest when stocks are oversold. I don't think this will be the end of the volatility we see.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8146 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

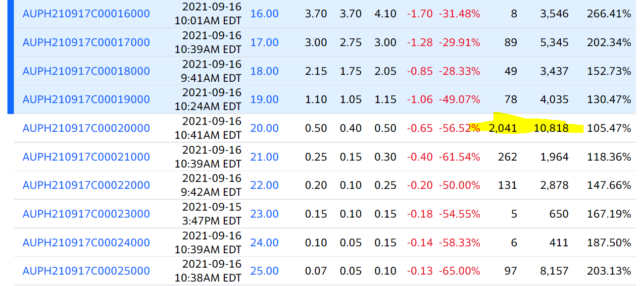

Hope you boys are having a hell of a ride on this $AUPH train. Positive another 15% today, busting through multiple ATHs. Not bad 76% 1MO run, not based on material news and high VOL. Could be one of three things happening behind the scenes. 1. The BO is becoming a reality 2. Scripts are picking up and validation of VOC 3. There are legitimate more potential uses for VOC. Maybe all three but checking the option chain and vol, we are seeing significant positive sentiment and still aren't near analyst PTs.

Also hope some of you got in on those hzac-wt's I was pounding the table on here in the 1.40s. Now back to 1.75 in about two weeks for a bit over 20% return.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#8147 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

Yup. AUPH has been solid together with HZAC. Have stock instead of warrants though on HZAC. |

|

|

|

|

|

|

#8148 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,243

|

It's relief after so much chasing on the way down. Very fat gains realized here with a more reasonable position going forward.

Even more of a ride has been CRVS since last week! Hope some others got in on this one at the lows. Things got moving a little sooner than I expected. Incredible opportunity, good things to come. |

|

|

|

|

|

#8149 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Quote:

Ahh, my .02 but if we see a pullback in the warrants again, consider flipping the stock into the warrants, much more potential upside. Especially before proxy is announced this month or early next quarter.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8150 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Gotcha. Only have 300 shares and was wondering if my couch is hiding more gains in loose change lol.

|

|

|

|

|

|

#8151 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

haha no, I would not expect much if any move in the sp pre-merger and be pegged at $10, you will see more movement in the warrants. Even so, lets say they merge and price goes to $15. That is 50% on your sp, the warrants have a strike at $11.50 and would be an intrinsic value of $3.50 which is about 100% from current price and does not include any premium which would need to be included for a total value of I would suspect ~$4-5.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#8152 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

Got it. Have to call my broker for warrant purchase? Can’t find it in ticker search |

|

|

|

|

|

|

#8153 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Try HZACWS. You should be able to do a warrant search on your trading platform. My broker lists the security as WT08 25HORIZON.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#8154 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,243

|

|

|

|

|

|

|

#8155 |

|

"TRF" Member

Join Date: Dec 2012

Location: Rhode Island

Posts: 63

|

|

|

|

|

|

|

#8156 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

|

|

|

|

|

|

#8157 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

More like luck. Fortunately, I bought some Aug , Nov & Jan calls early last Feb. Bought 9/17 $20.50 puts in late Aug and sold on Sept 1 after their PIPE unlocking. Had been cost averaging down pretty everything LCID in my portfolio during the last 3 months of dips. Started trimming last week & still continuing. Holding on to my common stock though. Definitely had some lessons learnt w/ CCIV & LCID (some really hard though). |

|

|

|

|

|

#8158 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Little fist bump

SoFi initiated with buy rating and $25 price target at Jefferies https://www.benzinga.com/stock/sofi/ratings |

|

|

|

|

|

#8159 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

|

|

|

|

|

|

|

#8160 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Quote:

Anthony Noto: "I would say the biggest game changer for us in the next 6 to 12 months would be the benefit of the bank (license), which will allow us to really differentiate the products and increase the awareness that we have in the US and adoption and the ability to innovate on products even more." https://www.youtube.com/watch?v=xiBecbNwCm0

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.