|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#8941 | ||

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

Quote:

https://www.occ.gov/news-issuances/n...cc-2022-4.html So I guess itís going to $9 tomorrow?

|

||

|

|

|

|

|

#8942 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#8943 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Quote:

Some good news for my portfolio. Thanks for sharing the link. Other than sofi and lcid 1/21 & 1/28 Puts today, tough day. Rough. |

|

|

|

|

|

|

#8944 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

Hence my ultra conservative buy. Its still in the money baby! |

|

|

|

|

|

|

#8945 |

|

"TRF" Member

Join Date: Apr 2018

Real Name: Russell

Location: Moses Lake

Watch: 216570 Polar

Posts: 282

|

Silver Linings, itís almost tax return season and if the market keeps plunging I get to buy at discount :)

Sent from my iPhone using Tapatalk

__________________

Polar 216570 ElPrimero Oí69 Nomos Tangente Hamilton Khaki Sub 114060 |

|

|

|

|

|

#8946 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

well it took < 1.5 days to go from -40% back to green on sofi. finally some hope back on the table

|

|

|

|

|

|

#8947 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Not to mention the runup we should see into ER on 2/9.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#8948 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

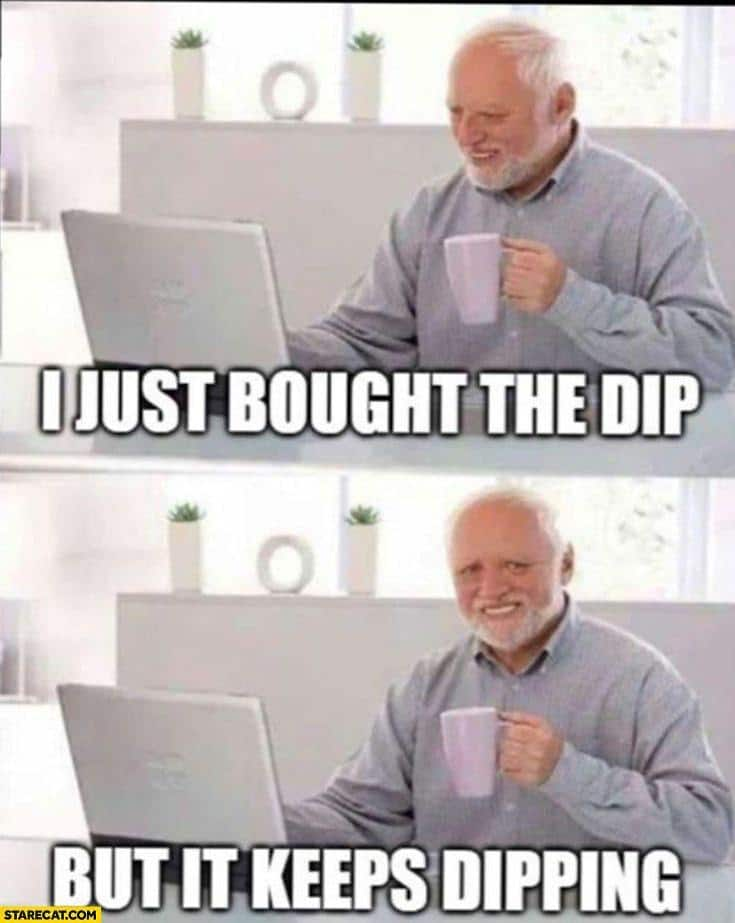

Man, markets refusing to hold gains it seems.

|

|

|

|

|

|

#8949 |

|

"TRF" Member

Join Date: May 2014

Real Name: Felix

Location: GMT +1

Watch: Yes!

Posts: 2,975

|

Indeed.

|

|

|

|

|

|

#8950 |

|

"TRF" Member

Join Date: Oct 2018

Location: /

Posts: 1,735

|

Anyone that owns GEVO stocks? Have taking a bad beating with that stock. The whole green sector is slaughter it seems…

|

|

|

|

|

|

#8951 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Wow, garbage close.

|

|

|

|

|

|

#8952 |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

|

|

|

|

|

|

#8953 |

|

"TRF" Member

Join Date: Oct 2018

Location: /

Posts: 1,735

|

|

|

|

|

|

|

#8954 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

|

|

|

|

|

|

#8955 |

|

"TRF" Member

Join Date: Dec 2011

Location: Marietta, GA

Posts: 3,248

|

|

|

|

|

|

|

#8956 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

netflix -20% after earnings even with squid game. think we're gonna finally see the streaming bubble pop

|

|

|

|

|

|

#8957 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

nasdaq is now as oversold as it was in march 2020, considering the amount of panic i remember from those weeks it's just insane to think about

|

|

|

|

|

|

#8958 |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

|

|

|

|

|

|

#8959 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

personally not buying anything right now but that's primarily because i don't really have capital. i'm not in too many positions as is and my biggest bag is crypto but i can't rotate from there to stocks because that market is down 40%+ from highs. just gonna sit on the sidelines and wait for a bounce and hope its just an overreaction. i definitely thought we had a few more months left and wasn't prepared for this. have a few smaller positions in tech that are basically dead at this point that i bought during oct/nov "corrections" lol

|

|

|

|

|

|

#8960 | |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

Quote:

Riding it out because I have no choice! |

|

|

|

|

|

|

#8961 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

To be completely honest, Iím a bit nervous here. Bonds/rate hikes are one thing, and they donít phase me much. But, the selling has gone beyond that, for two months now (soon to be ďofficiallyĒ a bear market) and VIX hasnít really heated up yet. Iím already getting emails from my hospital to prep for COVID wave 5, more boosters etc, and while remaining completely objective and unpolitical, there are global tensions, and polls indicate national confidence is low. There isnít much to sustain a short term rally at this point, and one bad move could turn the market further South short term. Need to tread lightly short term. |

|

|

|

|

|

|

#8962 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

i guess we'll see during the next fomc meeting (next week i believe?). i generally try to stay optimistic but at this point the damage has been so severe it hurts to think about lol |

|

|

|

|

|

|

#8963 | |

|

"TRF" Member

Join Date: Sep 2017

Location: Miami, FL

Watch: Tudor & Cartier

Posts: 2,497

|

Quote:

Let's hope this shakes off sooner rather than later. I need access to some capital and I aint touching it 30% down

__________________

"Chi ha paura muore ogni giorno, chi non ha paura muore una volta sola" - Paolo Borsellino |

|

|

|

|

|

|

#8964 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#8965 |

|

"TRF" Member

Join Date: Nov 2019

Location: USA

Posts: 720

|

|

|

|

|

|

|

#8966 |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Another day, another eod sell off… treading some rough water.. hang in there boys

|

|

|

|

|

|

#8967 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

|

|

|

|

|

|

#8968 |

|

"TRF" Member

Join Date: Jun 2020

Location: michigan

Posts: 2,286

|

Today sucked, but as i went through purging my portfolio, there were only 2 I sold and reinvested the money into other stocks that took 10%+ hits today. The only thing I really messed up on was rivian. And idk if theres any recovering it, but I can't bring myself to sell where my position sits.

My precious metals are fairing well this week atleast. |

|

|

|

|

|

#8969 |

|

"TRF" Member

Join Date: Jun 2020

Location: michigan

Posts: 2,286

|

|

|

|

|

|

|

#8970 |

|

"TRF" Member

Join Date: Apr 2017

Location: NJ

Watch: 126600, 79220N

Posts: 255

|

Absolutely brutal day. Biggest one day drop in my portfolio in quite some time. Hoping we are nearing the bottom as I am out of cash and prepared to ride this out. If we can get some good earning in the coming weeks, will look to selectively exit some plays.

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.