|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#8101 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

I guess I am the dumb one here. Own it at current price but have sold $10 and $7.5P to lower my cost basis. Will continue to sell puts to hedge |

|

|

|

|

|

|

#8102 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#8103 | ||

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

Quote:

|

||

|

|

|

|

|

#8104 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

I've pulled out my original investment that I jammed as much as I could into hzac-wt in the $1.40s I've been mentioning. I will trim my exposure here into the record date for the spinoff shares but will hold on until probably October and trim along the way. Nothing wrong with trimming exposure on 400% gains.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8105 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#8106 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

AUPH ripping here!! First time in a while I've felt good about loading the boat at 10 on my outsized and underwater position. About to lose half of my shares on covered calls (appx $20 breakeven at opex) but I'm not complaining.

|

|

|

|

|

|

#8107 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

|

|

|

|

|

|

#8108 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

Wish I bought more. Only holding 1K shares |

|

|

|

|

|

|

#8109 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

A gain is a gain, congrats so far! I built a substantial position here as I watched it fall and it took some determination but I greatly lowered my DCA buying just over $10 on what I thought to be unfounded selling pressure. It was rough because PG was saying some dumb shit and leadership was appearing very aloof.

I'm a huge bull on BCRX so it's kind of ironic that AUPH may be about to surpass in market cap what I find as a much better investment opportunity. Now if only CRVS could get its act together I'd be ecstatic about my returns this year. Dr. Miller better be working on good news between now and the end of the year. |

|

|

|

|

|

#8110 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8111 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

Quote:

But I'm also comparing Stonehouse to PG and it's like night and day. I watch these guys at BCRX and every time I buy more. Check out the difference, if you haven't already (highlights at 10, 18, and 24 min to the end of presentation): https://kvgo.com/wells-fargo/biocrys...-inc-sept-2021 Same conference as AUPH's presentation today if you want apples to apples (not as clean as the Wells conference, highlights at 15 and 23 min to conclusion): https://journey.ct.events/view/818ec...c-bf4121e7ca5d Plus, PG just looks like some kind of wizard with that ridiculous facial hair. |

|

|

|

|

|

|

#8112 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8113 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Just out of curiosity, how much powder do you keep laying around for dips? Do you guys keep a percentage or actual amount on hand? My problem is wanting to fully invest so I don’t regret down the road not having put more money into a stock(s). But the flip side is not having enough to buy dips :/

|

|

|

|

|

|

#8114 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#8115 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

I’ll add - the amount on reserve probably depends a lot on whether you are trading vs long holds. A lot of my portfolio is allocated to positions where I’m not touching them for years. If I was looking to predominantly trade then I’d probably keep more cash reserve. |

|

|

|

|

|

|

#8116 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

Quote:

BL: I'm in AUPH for the buyout potential. I'm in BCRX for the long haul. Feel stronger with BCRX than I did about SGEN and PCRX in the early days. Fortunately I have a very low cost basis in the low single digits. But I'm not kidding about buying every time I watch Jon and his team. First in around $3 but I'm still buying today. |

|

|

|

|

|

|

#8117 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Thanks huncho and logo. With Will Meade’s recent tweets about a possible correction soon, I’ll start trimming and holding cash.

|

|

|

|

|

|

#8118 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

On March 9 2021 Will Meade said he sold all his tech holdings as he “saw a bear flag” written in the Nasdaq charts and that another >10% correction was coming. Well, he was half right, just wrong direction. There was a 15% gain in Nasdaq since then. |

|

|

|

|

|

|

#8119 | |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Quote:

|

|

|

|

|

|

|

#8120 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Yeah, Will Meade is iffy. E.g. He was half right about TheScore. Told people to get in just before it moved from OTC to NASDAQ. Some folks got in at $40 taken into account the 10-1 reverse split. Then the IPO happened. Even if you held when he said buy it last Feb because of PENN’s partial ownership, you are still in the red. Now if you bought below $20, it wasn’t likely because of him

|

|

|

|

|

|

#8121 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

still trying to figure will meade out. he does seem to find a lot of small cap stocks before they pump but a lot of his tweets are about gamma squeezes/shorted stocks and i don't like playing that game/chasing those. he's been heavily shilling bbig for months though as well as a few airline stocks (UAL) which i do think is at a pretty good entry now, but i have no cash currently and i don't want to deposit anymore with how the market is right now. waiting to see how bbig plays out and then will probably sit on the sidelines for a bit and hopefully get to use that cash for any correction that might come. i'm 100% out of tech though besides sofi. seeing the nasdaq at these levels and remembering how i was down 30-50% AFTER averaging down into the march dip gives me ptsd lol

|

|

|

|

|

|

#8122 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Totally agree with Huncho.

Same here. I’m out of “play money” not depositing more given the current market state. Now if I didn’t have so much of my “play money” in LCID & LCIDWs. I’m not touching my “long holding” portfolio unless we have a huge dip to avg cost down. Play money for me is risky investments. |

|

|

|

|

|

#8123 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

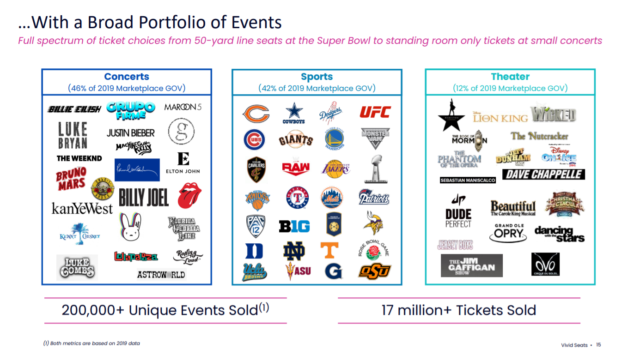

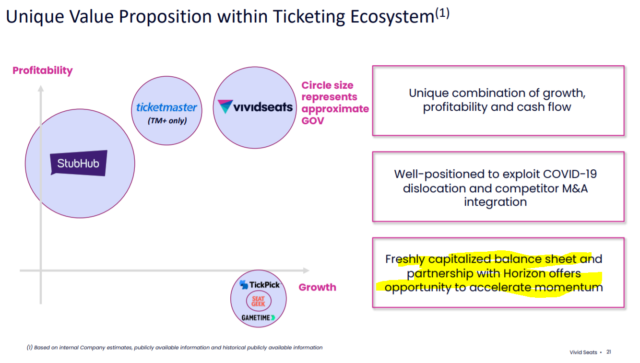

I added to my position here as well. Just an update for you from the ticketing world - at this year's conference in Las Vegas it was presented by processors that Vivid is holding a YTD market share of 40-45%. What this means is any broker who is using automated software to process their sales through their POS (which is virtually everyone unless you are living in the stone age) is seeing this percentage on average. Absolutely astounding Vivid's market share is rising, now for them to translate that into larger earnings |

|

|

|

|

|

|

#8124 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

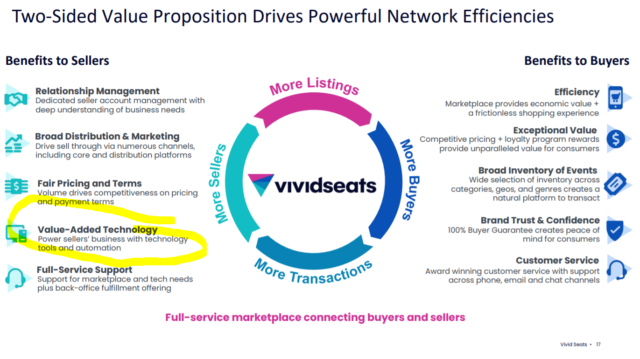

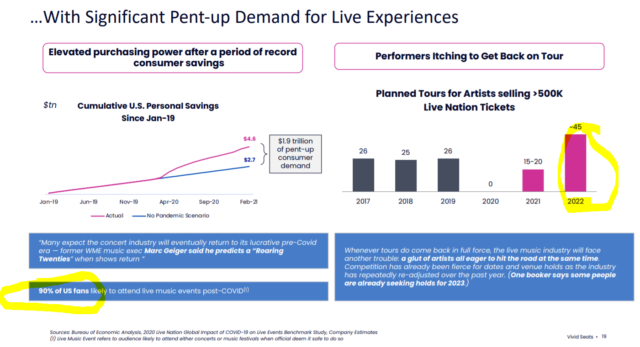

Here's a couple things about Vividseats for those investing in w/o using their ticketing system. Sorry but this will be a long post. However, I think folks should be aware of their NFL product offering if investing in HZAC stock and warrants.

1. Process for selling NFL tickets on Stubhub for a regular user. a) open 2 browser windows: 1. nfl team site (Ticketmaster back-end) to view your tickets and 2. Stubhub selling page. b) on Stubhub pg, select your game & date. on the nfl team pg copy & paste each and every barcode for that event onto the Stubhub pg. barcodes are validated for each seat. c) type in a price and the seats are then listed. d) when tickets are sold, you do nothing. everything is handled for you. e) rinse and repeat pretty much the same steps for Ticketmaster. Very automatic process. very user friendly. HUGE Revenue driver for Stubhub and Ticketmaster = regular people can easily list tickets for sale. no need to be a broker or larger volume seller. 2. Process for selling nfl tickets on Vividseats reg site for non-largeseller users. a) you can't. vividseats.com site doesn't allow you to copy and paste barcodes from NFL team sites yet. it's not supported. LOST revenue here for VividSeats.com I think they need to sign a contract w/ the NFL for the barcode integration like the other 2 companies? 3. Process for selling NFL tickets on Vividseats skybox web site. a) open 2 browser windows: nfl team site (Ticketmaster back-end) to view your tickets and Stubhub skybox site. b) on skybox pg, find the game & date. The user interface is confusing. They do have helpful videos on their support page, On the NFL team pg copy & paste each barcode for that event into skybox seller page. Barcodes are validated for each seat like Stubhub. note: You will need to link your Vividseats , Ticketmaster and Stubhub accounts on skybox. This will allow your listings to propagated on all 3 sites. However, you will need to remove the final letter (usually a K) for each seat in the barcode for the tickets to be listed on Ticketmaster (dumb). https://vimeo.com/333136374/cc33d92483 c) when tickets are sold, you will get an email and manual invention is needed on a THIRD vividseats web site. If sold on Stubhub, it’s automatically handled. d) When tickets are sold on vividseats.com, you will need to visit another site, brokers.vividseats.com. Each site is a separate 1 time Vivid registration. On that site, you need to confirm the sale by clicking a couple links, copy / paste the buyers email address & name, go to the NFL team page and forward them the buyer. Vivid strongly encourages you to take screen shots and attach them to their web site for proof of forwarding the seats. Then go back to skybox and mark the sale complete so it doesn’t show as still active on that site. e) now imagine doing steps 3b to 3d for at least 90 sets of NFL tickets like I have. Plus, I hate forwarding tickets to people via email. Emails get filtered into junk, buyers occasionally have typos in their listed email address, etc... I want my ticket site to handle that especially when they are charging me seller fees (plus buyer pays fees). Random thoughts. 1. vividseats doesn't charge a seller commission for seats sold on stubhub, Ticketmaster, etc... except 15% on their site when using SkyBox (note: they charge non-sellers 10% fees for vividseats sales). maybe they get a small referral fee from ticketmaster and stubhub? obviously, they get the full buyer fee if bought on vivid as stated earlier. maybe a buyer referral fee from ticketmaster and Stubhub ? 2. of the two, stubhub is by far the UI easier to use web site to buy and sell tickets on. 3. some tickets can't be listed on vividseats or doesn't make sense to. so if i list those tickets on stubhub myself, my skybox account will automatically delete those stubhub listings. https://skybox.zendesk.com/hc/en-us/...ideo-Tutorial- 4. as large volume seller, i want to LOVE vividseats (skybox ) but just can't. it's a huge pain in the arse to use and very time consuming. just wondering why i need to watch so many video lessons & use the FAQ often to simply sell tickets. we are not talking rocket science. https://skybox.zendesk.com/hc/en-us/...ideo-Tutorials https://skybox.zendesk.com/hc/en-us 5. I have multiple friends who are licensed ticket brokers in the northeastern states. They like vividseats but also find the seat hard as heck and time consuming to use. They are great to sell concert tickets than sports (in general). My friends and I question Vivid having a 40% market share in anything other than maybe the midwest region for specific events. Concerts maybe? That is big business for for them and Ticketmaster / live nation. In summary, I think HZAC is definitely worth the low risk (especially the warrants) at these cheap prices. I just think (again, in my opinion) Vivid's product still inferior to the bigger companies until they can sign exclusive contracts or maybe merge w/ another company? |

|

|

|

|

|

#8125 |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

I think of the competition between Stubhub and Vividseats this way..

Vivid has been able to deliver the revenue and growth they have by catering to large sellers on their wholesale end. Why have 10,000 individual users that generate 1m in revenue when you are trying to grow when you can have 1 user that generates the same revenue. The 40-45% market share I mentioned is among the secondary ticketing industry, brokers, who are all using processing solutions to manage their POS. This specific industry accounts for north of 200m+ in revenue per year. This is not just a random niche market in the midwest. Viagogo now owns Stubhub which has an absolutely notoriously bad reputation. They have the worst customer service of any secondary site and are a huge pain to work with. The article below shows a settlement of just Ohioans from Stubhub's handling of the pandemic. This was happening nationwide with tens of millions of dollars. Not a company I have much trust in the future to grow. https://fox8.com/news/ticket-reselle...stigation/amp/ Jaisonline is correct. At the moment if you only sell NFL tickets it is much more simple to list on Stubhub, especially if you have not reached Vivid's large seller status of over 10k in revenue per year. But NFL tickets do not only need to be delivered by barcodes. One can easily transfer a season ticket to someone through their season ticket account. What this means is that Vividseats at the moment can decide to allow small sellers to sell NFL tickets via this method but have decided not to as I'd assume they don't have the infrastructure to handle this massive amount of management at this time. They do not need a contract with the NFL to do this. I think Vivid has been doing everything right during their growth and the tides are changing. It has been happening for quite some time now. Their potential for growth is massive while Stubhub seems to be stagnant at the top and having their reputation going downhill ever since Ebay sold them to Viagogo. |

|

|

|

|

|

#8126 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

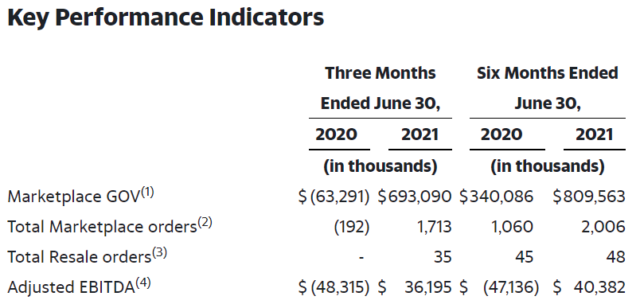

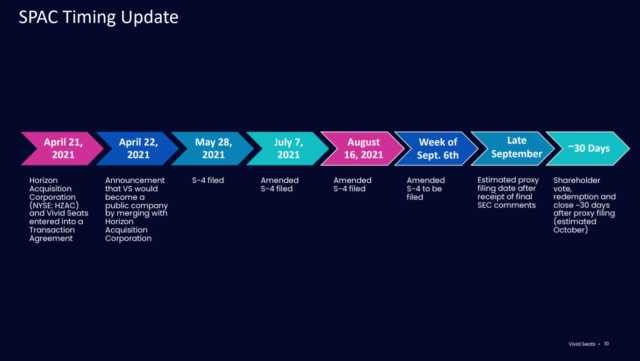

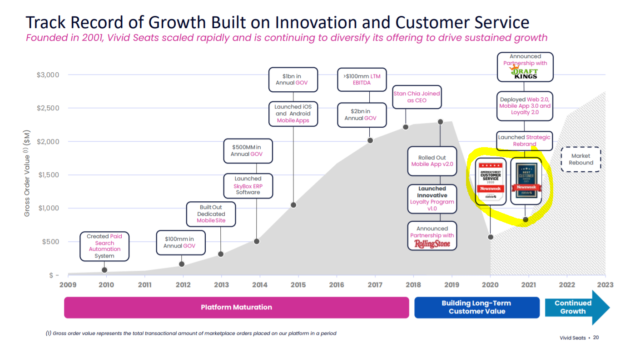

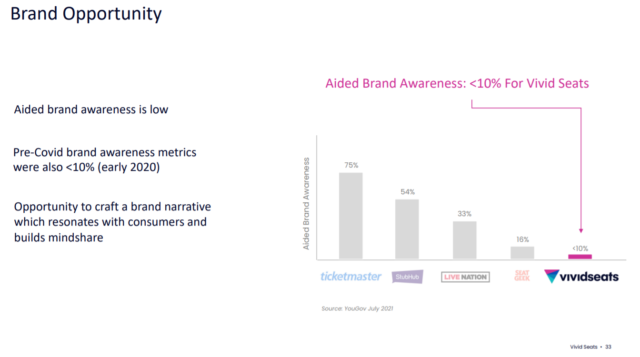

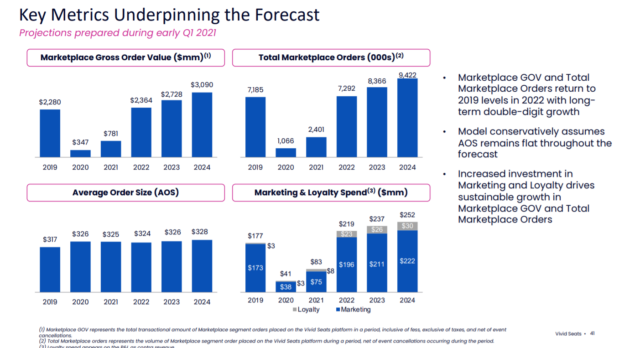

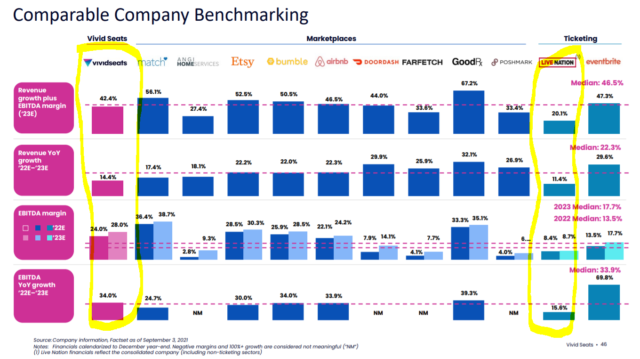

When you sell the same priced ticket on ticketmaster/stub hub compared to VividSeats, does one net you a higher value post fee than the other? It sounds like the biggest issue for VS is their UI which I have to imagine would be an easy fix and something customer feedback would lead to. Pulled from their last S4, their Q2 results were exceptional and above expectations. Noticing the significant uptick in GOV, REV and adjusted EBITDA of 36m (rather rare for a positive EBITDA SPAC). I do believe Delta will probably hinder Q3 results but still seeing packed stadiums and with NFL season starting that should help. Lastly seeing many artists announce tours for 2022 and people can't wait to get out to participate in these events. Assuming no other variant breakout, this poses significant upside as a reopening trade, where most of similar trades are expensive. My real question is, what would make a seller sell on VS over stubhub. If stubhub is easier to use and it is the same net total price received by the seller, where is the incentive for a seller to use VS. Or do sellers have tickets listed on multiple websites and then once filled, take down the other listings with no priority to one or the other? Also looking through the VS investor deck, they have their own reselling team, which perhaps favors inhouse sales opposed to 3rd party sellers?  Their presentation at Canaccord Growth Conference seemed optimistic, I've posted a few slides below highlighting growth factors and why I continue to buy HZAC-WT from an investor standpoint. Can see the full deck here https://www.horizonacquisitioncorp.c...ed-9-11-21.pdf  Room to grow in the theater market, I suspect this grows in 2022 with concert marketshare.  This is the disconnect where it appears their technology lacks the peer group coming from sellers  Highlights the importance of pent-up demand I mentioned earlier showing the demand from consumers for live music and the supply from artists who want to tour which I believe means more tickets for sale and higher GOV  High accolades for customer service and more importantly, building new partnerships during COVID  Using cash from merger to pay down debt and use to leverage to accelerate growth in attempt to capture more GOV from Stubhub  15+ day pay on delivery rollout in Nov  Substantial progress with their new app launch that is driving mobile sales  Another opportunity for VS to gain more GOV and Revenue by increasing brand awareness. Higher capture here will lead to more sales and as consumers search for tickets next year, I imagine VS exposure and brand awareness has to grow.   These are 2022-2024 estimates which I think are low. I imagine 2022 GOV, and Total Market Orders will be much higher than 2019. So should the AOS as demand increases.  From an investor standpoint, when we compare VS to LiveNation, below shows higher Rev Growth with better EBITDA margins. The downside is their EV/Revenue is higher than LN but I suspect this changes in the next year or two as sales ramp up.  Anyways, this was a very long winded answer. I see plenty of upside and growth from an investor perspective. It concerns me the difficulty for sellers to sell on VS and how much will that deter them in the future. Regardless, these warrants at sub $1.50 have relatively low risk with I think potential great upside when we return to normalcy. At the very least, warrants should run up in value once proxy announced per the first slide. I'll probably trim exposure at merger and see if the stock declines similar to others after they de-spac. Just my .02 but I think as an investor you have a company poised for substantial growth, POSITIVE EBITDA, relatively inexpensive and a strong balance sheet after merger. I've been posting often on here buying and loading the truck on any warrants I can buy sub $1.50 which has amassed a large size position for me.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8127 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

I prefer my tickets to sell on Vivid as I will receive more money, but the name of the game for me is exposure. I want to capture a sale, so I list my tickets on every marketplace. My tickets are listed on Vivid, Stubhub, Seatgeek, Ticketnetwork, etc. Once the tickets sell on one site, 1Ticket (a processing service I use) removes the listings from all other sites instantaneously and processes the sale. I don't see why any large seller would exclusively sell on one vs the other as you are just missing the opportunity for a sale. Now I know of some people marking up the price of their inventory on one exchange vs another in order to make up for the difference in the exchange rates they receive. I have marked inventory up a few percent at times and have still received a good volume of sales. |

|

|

|

|

|

|

#8128 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8129 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

But as far as stopping selling on Vivid’s site goes, I would never do that unless I was worried about them being in financial trouble and not being able to pay me. I want to be on every major ticket exchange to increase my likelihood of a sale. My business is a large scale operation so I hire staff to deal with the fulfillment end of delivering tickets to Vivid, Stubhub, etc. I sell everything from concert tickets, NFL, NBA, theatre, NCAA, and so on. One site being slightly more time consuming to fulfill an order is not something I am concerned with as long as I am continuing to generate revenue and increase my cash flow. I give free rein to Vivid, Stubhub, Seatgeek etc. to sell my tickets and whichever site is able to generate the sale gets my commission. And for the past few years Vivid has been dominating |

|

|

|

|

|

|

#8130 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

Dipping into the HZAC warrants here, thanks for the inside details from sellers on your experience.

Probably a dumb question, but for you with volume businesses where do you get your ticket supply? I always assumed these sites were for the average Joe season ticket holder to post tickets for the games they couldn't attend. Are you sourcing hard to get tickets at retail and flipping? With the commissions these resale sites charge I'd be worried about buying high and selling low as well. |

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.