|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#9511 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,131

|

And then it goes up?

|

|

|

|

|

|

#9512 |

|

"TRF" Member

Join Date: Aug 2019

Real Name: Phillip

Location: Right here

Watch: SD43 Daytona Blusy

Posts: 1,795

|

|

|

|

|

|

|

#9513 | |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,681

|

Quote:

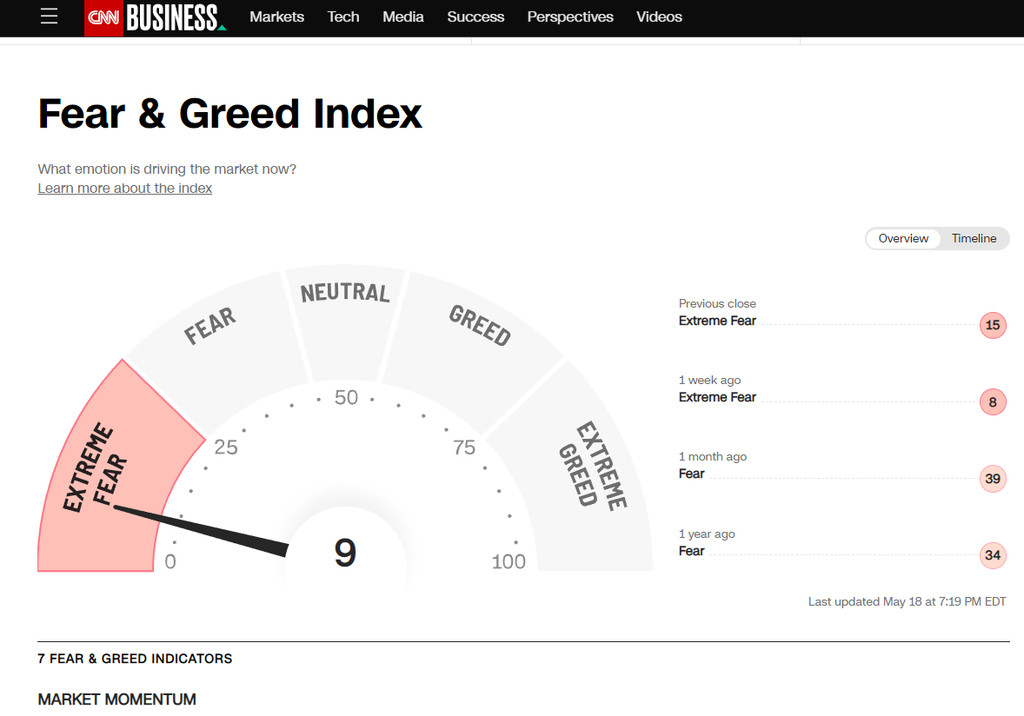

We need real fear for things to shift. And people aren’t afraid just yet. Folks think it’s all going to go back up. No fear, no capitulation.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

|

#9514 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

There is plenty of fear in the market, easy to see this in put to call vol...I see and hear panic from large institutional investors all day long. There is tremendous stress and cracks under the hood, putting aside the already skiddish retail investor. I see clients panic selling high grade small odd lot muni bonds at 10+ point plus bid/ask spreads in sheer fear of market uncertainty, for an asset class that is the healthiest in over 30 years and no outstanding credit/solvency issues. I haven't seen this since 2010 and systemically back to 2008.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#9515 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,131

|

Why would people sell munis now?

Quote:

|

|

|

|

|

|

#9516 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,339

|

Remember to discern the difference between coupon vs CY vs book yield vs YTW. VERY few bonds at 4% coupon, with reasonable maturity are issued at par. Most are issued at a premium to par, esp 5% coupon bonds, this lowers your true book yield and you have to take into consideration the spread you were sold to buy the bond and the future spread to sell to TLH to then access lower priced bonds at higher yields. Unless you are buying lower quality paper @ 4% coupon, I'm sure you paid a premium to buy. The only paper I have traded near 4% at par has been long maturity BBB bonds. Which isn't always a bad thing, premium bonds are inherently less interest rate sensitive. I do believe it is a fallacy to hold to call (they won't call and you extend to maturity via extension risk) and you should look to sell long before maturity which can create several uphill battles in a passively managed strategy like a ladder or self directed. As absurdly boring as muni bonds are, they can be incredibly complex.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#9517 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,681

|

Quote:

Maybe we are getting near a bottom.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#9518 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,090

|

Quote:

Futures are down this morning. As others have suggested, I don't think we've seen the capitulation that we need. I was thinking a bit about this earlier, and I suspect that a lot of the kids who've never lived through a correction/bear before, those crypto/Robinhood folks, many of them are likely stunned to discover that their investments do not always go up. Yes, that was a bad sentence, but mostly because I wasn't sure how to end it. When do those folks capitulate? Or better yet, start buying again? And maybe this time they'll move to quality over hype.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

|

#9519 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

i do feel like the selling yesterday and last week was just firms unloading massive amounts of their positions in an orderly fashion because it was just purely consistent selling with no bounces. just reminds me of the movie "Margin Call" (which sucked) lol |

|

|

|

|

|

|

#9520 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,090

|

I thought it was a good movie from the perspective of having an excellent cast and good production values. It's probably unrealistic (like so many movies) but then, I never worked on Wall Street so maybe it was? I think from the perspective of the brokerage/bank screwing their customers it was realistic, I just don't think that those companies were aware of the precipitous nature of their business, or if they were, they didn't care.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#9521 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

The market has seen several funds blow up and systematically liquidate which is why the VIX has not spiked like the way Mar 2020 did. Think we will see more downward pressure as the next 50 basis point hike takes place and beginning offloading of fed balance sheet. |

|

|

|

|

|

|

#9522 | ||

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

Quote:

|

||

|

|

|

|

|

#9523 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

Margin call happens to everyone over levered regardless if you are a fund or an individual. That is one source of volatility you can’t really predict or feel from news sources. There is going to be rerating of stock prices now that the likes of WMT and TGT are guiding 50% less profit back to pre pandemic levels. I do think we are closer to bottom but question of growth remains to be seen.. |

|

|

|

|

|

|

#9524 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

|

|

|

|

|

|

|

#9525 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Speaking of guessing a “bottom”, I’ve been looking at historic Forward P/E values during recessions. Is anyone doing the same or using another method? Current Forward P/R is between 16.5% to 18.5% depending on source & May date.

|

|

|

|

|

|

#9526 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,090

|

It's turning into another brutal day, down 2% right now.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#9527 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,681

|

https://youtu.be/BR2003lJmXQ

This is exactly what I thinking when I said, not enough fear yet. A buddy just sent this to me. I happen to agree. Except, I do think a recession is on the horizon. But a big day is coming. It’s going to be painful, but it’s needed to get to the bottom.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#9528 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Jun 2019

Location: FL

Posts: 377

|

I spy a nice reversal…

|

|

|

|

|

|

#9529 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

they really waited until the last 20 mins to screw over all the put holders lol

|

|

|

|

|

|

#9530 |

|

"TRF" Member

Join Date: Feb 2021

Location: MN

Posts: 293

|

Yep - these wild ass 500+ point down/up or up/down swings over mere hours within a trading day are becoming crazy! I haven't dug into the volumes to see who/what is making those moves, but it must be some rather large orders (on either side) do to that without much news.

|

|

|

|

|

|

#9531 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Nothing is ever on time with BBIG…what a letdown.

“Fairport, NY, May 25, 2022 (GLOBE NEWSWIRE) -- Vinco Ventures, Inc. (NASDAQ:BBIG), a digital media and content technologies holding company (“Vinco Ventures,” “Vinco,” or the “Company”), today announced that, due to contractual and regulatory conditions, the Company’s Board of Directors has decided to delay the distribution date for the previously announced spin-off of Cryptyde, Inc. (“Cryptyde”). On May 5, 2022, the Company announced that each Vinco stockholder of record as of the close of business on May 18, 2022 would receive one share of Cryptyde common stock for every ten shares of Vinco common stock held and that such share dividend was expected to be distributed on or about May 27, 2022. The Company currently expects the distribution date for the Cryptyde spin-off to occur on or about the end of the second quarter of 2022, subject to certain contractual and regulatory conditions being met or waived.” |

|

|

|

|

|

#9532 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,090

|

Quote:

I'm no economist, but I'm not 100% sure that we'll go into a recession; the economy is quite strong and resilient despite the multitudes of things working against it, like the continued supply problems, inflation, scarcity of workers, housing market and of course, the war in Ukraine.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

|

#9533 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,090

|

Looks like they are getting hammered pre-market, down 10%.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#9534 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Yeah, extra painful since I recently bought a lot more Jan 2023 options and shares to lower my cost basis anticipating the TYDE dividend to happen early next week. I was going to fully exit once the stock ran up. At least GME is up so it's offsetting my losses in BBIG :/

|

|

|

|

|

|

#9535 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,131

|

Bought a couple of utes, DLTR (recession choice), NOW (SAAS) that will work in a recession. Plus ALB for lithium mining for electric engines.

|

|

|

|

|

|

#9536 | |

|

"TRF" Member

Join Date: May 2013

Location: Vain

Posts: 5,910

|

Quote:

|

|

|

|

|

|

|

#9537 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Quote:

Thanks see Kevin’s point. A big event would be quite the indicator. Granted, Kevin is talking moving indices violently down sharply. Kevin will unfortunately get his wish as we have 2 years of Fed printing money to combat plus their QE since the late 2000s. Regarding recent retail / consumers, their spending more (increasing maybe due to inflation), savings (decreasing) and revolving debt (increasing) are getting worse.

|

|

|

|

|

|

|

#9538 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Crazy relief rally past 2 days. Pretty low volume though, happening before the long weekend and end of month. IMO nothing has really changed. Cautiously awaiting Tuesday….

|

|

|

|

|

|

#9539 | |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,131

|

Just when you think the bleeding is over…

Quote:

But whatever one expects to happen is not what actually happens. Good luck out there. Will Rogers said he was more concerned about the return OF his capital than the return ON his capital. |

|

|

|

|

|

|

#9540 | ||

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

Quote:

|

||

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.