|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7021 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

I follow a few threads on this topic on various public forums including reddit. They are all filled with good take away info but it does not mean it is without noise. One of my best trades last year came from Rennlist where I came across one of the APPS founders and bought in at $5.80. That thread has since deteriorated but we still keep in touch and share ideas.

There is no right or wrong way to invest; only what is right for you. Who is to blame if you take an investment advice from strangers on a public forum and have it go south. Financial advisors also come in all different shapes and sizes so just because some person barely passed a certification exam does not make them an expert in the field. 7sins graciously and selflessly offered his knowledge here and I appreciate him taking the time and effort to do so. He is great and has a lot to offer to people who want to expand their tools in their financial management tool chest. One can always skip his post if you donít want to learn as there is no quiz on this next week. There is a statistic that only 14% of people who trade individual stocks also trade options. Option trading is an excellent tool to manage your long position risk if you do it a certain way or if you can just trade them naked as the risk and reward correlates with your decisions. I read othersí opinions and take away what I agree with and leave what I donít. Why would some clairvoyant economic financial genius find him/herself as a staff writer on CNBC or another financial rag? We are all putting our money where our mouth is here but what works for me does not mean my portfolio management beta or asset allocation thesis is for everyone else. Good luck all |

|

|

|

|

|

#7022 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

Quote:

Good luck all

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#7023 |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

I'm pretty sure nobody was aiming "reddit" comments at 7sins.

|

|

|

|

|

|

#7024 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

If it’s my posting asking questions about things that made it feel Reddit like then I sincerely apologize as that wasn’t and isn’t my intention. I’ve been lurking to educate myself on stocks and to expose myself to different stock recommendations by the other investors here.

7sins, jpeezy, beshannon, and others...I hope you all still contribute. I really do appreciate everyone’s post (bull or bear) within this thread as I’ve learned a lot and my portfolio thanks you all. |

|

|

|

|

|

#7025 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Gentlemen, at the end of the day this is a discussion board. We can’t control who posts what, and must remember there are members here with investing experience ranging from nothing to expert, so not every post will contain top-level analysis, and many times the most basic question a new investor has is simply “what do I buy?”. Perhaps not helpful, but an opportunity to educate. For those experts posting, it goes without saying that I, and many others are very grateful for your posts. There are several members here who have put a lot of time into this thread to provide a great deal of insight to the overall market, trading, strategy, technicals, options, new stock picks etc. The board turned into Reddit because that’s what the market (and really the whole world) was doing at the time - when there are billboards in Times Square, it’s not just a matter of our Talking Stocks thread. To me, that is a time for further analysis and commentary, because as much as the market and world has been crazy, it has also been extremely easy to lose your money the past few weeks if you are new to investing and chasing.

We are lucky to have such a broad array of members here with different backgrounds to contribute to this thread in different ways, and I hope to see it continue. |

|

|

|

|

|

#7026 | |

|

2024 Pledge Member

Join Date: Aug 2010

Location: Baltimore, MD USA

Watch: 116509

Posts: 136

|

Quote:

|

|

|

|

|

|

|

#7027 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

|

|

|

|

|

|

#7029 | |

|

"TRF" Member

Join Date: Dec 2017

Real Name: Matt

Location: UK

Posts: 1,236

|

Quote:

I donít post in this thread as frankly I have nothing of value to add but Iím sure there are lots of lurkers like me out there who feel the same way. |

|

|

|

|

|

|

#7030 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

This thread is NOTHING reddit-like and thank goodness for that. I donít see people pumping stocks or scheming to plot. I see many insightful posts about strategies, theories, links, articles, etc...

|

|

|

|

|

|

#7031 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Please don't stop posting. I just think the last couple of up & down weeks plus quite a few ďwhat do you think about company ABC ď posts have made people a little grumpy.

Quote:

|

|

|

|

|

|

|

#7032 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

I truly think that we all benefit from each other's insight, and because of that, I (and hope others) will continue to post thoughts on the state of the market.

I'm sure we all get burned out and things can get frustrating at times, just like any other board/thread, but at the end of the day, this is one of the most helpful threads out there for all. Thanks to all that have provided their thoughts here.

__________________

|

|

|

|

|

|

#7033 | |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

Quote:

Thatís awesome to hear! Youíve been extremely helpful with your insight in FSLY, APPS, and MGNI. And 7sins is the only person thatís made me feel like I fully understand basic options even after the numerous articles Iíve read online. You guys make this thread what it is and as a 25 year old beginner trader I am grateful for all the informative posts. Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#7034 |

|

2024 Pledge Member

Join Date: Feb 2013

Real Name: Ryan

Location: DMV

Watch: LVc

Posts: 2,035

|

I am very grateful for the insights that have been shared here, and hope you guys will continue to contribute.

This forum has been a tremendous resource during a very difficult year and I hope it will remain so. Thank you sincerely to all who contribute here. Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7035 |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,151

|

I used 7sins tactic for put spreads to hedge my big position in a certain stock. It saved me a lot of money last week. He's my Allstate!

|

|

|

|

|

|

#7036 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

Thank you everyone for the kind and endearing words, they certainly do not fall on deaf ears. Also timely since I am almost finished with part 3 of my next write-up and was debating posting it. Nothing provides me more gratification than helping others and providing you the resources, knowledge and tools to have an even playing field with professionals. There are several others on this thread that provide great insight as well, a welcomed variance of opinions that will continue to make this thread great and I value their thoughts along with time that goes into their commentary.

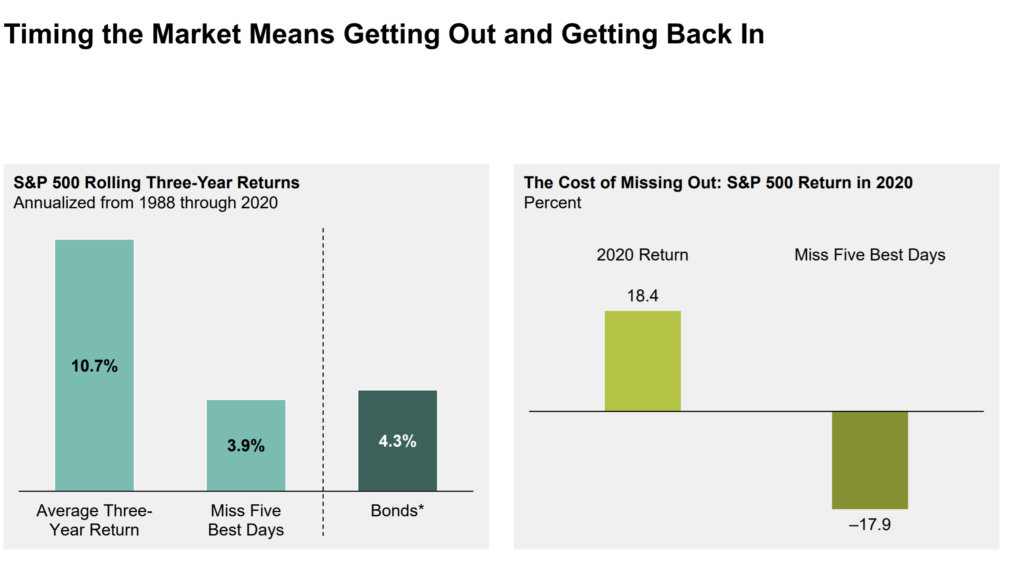

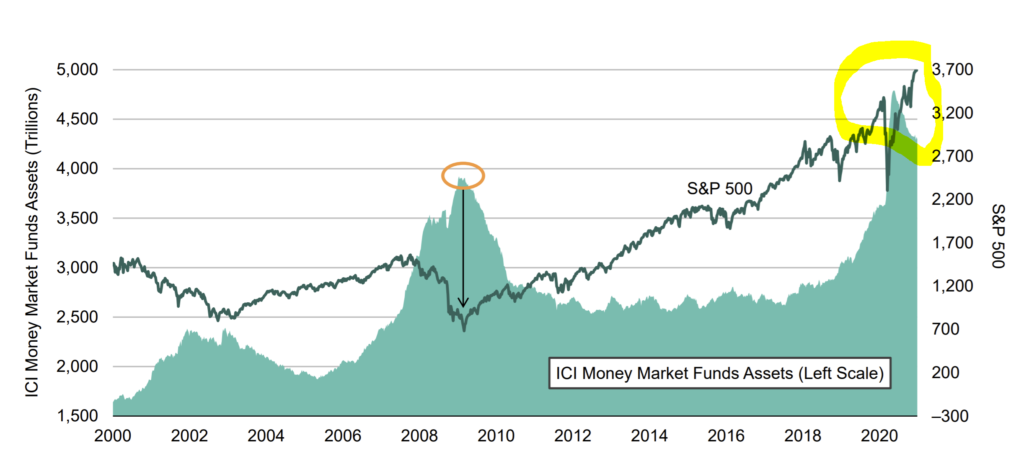

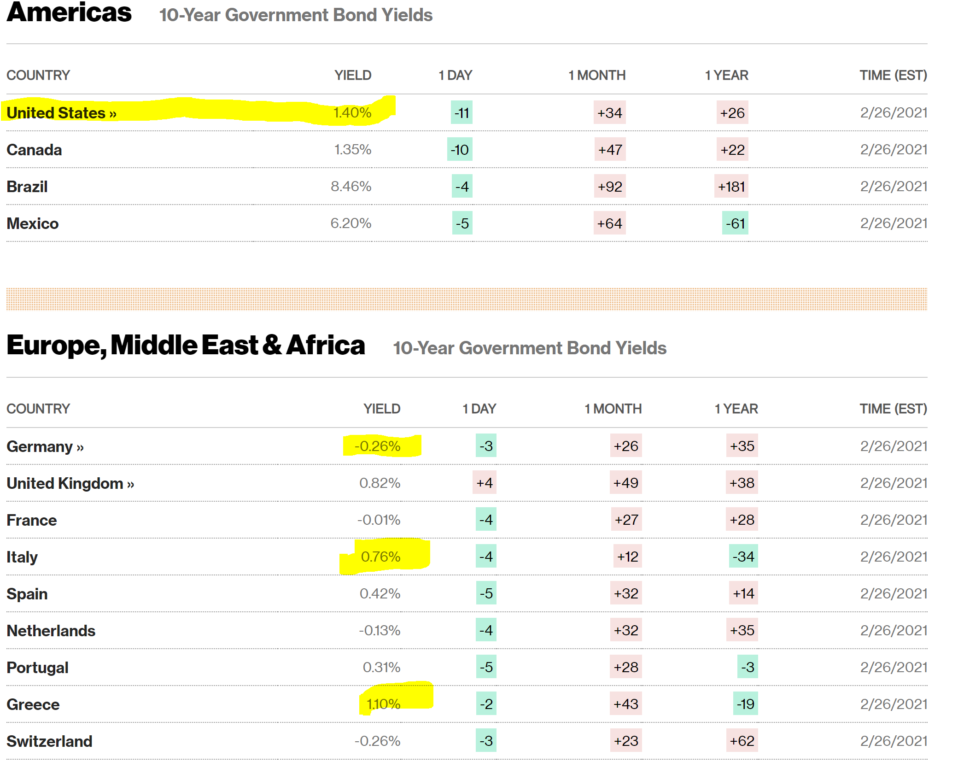

As a financial consultant with multiple securities licenses, I work with advisors clients to achieve their financial goals ranging from sending their child to Harvard to financing a helipad on a yacht through portfolio construction. Point being, is we all have goals and I believe, collectively, we can all help each other achieve our goals. Most importantly, I want ALL of us to get our grail watches, that is after-all, our commonality on TRF - as watch enthusiasts. All my posts are for your education, to learn and provide as many arrows in your quiver to generate Alpha, I have no financial responsibility for any trades you make and always suggest doing your own research. With the aforementioned out of the way, I know it was an utter bloodbath for us last week, which is why I mentioned in older posts you should ALWAYS have long put positions in over-valued stocks to offset volatile weeks - especially when the market is near all time highs. My personal opinion, this is a better option that shorting where the cost to short can be astronomically high. To put some of your nerves at ease, when talking with my clients, I use the two below charts to remind them the importance of STAYING INVESTED. People always try to time the market and the first chart below shows you how detrimental that can be to returns. The left chart shows annualized returns back to 1988, average three year returns is over 10%, if you missed JUST THE BEST 5 DAYS you return was 3.9% annualized, underperforming bonds. Same holds true for 2020 and I firmly believe going forward, if you missed the best 5 days in 2020 your return was NEGATIVE 17% compared to the SP500 return of 18.4%. This should be eye-opening for the novice traders, have a plan, stick to it and make sure you have volatility layers in your portfolio. At a later post I will explain portfolio construction, options only account for 40% of my portfolio however I have a long time horizon and aggressive risk profile given my age.  Second, this chart shows you the amount of cash sitting on the sidelines which I think is vital when you think about "how much fuel is in the tank" for the equity market. The amount of cash on the sidelines is at historic highs, that means when that money is put to work that will bode well for the market.  Lastly, A LOT of talk about 10yr rates, remember from my old posts the FED does not control this directly, it is driven by supply and demand - FED controls the ultra short part of the yield curve. The FED does NOT want rates to go higher. Why? The higher rates go, the more they will have to pay in debt servicing cost, it is in their best interest to suppress rates. Here is what no one else is talking about that they should be. Sovereign 10yr Developed Market Interest Rates are at incredibly low levels. Germany NEGATIVE 26bp, France negative 1bp, Greece which was and is on the verge of bankruptcy is 40bp LOWER than the US 10yr. If you are a foreign investor, would you prefer 150bp in a US treasury or Negative 26bp (currency hedging costs are low)? As rates rise here, foreign demand will rise and more money will come into the treasury market keeping a lid on here domestically. Also as rate rises, they become more attractive to other investors/pensions where 150bp is certainly more attractive than 50bp a few months back. The velocity of money here is important, and this is nothing like the taper tantrum in 2013 where the 10yr went from 1.5% to 3%.  Some absolute fire sales last week, I was a heavy buyer into weakness last week and will continue to be next week. It is completely healthy and normal for these markets to go through these phases and consolidate. My best advice is follow 15-20 companies, know them IN AND OUT, follow them every day and you will know what prices you should be buying into. IE I've been following VMW recently, I posted a few weeks back to buy after the stock dropped 10% because the CEO left to intel and the market punished them for it. Stock rallied back the next week and suggested to exit. Now stock is back down again after a killer earnings, I am adding on every dip, as I firmly believe this is going higher, the market is not pricing, AT ALL, the anticipated spinoff from Dell in Sept. I'll post more on this at a later date but I would keep this on all of your radar.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7037 |

|

"TRF" Member

Join Date: Jul 2014

Location: Los Angeles

Posts: 137

|

I think once the "reopening trade" plays out and we see rotation out of the "stay at home" trade, we're going to see the realities of where we're at in the market. We're way overbought and we're due for a nasty correction in the order of 20% or so. I think it's going to catch a lot of newbie investors by surprise. Difficult to ascertain when though.

Really interesting points made here: https://youtu.be/2g8PawZIRrk Not saying I necessarily agree with every prediction or metric, but definitely a kernel of caution to employ. Would not be getting overly aggressive in these conditions. Or at the very least, hedge like crazy with puts. |

|

|

|

|

|

#7038 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Mar 2013

Real Name: Kevin

Location: Cape Cod

Watch: Submariner 114060

Posts: 1,915

|

Long time lurker. My focus is growth and value stocks and how dividends play into it. Iíve taken advice and listened to my heart and have built what I think is a good portfolio of about 20-25 stocks.

My apologies to the options folks, Iím just not going that route. Maybe my mid-50ís age : ) is showing through. Iíve learned to buy and hold and protect my profits with stop orders. Iíve been chugging along but really the advice has been a bit stale for me over the last few hundred posts. I love you all but really leaned in on bshannon and jpeezyís advice, whether they knew it or not. 7sins, a wealth of knowledge, would love your continued insight on building/parsing stocks for a portfolio as well. In case you are worried Iím not going anywhere. Haha. Iíll stay and pick from scattered tid bits. A few asks since I got the courage to post, do I buy back more FSTLY? I sold half and have been riding on mostly profits left in. Do I simply hold on to those or buy back in with some of my profited capital? What about BA, CRM, are they good buys? I recently got sold out of BA due to stop in place and now it see it leveling off. I had WORK and sold after it shot up, and now that CRM has dropped, it seems like a good time to buy CRM? What about COP. I think I know what to do: put a stop in place to protect my profits and keep holding, right? Thanks again. |

|

|

|

|

|

#7039 | |

|

"TRF" Member

Join Date: Jul 2014

Location: Los Angeles

Posts: 137

|

Quote:

Good example. Everyone likes AT&T for the obvious yield. Buy 100 shares, and immediately sell the $30 covered call for Jan 2022. Be paid to wait for the stock to go up $2.xx *if it even can. Worst case you get paid to sell your stock at a profit, all the while collecting the DIV. |

|

|

|

|

|

|

#7040 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

Quote:

Great thought on T and thank you for sharing. It is a good example on a covered call for a stock that trades in a small channel which is great for a CC - I try to find higher IV stocks that can generate more income but the higher DIV helps here. For those reading, thought I would further elaborate to help everyone who doesn't under CCs and explain a few different scenarios for other things to consider on this trade that highlights my last how-to on CC so others can see ALL sides of this trade and clarify the underlying risks so everyone can better understand how they work. The actual worst case is the stock continues to decline, which is plausible considering the obscene amount of debt they have (record high $190B+ debt, with a struggling stock could mean a possible DIV cut), however as they sell DISH to lower debt and continue their 5G play there could be upside from here. Plus T usually trades in a rather small price channel, which is at the bottom of now. The first thing to consider is IV is VERY low for T, which means you will not collect a lot of income for writing the covered call. Jan 2022 $30 CC is only $1.43. Using your example of 100 shares: 100 shares x 27.90 = $2,790 cost to purchase the shares Only generating 1.40 for each contract you write (100 shares) which is $140 as a net credit which is pretty minimal for a contract 10 months out. So even at 1000 shares, or $27,900 cost you only generate $1400 of income, which is roughly 5% (not too bad). Now to your point, the 7% DIV is significant as it lowers the stock price (when a div is paid it reduces the stock price from that amount) assuming the stock doesn't get called away from you as then you would no longer receive the dividend. Worst case scenario is the stock drops substantially, lets say it declines further to $24, that would represent a 9% loss including your income from the call not including dividend, so net a 2% loss. If it trades flat at $27 until expiration of your calls, you net 1.8% including the income from writing the calls not including the dividend you received from owning the stock. So that begs the question of opportunity cost, for a stock that doesn't move much, pays very little to write the calls, are there better opportunities out there? For a lot of investors and their risk tolerance, this could be a great play to initiate a few % if the stock trade sideways. Besides opportunity cost, on the other side of the trade, if the stock rises dramatically above $30, you will miss out on the upside as your stock gets called away. Lets say it moves above $30 quickly, then stock gets called away which means you don't receive the quarterly dividend. Then you profit between your stock price purchase and $30, which net after short term cap gain tax will be small plus the income from writing the call which would also be small (due to low IV). Which you can hedge by buying OTM calls with a portion of the income from writing the call. To your point, highly unlikely T trades above $30, which makes it an interesting play as long as it doesn't further drop (which I agree is unlikely) since there seems to be a brickwall at $30 - a obscure amount of option buying and OI above $30 though. Just goes back to my question, does an investor feel comfortable putting cash here to work for this type of return or are there better opportunities and what is the role of that intended cash allocation. The other thing to consider for those reading this, is if you write covered calls against existing stock you have bought previously and it gets called away, this will trigger a sale of your stock which will be a capital gain tax - less than one year is ST and longer than one year is LT, two different tax brackets plus state tax. This can dramatically reduce your profit and something else to consider. I like to write-covered calls on stocks I want to sell, sometimes ITM, which triggers the stock to be called, thus I get PAID to sell a stock I was going to sell anyways (assuming no sharp decline) which I covered in my last Covered Call guide here. When you trade options, no matter the play, you have to think through each possible outcome then plan how you can hedge against it if the trade starts working against you.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7041 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

Quote:

FSLY guidance was weak, earnings missed badly. The chart is weak. BA while a possible long term performer still has many near term challenges, no dividend, fines, reduced order book and now new inspections. The reopeniong trade wont help here because the deliveries are too far out. CRM had a solid earnings report, reduced guidance but the trend is slowing. The valuation is rich but I believe it is a good long term hold. I am long CRM COP like all energy has been doing very well lately. Will this continue? I am long COP mostly for the dividend though the company is well run and a solid performer even in tough times. I am long COP. I am also long XOM, KMI, AM and CVX J&J Vaccine, Walmart, AMC and NIO - 5 Things You Must Know Monday https://www.thestreet.com/markets/5-...-monday-030121

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#7042 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Quote:

I do think Fastly is an interesting name and could still be solid in the future, but I think there's too much competition to ride them as my go-to cloud stock or whatever you want to categorize them as. I've also come away a but underwhelmed by the CEO, which is a departure from my original feelings.

__________________

|

|

|

|

|

|

|

#7043 |

|

"TRF" Member

Join Date: Apr 2010

Location: DC

Watch: Daytona

Posts: 2,698

|

Love this thread. I prefer to be a silent learner. I have been focused on US airlines particularly AAL and UAL. I would like to see a takeoff however with diminished to no business travel until 2022 I expect some turbulence on the ascent back to pre-pandemic levels.

Pardon the metaphors.

|

|

|

|

|

|

#7044 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

From Bloomberg Terminal

ďDoorDash, IPO Underwriters Agree to Early Release of Some Lock-Up Pacts DoorDash: Lock-Up to End on 40% of Shares Covered, or 20% if Held By Board, Management DoorDash: Shares Will Be Eligible for Sale in Public Market at Open of Trading March 9Ē |

|

|

|

|

|

#7045 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

|

|

|

|

|

|

#7046 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,099

|

Quote:

Do it as a trade, as vaccine hopes bring the segment back up, but that's all I'd recommend.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

|

#7047 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,099

|

FWIW, after losing my shirt last week shorting CCL, I'm long this morning hoping on a J&J vaccine pop.

I'll be out by this afternoon. It's still a garbage company in a garbage industry.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#7048 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,099

|

Quote:

Hey, want a $1M portfolio? Start with $2M and do what I do.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

|

#7049 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

MELI reports at close today, with SE reporting tomorrow before open.

Two of my top holdings, with e-commerce only getting stronger over the next few years, while also providing exposure to overseas markets. I'm adding on any significant weakness, even if I'm already very heavy in both.

__________________

|

|

|

|

|

|

#7050 |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,267

|

|

|

|

|

|

| Currently Active Users Viewing This Thread: 7 (0 members and 7 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.