|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#6541 | |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,148

|

Quote:

CNBC stated there was like 10 million new retail accounts created in the last 3-4 months I believe. I always liked the "when your uber driver gives you stock picks" one lol. |

|

|

|

|

|

|

#6542 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

If and when these meme stocks come back down to planet earth how will the impact the market as a whole? I’m contemplating whether things will go back to business as usual.

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#6543 |

|

2024 Pledge Member

Join Date: May 2011

Real Name: Duey

Location: Maui

Watch: Too Many To List

Posts: 3,575

|

Good little read here - https://www.cnet.com/personal-financ...erry-are-next/

This is true insanity - When anybody and everybody is marking money in the market it's time to get out. |

|

|

|

|

|

#6544 |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,267

|

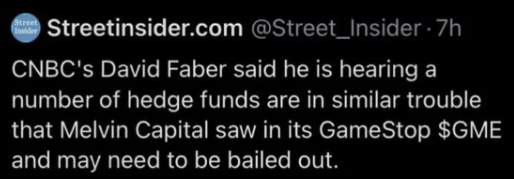

|

|

|

|

|

|

#6545 |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,148

|

Just updating here. WSB discord channel server has been taken offline. The WSB reddit channel has went into private mode lock down. Only mods can enter.

Now lets look into the hedge fund channels. |

|

|

|

|

|

#6546 |

|

"TRF" Member

Join Date: Oct 2020

Location: USA

Watch: The Citizen Ti

Posts: 598

|

|

|

|

|

|

|

#6547 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Dave Portnoy, barstool sports founder and retail investor has posted he has $1M in AMC and NOK. https://twitter.com/stoolpresidente/...397601798?s=21

He has a large following. This is all getting so crazy. |

|

|

|

|

|

#6548 | |

|

2024 Pledge Member

Join Date: Apr 2019

Real Name: Brad

Location: Purdue

Watch: Daytona

Posts: 9,084

|

Quote:

Cash in the brokerage. Dry powder to deploy.

__________________

♛ ✠ Ω 2FA Active |

|

|

|

|

|

|

#6549 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Thought this was interesting, if this is true, this could cause a serious short term problem for the market and possibly a very unique buying opportunity. Lets think this through, if GME keeps rising, these massive hedge funds will need to sell most of their liquid stock positions to cover margin calls as to not completely collapse. If they become forced sellers, that forced liquidation will cause a selloff across most widely held stocks by hedge funds. We will see how this plays out but I foresee some excellent buying opportunities in the near term. Certainly this is dictated by which hedge funds are underwater and what other underlying securities they own since not all HF's are short gme. Quick search shows the 25 stocks below are most actively held by hedge funds. Would love to add to my PYPL position below $200 and V at $180 again. 25 Most Popular Hedge Fund Stocks Rank Name of the Company Ticker Change from Last Quarter 1. Amazon.com, Inc. AMZN ↗ 2. Apple, Inc. AAPL ↙ 3. Facebook, Inc. FB ↗ 4. Microsoft Corp. MSFT ↙ 5. Alphabet, Inc. GOOG ↗ 6. Visa, Inc. V ↙ 7. Adobe Systems, Inc. ADBE ↗ 8. Danaher Corp. DHR ↗ 9. salesforce.com, Inc. CRM ↙ 10. UnitedHealth Group, Inc. UNH ↗ 11. Mastercard, Inc. MA ↙ 12. NVIDIA Corp. NVDA ↙ 13. Netflix, Inc. NFLX --- 14. Bank of America Corp. BAC --- 15. PayPal Holdings, Inc. PYPL --- 16. Tesla, Inc. TSLA ↙ 17. Comcast Corp. CMCSA ↙ 18. Cigna Corp. CI --- 19. General Electric Co. GE --- 20. ServiceNow, Inc. NOW --- 21. Global Payments, Inc. GPN --- 22. Berkshire Hathaway, Inc. BRK-A ↗ 23. Intuitive Surgical, Inc. ISRG --- 24. The Walt Disney Co. DIS --- 25. Baker Hughes Co. BKR ---

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#6550 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

Thanks for taking the time to write and share your knowledge. Will you be sharing thoughts on option straddles as well? I typically will sell high IV ITM straddles(selling both calls and puts at the same time) if conviction in a position is strong. Price of a stock can only go up or down and you get to collect premium as extra profit if price moves up or additional hedge when price goes down and you get put the stock. Your account need to have enough cash to cover the puts sold in an IRA account or have margin. I will also sell a higher strike price call if the premiums collected justifies my belief in the stock. |

|

|

|

|

|

|

#6551 |

|

"TRF" Member

Join Date: Oct 2020

Location: USA

Watch: The Citizen Ti

Posts: 598

|

|

|

|

|

|

|

#6552 | |

|

"TRF" Member

Join Date: Aug 2013

Location: HK

Posts: 2,261

|

Quote:

|

|

|

|

|

|

|

#6553 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

You are welcome, happy to help and share strategies we can all benefit from!

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#6554 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

I came across CVLB few weeks back and did not pay attention to it. It jumped yesterday but still trading at 8X sales with low float and high insider ownership. Comparing to OTRK which is at 24X sales or TDOC at 46X https://finance.yahoo.com/news/conve...133100395.html |

|

|

|

|

|

|

#6555 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

|

|

|

|

|

|

#6556 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

I like Tom Lee and one of the guys I respect. His comment of 3 trillion dollars from the bond market flowing into the equity market is interesting to hear.

https://youtu.be/WMh6eCvmpnw |

|

|

|

|

|

#6557 |

|

2024 Pledge Member

Join Date: May 2011

Real Name: Duey

Location: Maui

Watch: Too Many To List

Posts: 3,575

|

7sins - Thanks for the "hedge funds will need to sell most of their liquid stock positions "

This is going to be a very interesting next few weeks. I'm sure we will see some excellent opportunities |

|

|

|

|

|

#6558 |

|

"TRF" Member

Join Date: May 2013

Location: Vain

Posts: 5,918

|

This was bound to happen sooner or later since the general public has free and ridiculously easy access to trade STONKS, some of whom have loads of freshly minted internet cash to use on whatever...might as well be STONKS. Very simple to be cheeky and try to derail an institution to prove something, especially when there are factions who don’t have any respect for it.

|

|

|

|

|

|

#6559 |

|

"TRF" Member

Join Date: Jul 2020

Location: San Francisco Bay

Posts: 247

|

💎🙌

|

|

|

|

|

|

#6560 |

|

"TRF" Member

Join Date: Aug 2015

Real Name: DM

Location: USA

Watch: DD-YG/DJ/Breitling

Posts: 8,795

|

.

Is there anyone on this thread trading on Robinhood? Thanks, DM

__________________

. People of integrity expect to be believed and when they are not they let time prove them right. A best friend is like a four leaf clover - hard to find and lucky to have. SJP |

|

|

|

|

|

#6561 |

|

"TRF" Member

Join Date: Sep 2019

Location: Los Angeles

Watch: 126710 BLNR

Posts: 75

|

|

|

|

|

|

|

#6562 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Dec 2010

Real Name: PaulG

Location: Georgia

Posts: 40,722

|

Some reckoning coming (i.e., moral hazard chatter) if Treasury comes into the current subreddit manipulation + bailout plans for illiquid hedge funds who overplayed shorting GME and others.

Clearly this could make the 2008 financial crisis look pale. I have no tears for the hedge managers as their quants and algo’s led them into over shorting the actual volume of issued shares. But behind those hedge funds are large institutional managers who relied on them to balance their own positions. Guess who gets left losing the actual money? Pension funds, IRA/401k holders of the underlying funds who will now re-value their NAVs. Those who bash Reddit for hosting the current cabal have forgotten the pump and dump strategies - now, "short and distort" replaces it. Behind this current effort could be funding by Crypto-fueled connected individuals who want to strike a blow against that form of securities fraud. Lastly, I’m not so sure the façade is truly what we think it is. We may need to wait until it all unwinds. Maybe this isn’t a cohort of retail investors... Not a conspiracy theorist myself but if state-sponsored fintech hacking ops wanted a strategy to mess with soft underbelly of open markets - this is the best way to do that. Sent from my iPhone using Tapatalk Pro

__________________

Does anyone really know what time it is? |

|

|

|

|

|

#6563 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Will be interesting to see where the price action goes for FB today, which had a great Q4 (same goes for AAPL).

Does the Wall Street Bets action continue to affect it, or do we see a rise? Futures is relatively muted...

__________________

|

|

|

|

|

|

#6564 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,095

|

I'm thinking that fb and aapl have too large a float to be manipulated like gme.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#6565 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Quote:

Let's hope this ends soon.

__________________

|

|

|

|

|

|

|

#6566 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

https://www.cnbc.com/2021/01/28/walm...business-.html

Walmart partners with The Trade Desk for ads; should be huge for TTD. Long here.

__________________

|

|

|

|

|

|

#6567 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

robinhood stopped trading of gme/amc/bb/nok today, just says "stock is not supported on robinhood". talk about manipulation

|

|

|

|

|

|

#6568 |

|

"TRF" Member

Join Date: Feb 2017

Location: USA <> BKK

Posts: 5,912

|

|

|

|

|

|

|

#6569 | |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,444

|

Quote:

Keep buying GME AMC etc STRONG hold and DO NOT let the brokerage lend it out.

__________________

__________________ “Life should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'” -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

|

#6570 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Quote:

This is huge on so many accounts. The suits had a secret meeting and came up w/ this. RH users with these shares prob feel like a 1980s boxer after a sparring session with Mike Tyson. |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 3 (0 members and 3 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.