|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#8821 |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,264

|

Another great year in the books! 20%+! What outlook does everyone have for 2022?

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#8822 |

|

"TRF" Member

Join Date: Jul 2014

Location: Los Angeles

Posts: 137

|

|

|

|

|

|

|

#8823 | |

|

2024 ROLEX DATEJUST41 X2 Pledge Member

Join Date: Sep 2018

Real Name: Bill

Location: Indiana

Watch: Explorer 214270

Posts: 6,644

|

Quote:

The S&P will drift up initially, then inflation numbers will show a slowdown in the 1st Qtr economy, which will begin the pullback that will eventually end up in a 50% drawdown. Commodities and crypto will be best performers of the year.

__________________

ďThe real problem of humanity is we have Paleolithic emotions, medieval institutions, and godlike technology.Ē -Edward O. Wilson |

|

|

|

|

|

|

#8824 |

|

"TRF" Member

Join Date: Jul 2014

Location: Los Angeles

Posts: 137

|

You’re literally predicting an economic depression? In the next 3

months or so? I’d politely say, there’s little chance we’ll see a violent move that quickly. We still have a swath of consumers spending money they don’t have to buy stuff they don’t need. To impress people they don’t know. As long as that holds true, I think we can stave off a massive recession. Fed will be timid raising rates to avoid a massive shockwave. |

|

|

|

|

|

#8825 | |

|

2024 ROLEX DATEJUST41 X2 Pledge Member

Join Date: Sep 2018

Real Name: Bill

Location: Indiana

Watch: Explorer 214270

Posts: 6,644

|

Quote:

Not predicting a Depression. Also not saying the 50% pullback will happen in the next few months. Just that it will start in this quarter.

__________________

ďThe real problem of humanity is we have Paleolithic emotions, medieval institutions, and godlike technology.Ē -Edward O. Wilson |

|

|

|

|

|

|

#8826 | |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,264

|

Quote:

Well letís hope that doesnít happen! Have you sold out of the markets in preparation? Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#8827 | |

|

2024 ROLEX DATEJUST41 X2 Pledge Member

Join Date: Sep 2018

Real Name: Bill

Location: Indiana

Watch: Explorer 214270

Posts: 6,644

|

Quote:

As far as the market goes, I don't hope for it going up or down. I know it doesn't care what I think  I just try to guess where it is going. I just try to guess where it is going.

__________________

ďThe real problem of humanity is we have Paleolithic emotions, medieval institutions, and godlike technology.Ē -Edward O. Wilson |

|

|

|

|

|

|

#8828 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

Quote:

also i believe more than half of the stocks in the s&p were at 52 week lows last month and a lot of mid caps are down 30-40% already. the pullback started in q2 and has been going since |

|

|

|

|

|

|

#8829 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Jan 2019

Location: NJ, USA

Watch: Hulk, BLRO

Posts: 1,594

|

|

|

|

|

|

|

#8830 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

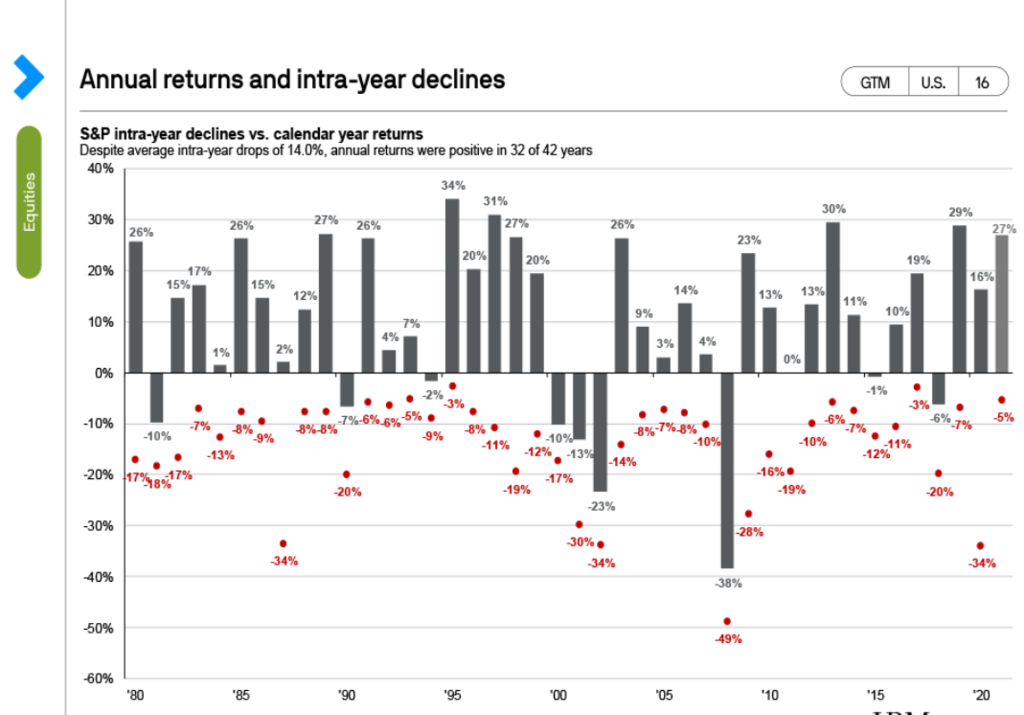

I would love to see a 50% pullback, I would be a buyer, hand over fist if that happened. Just my .02 and friendly dialogue, I agree with you we do see heightened volatility this year that will cause buying opportunities but 50% is substantial especially given the amount of broad based liquidity in the market. Single security selection has never been more important and will outweigh broad based index investing in 2022. Look at the above chart and intra year declines, even in 2008 when there was systemic illiquidity, the intra-year decline was 49%. We are nowhere near the environment of 2008, infact, household balance sheets are some of the strongest we have ever seen. Additionally you have over $5T of cash sitting on the sidelines waiting and consensus 2022 GDP at 4%. Hard to imagine that significant of a pullback with the economy still growing rapidly. I do believe that you will see individual high growth high P/S names pull back extensively but not at the index level. Historically rising rates have not dampened SP500 returns, I believe average SPY return during any year of rising rates back to the 70s was ~17%, have a chart somewhere for that. In fact, if you take a look under the hood of the indexes, there has already been a substantial pullback over the last few months, especially in small caps. Big tech has created a faÁade that has pulled broad indexes higher. Over the last month, small caps and value stocks have sold off more than 10%, high beta stocks have sold off more than 30% (rightfully so). On average, US securities are down 28% from the highs earlier this year while the R3000 is positive 22%. Would be interesting to see how crypto behaved in that severe of a downturn. Looking back at charts, it appeared to be correlated with the SPY decline after Delta and Omicron hit the market. IMO, in a 50% pullback, the psyche of the retail investor will cause a flight to safety and to sell to harvest any remaining gains. Where asset-flow will be to cash, treasuries and MMFs like we saw in 2008.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8831 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

Quote:

crypto is the definition of over leveraged with cascading liquidations every other month lol, i can't imagine how people think it would survive a collapse in the traditional markets |

|

|

|

|

|

|

#8832 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

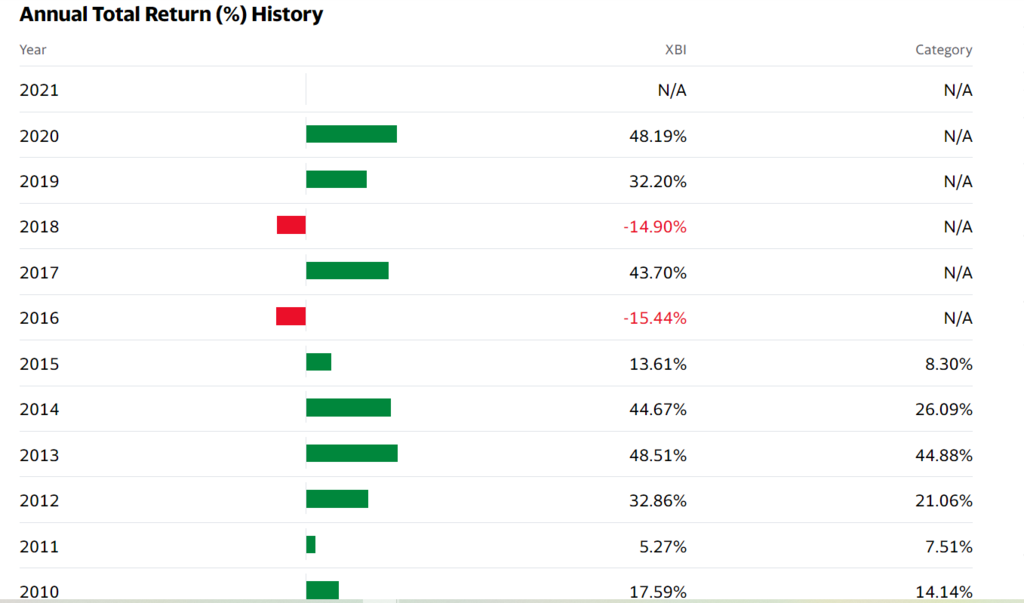

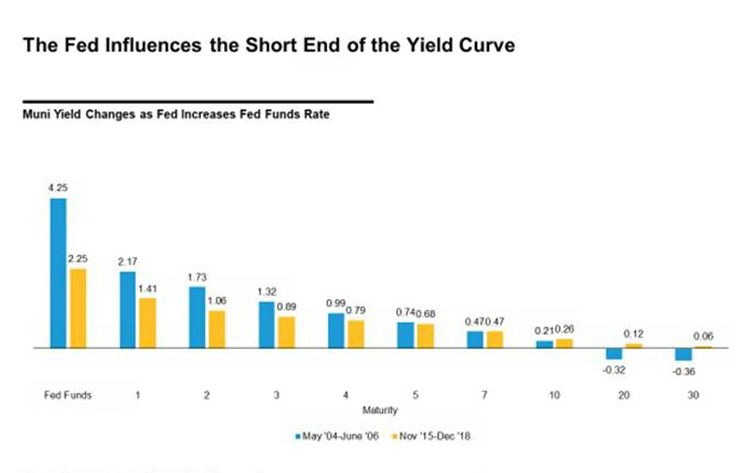

1. Best Sectors: Biotech and Financials Why: A: Biotech is an easy choice here based on sheer sector rotation. XBI was HAMMERED in 2021 down 15%. Big Pharma has RECORD amount of cash to leverage for bolt on acquisitions and more importantly they have massive patent expirations to deal with https://www.fiercepharma.com/special...-coming-decade. M&A this year in biotech is going to be tremendous and bring up the broader based sector, you had multiple BP's in 2021 announce they are going on a spending spree for bolt on acquisitions and increasing buyback/dividends. Personally I think there is better money to be made in the small cap bio space, many are down 20-30% in Q4 alone, trading often below FDA approval levels. I like AUPH (obviously), MYOV, ALBO (hidden small gem) and TGTX. Additionally take a look at LABU, it is 3x leverage XBI, wait for a base to form and should the sector rotate, this will be off to the races. Look at the last decade, anytime the sector rotated out of XBI for a negative year, the following year returns were off the charts.  B: Financials will be a benefactor as the FED raises the FED funds rates as their loans will be more profitable, easy hedge against rising rates. I like Citi here that is at a severe dislocation (LEAPS are cheap) and JPM for a higher quality bank. 2. FED Raises Rates 2X this year. They will raise in 25bp increments, this is ultimately meaningless in the grand scheme of the FED funds rate. I am not sure why people believe this will be that impactful to the stock market. Look at the Bank of England, they raised rates in Dec and did not see any meaningful impact to their market. The other VERY important thing to note about the FED, is they ONLY control interbank lending rates. That is 0-3 years of the yield curve. Look at the yield curve below the last two periods the FED raised the FED funds rate. You saw the biggest impact in yields on the short end while the intermediate yield curve flattened. Why? Because the intermediate is controlled by supply and demand, we are one of the highest Developed Market 10yr bonds in the world (Germany still negative) and thus you will continue to have heightened foreign interest. I do believe yields will creep higher across the curve but it is a mistake to tighten duration in bonds as the FED raises FED funds rate. If you are in TBT (full disclosure I am long here), I think this will still pay off this year as the 10yr realistically should get to ~2%. If you want to hedge your fixed income portfolio against rising rates, buy midgrade bonds and or CPI swap funds, both will dampen the impact of rising rates.  3. FED tapering wont have much of an impact This is another big concern of the market which I think is overblown. Even look at rates when they began tapering, did not see much movement, I believe rates even went down that down. More importantly, you have over $800B of treasury supply being taken off the books this year, that will offset the reduction of treasury buying from the FED in the first half of this year. 4. Security Selection has never been more important Finding the right securities will generate higher returns this year than broadbased index buying. Megacap tech has propped up the indexes in 2021, that creates opportunities in smaller cap stocks that were unnecessarily sold off in Q4 either do to tax loss selling, index based selling and or omicron selling. 5. Runnerup Sectors Personally believe we will continue to see a runup in chips, more so on the auto side (I like MRVL here) and then travel recovery plays should pan out well assuming there isn't another variant (fingers crossed SABR). 6. Buy LEAP Puts and roll calls There are several high growth and VERY high P/S stocks that the market will punish in a rising rate environment. You certainly could also buy SPY puts to hedge your long portfolio. Personally I pick 4 or 5 overvalued stocks and I buy LEAP puts on them. When we do see a market pullback, the puts will gain in value and it is an easy trade to take those gains then rotate that money into calls on oversold stocks. Efficient way to have an effective hedge in your portfolio and profit in a down market, especially in a year where we are expecting downside volatility. I have also been rolling a few 2023 calls to 2024 to buy more time.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8833 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

You watching VIAC today? Nice to be in the green. Are you keeping your position this year?

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8834 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

i jumped ship in december lol, i believe my breakeven was around 40 with iv getting lower and lower every month. decided to just get out and threw the remains in sofi leaps after its sell off

|

|

|

|

|

|

#8835 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

for those in TREB -

https://finance.yahoo.com/news/trebi...140000741.html "Upon closing, the combined company is expected to be listed on the NYSE and begin trading under the ticker symbol “SST” on or about January 25, 2022" looking forward to some price movement hopefully, it's been pretty under the radar with no mentions anywhere |

|

|

|

|

|

#8836 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Jan 2019

Location: NJ, USA

Watch: Hulk, BLRO

Posts: 1,594

|

Quote:

The majority of BTC is purchased with Tether and the financial backing of Tether is murky, at best right now. Many offshore crypto accounts can use Tether on a margin of 100x to purchase BTC, and so as a result I believe BTC is very inflated. This isn't to say that BTC shouldn't be valuated at 100k a coin at some point in the future like some "experts" say...because I think it can get there legitimately after a correction. The question has become whether Tether is backed with Chinese junk bonds (and not US dollars, as they claim) and thus exposed to the inevitable default of Evergrande (and their bonds). If so, we potentially see Tether go to zero and BTC collapse. It seems too volatile for me right now until some of this stuff plays out. |

|

|

|

|

|

|

#8837 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

Quote:

the biggest impact tether will have if it folds is the fact that billions of dollars are currently sitting in it so they'll just be lost. also people think that all the printing done by tether props up a lot of the prices of alts |

|

|

|

|

|

|

#8838 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Cloudflare, my precious, why do you cause me such pain lol

|

|

|

|

|

|

#8839 |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,786

|

With all this red the only saving grace I had today was Ford. Btw, what the hell tripped this uptick?

Sent from my Apple privacy invasion product |

|

|

|

|

|

#8840 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

BTW I like your call on adding more SOFI, enticing here at sub $15. Good two days for us in Seat-WT too. Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#8841 | |

|

"TRF" Member

Join Date: Apr 2018

Real Name: Russell

Location: Moses Lake

Watch: 216570 Polar

Posts: 282

|

Talking Stocks 2.0

Quote:

The last year and a half with most leftover $ from other stock purchases I used to buy F. I think this purchasing started ~ $5 or $6 mark. I didnít think it would ever cross into the $20 territory but pleasantly surprised. And now even a 2% dividend is just gravy. I still donít have a large sum (160 shares) but I smile nonetheless. My avg price is ~ $10, canít complain with a 130% gain. Ok and all you ballers can now put me to shame with your multi Daytona & GMT flex :) And I think the nice uptick is their continued investment in EV and so far success of the e-Mustang + coolness of the Bronco + Tesla (rising tides). Ford has all the resources to succeed if the EV revolution really takes off. Likewise if youíre a believer in the eventual Federal legalization of marijuana, Altria and Phillip Morris will clean that up in spades, IMO. Way too much money to leave on the table; complements Ah, BRKB was my other saving grace on the day, my largest holding. Likely a tick up for its AAPL holdings Sent from my iPhone using Tapatalk

__________________

Polar 216570 ElPrimero Oí69 Nomos Tangente Hamilton Khaki Sub 114060 |

|

|

|

|

|

|

#8842 | |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,264

|

Quote:

No shame in 130% gain. Well done! Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#8843 |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

Hey logo I was an early follower of your NET posts back in mid-2020 and took a big plunge into it when the price was around $40. I cashed out everything at $190 - my best trade ever. Would like to thank you for that great tip. I have been buying in again recently at around $160 as I believe in the company. Just wondered where you were on this - holding or buying more?

|

|

|

|

|

|

#8844 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

Their forward 2022 P/S is about 45 at current pricing. On the high end, but their price-to-book value at current pricing is actually directly in line with huge established companies like TSLA and NVDA. From a value perspective compared to those, NET is growing 50% YoY with no stop in sight - the CEO has repeatedly indicated they have ZERO intent on generating positive cash flow for the next several years because every penny is getting reinvested into growth opportunities. From that perspective, does P/S matter? I honestly donít know because itís entirely dependent on when growth caps out. Many people cannot understand exponential growth, but at 50% YoY if you give them to 2025 thatís an annual revenue of $3B. Just 3 years, and revenue topping $3B. Give them to 2030 and thatís >$15B in annual revenue. Even with a P/S of 15 at 2025 that point is a cap of $45B, or pps of ~$120. At 2030 thatís a cap of $225B, or pps of $620. Iíd argue a P/S of 15 would be unreasonable for a company operating at 50% YoY growth into the billions in revenue, and thus todays prices in my view are a bargain if investing for long term and you believe their growth can sustain, which I do. Iím not an expert on interest rates in terms of how significantly a rising rate environment can push down P/S ratios for growth companies, but itís also not likely we see rates go insane - we are talking about a rise off of historic lows. If you look to competitors like AKAM, they have about $3B in revenue, cap of $20B. Half the cap of NET, but triple the revenue. Looking closer, AKAM focuses exclusively on large customers and in fact they only have 50,000 of them. Revenue growth is consequently quite small. NET on the other hand has millions of free and paying users and growing at 70% YoY for large paying customers. This is where they have a ďFacebookĒ model of growth that is anchored in network effects which I suggest googling to truly see what cloudflare is doing. Network Effects are essentially what makes a platform sticky? Grow your user base through free users, use them to rapidly iterate and test new tech before deploying to paying customers, and offer everyone something that they simply cannot get elsewhere. If you amass such a following, you become essential to functioning. Think about it this way - one person with a fax machine makes fax machines useless, even if that fax machine company sold it for $10B, the product/service doesnít have a strong utility. However, 100 people with an internal corporate landline can be efficient in communication with each other. Not as efficient as a country with 300M cell phones, and not as efficient still as 7B with internet access. Power in numbers, where every additional user not only receives benefit themselves, but the whole network benefits AND those not in the network are incrementally motivated to join that network. Thatís how FB took off, and THAT is why cloudflare is valued so strongly compared to peers - currently, 80% of all websites that use a CDN use cloudflare. Itís no surprise that cybersecurity is becoming increasingly important and that pull to cloudflare should continue. This, in combination with the continual agile value-adds they provide that compete directly with players like AWS, cloudflare is a winner long term. All that to say, I am holding, and buying with eyes on 2030. |

|

|

|

|

|

|

#8845 | |

|

Banned

Join Date: Apr 2018

Location: HOME!

Posts: 1,175

|

Quote:

Hugely appreciate your input here. |

|

|

|

|

|

|

#8846 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,323

|

one month it's covid killing travel and value stocks and then the next month it's back to inflation killing tech and repeat

can't win the last few months lol |

|

|

|

|

|

#8847 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

. Hope everyone faired better than I today, this had to be one of my worst days and I am completely underweight tech along with high P/S stocks. . Hope everyone faired better than I today, this had to be one of my worst days and I am completely underweight tech along with high P/S stocks. Want to see how things shakeout tomorrow, plan to initiate 2024 $30C LABU.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8848 | |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,786

|

Quote:

I feel ya. I took my gains and sold out on AUPH and BORR this morning. Dumped it all in Ford and it seemed like a good decision till about 12:30 est. Then all hell broke loose and I lost 5.5% for the day. Markets so volatile on everything right now, Iím debating pulling out of all of my play money positions (even taking a big loss on BBIG) and sitting on the sidelines for a while licking my wounds till things calm down. Sent from my Apple privacy invasion product |

|

|

|

|

|

|

#8849 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

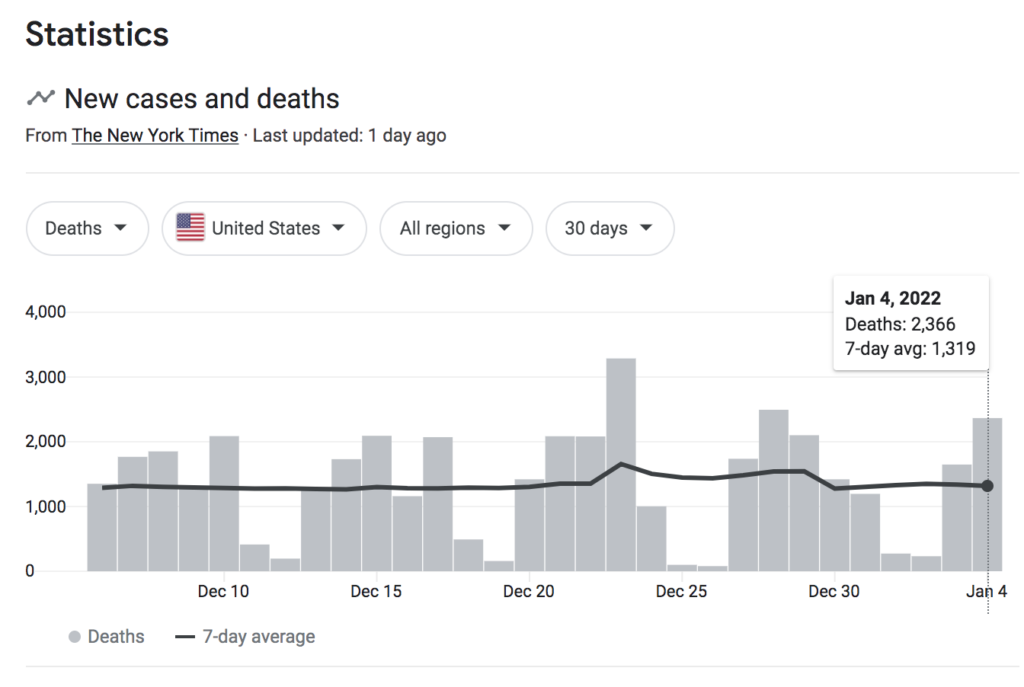

I will be over here hanging on for dear life.  I think what is fascinating, looking at the 30 day COVID cases, we are seeing a 3 multiple increase yet deaths haven't moved at all, which I hope means we overcome this wave quicker than Delta.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8850 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Quote:

Ditto here. Too much red. My only gain was LCID $35 Jan 21 puts purchased in batches since early-Dec. Founder Shares are unlocking week of Jan 17. DKNG is brutal as I averaged down common shares since $40. Also picked up $35 and $40 Jan Ď2023 LEAPs that are now down. I sold my SEAT Warrants & DIS. Very bad timing to sell but Covid is canceling events it rescheduling isnít possible. Our household had Covid late last month. So many people at work also caught it while on holiday break. Iím boosted & had zero issues until getting a sinus infection. Was sick for 3 days and now back to normal. My kids & wife were fortunately asymptomatic. Same with the sets of grandparents. Quite a few people at work also caught it but are doing well. Iím hearing through my MD contacts that hospitals are definitely filling up w/ + patients but not all need to be there. Very unlike 2020 and Jan to April 2021. Their worries are the Med staff have been testing + so who will treat patients. My kidsí schools are mess w/ + faculty & students being out. Kids are spreading it (how we caught it). The *key* point is the mortality rate isnít increasing w/ more hospitalizations. The unprotected seem to be the ones usually getting really sick with it. Not getting p0litic@l here just want Iím seeing / hearing and published data is supporting that. The latter info is helping to drive some of my thoughts on specific stocks. |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.