|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#1 |

|

"TRF" Member

Join Date: Mar 2022

Location: Vietnam

Posts: 149

|

Will you invest in U.S STOCK NOW ?

CPI/ Inflation rate are high, FED cause a lot of problem in the interest rate and also the market

Will you choose to Invest now or wait, and why? And if you choose to wait, until when you will jump in the stock market? |

|

|

|

|

|

#2 |

|

"TRF" Member

Join Date: Mar 2019

Location: Atlantis

Posts: 1,432

|

I am still investing. Every month like clock work for years.

A large portion of my income is auto deposited in my brokerage account which is swept into the market automatically each month. |

|

|

|

|

|

#3 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

I am always investing

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#4 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,454

|

Is there 'blood in the streets' yet?

Not yet imho, but there's always currency to be made on the up and downs.

__________________

__________________ ďLife should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'Ē -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#5 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,102

|

Buy, buy, buy.

Buy quality, not meme stocks or hyped b.s. You can never spot the bottom until later. This is a long-term strategy for "investments". If you are just playing and want a quick return, then buy options and memes. That's also a great quick and very efficient way to lose a lot of money. DAMHIK.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#6 |

|

"TRF" Member

Join Date: May 2020

Real Name: Henry

Location: USA

Posts: 4,190

|

Now is probably not a bad time to buy blue chip dividend stocks if you are in it for the long haul.

|

|

|

|

|

|

#7 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,698

|

I am getting closer. But not yet.

Likely just before or after the midterm elections. But I am thinking 3,200 is my magic number.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#8 |

|

2024 Pledge Member

Join Date: Jul 2013

Real Name: Brian (TBone)

Location: canada

Watch: es make me smile

Posts: 73,713

|

I’m Canadian but our markets tend to follow yours.

I’ve been buying cash generating, dividend growers during this volatile time. Examples of these: banks, utilities and oil and gas, (as much as it is unpopular to some here), and infrastructure which includes pipelines. As an FYI, many oil and gas companies will be debt free in the coming quarters. If that doesn’t resonate, read it again, debt FREE. They are already spinning off unbelievable cash flow which is flowing back to share holders. They’ve finally figured out the plot … no more dollars going into exploration and drilling. Run out the reserves, and pay the money back to the shareholders. Some of these companies have 30+ -40 years of reserves.

|

|

|

|

|

|

#9 |

|

"TRF" Member

Join Date: Jul 2007

Real Name: Mike

Location: Virginia, US

Watch: SD 16600

Posts: 4,309

|

No way to predict the bottom so I buy on the way down and will hold long-term. The only way to lump-sum at the market bottom is to be extremely lucky and luck is not a strategy.

__________________

The fool, with all his other faults, has this also - he is always getting ready to live. - Epicurus (341Ė270 BC) |

|

|

|

|

|

#10 |

|

2024 Pledge Member

Join Date: Nov 2020

Real Name: Mitchell

Location: EST, EAT

Watch: Trusty Explorer

Posts: 891

|

I try not to let the pursuit of perfection in timing the bottom be the enemy of sufficient when it comes to investing. Itís a losing game. Courtesy of Putnam Research:

.jpg Sent from my iPhone using Tapatalk |

|

|

|

|

|

#11 |

|

Banned

Join Date: May 2012

Real Name: CJ

Location: Kashyyyk

Watch: Kessel Run Chrono

Posts: 21,113

|

Rolexeses!!!!!

Rolexeses are flooding the market. Already have 67 Daytonas at ~$7k below MSRP en route from the UK. Be smart. Wear your 401K !!!! |

|

|

|

|

|

#12 |

|

"TRF" Member

Join Date: Dec 2017

Location: In denial

Watch: It's complicated

Posts: 1,610

|

Monthly for as long as I can remember.

|

|

|

|

|

|

#13 |

|

Banned

Join Date: Apr 2020

Location: here AND there...

Posts: 2,240

|

time in the market is better than timing the market

dca |

|

|

|

|

|

#14 |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,364

|

|

|

|

|

|

|

#15 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,454

|

Best bet may be to follow what members of the US Gov top employees buy, they seem to have an optimum way of profiting in the market. Just remember the losses due to currency devaluation and VIG.

__________________

__________________ ďLife should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'Ē -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#16 |

|

"TRF" Member

Join Date: Aug 2019

Real Name: Phillip

Location: Right here

Watch: SD43 Daytona Blusy

Posts: 1,800

|

|

|

|

|

|

|

#17 |

|

"TRF" Member

Join Date: Jan 2011

Location: CA, USA

Watch: Out!!!

Posts: 6,407

|

I haven't sold anything and have begun to add to my mutual funds.

|

|

|

|

|

|

#18 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2007

Location: San Francisco, CA

Watch: Date & No Date

Posts: 10,857

|

You can buy now or later it won’t make any difference. Many many more years ahead of us before we ever get close to high times again. If at all…

__________________

"You might as well question why we breathe. If we stop breathing, we'll die. If we stop fighting our enemies, the world will die." Paul Henreid as Victor Laszlo in Casablanca |

|

|

|

|

|

#19 |

|

"TRF" Member

Join Date: May 2013

Real Name: Nick

Location: Las Vegas

Watch: 1601

Posts: 10,424

|

Yea why not?

|

|

|

|

|

|

#20 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,146

|

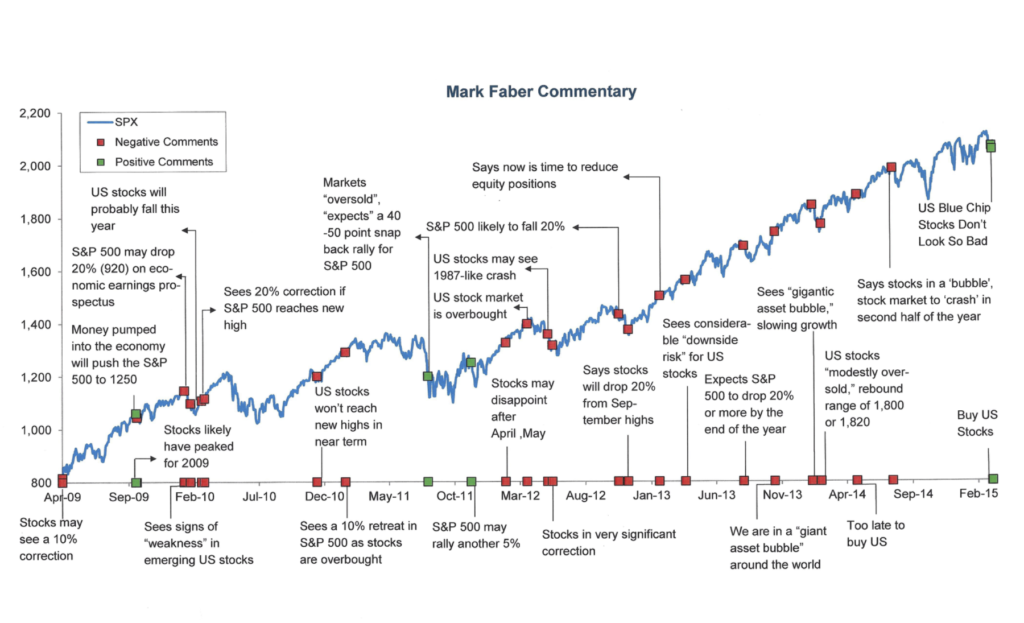

The most important principle.

|

|

|

|

|

|

#21 |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,364

|

|

|

|

|

|

|

#22 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,698

|

Well, there is a very real possibility the down turn is just getting started.

But I do realize that convention wisdom says keep buying, go long term. I do get it. And mostly agree with it. I simply think itís better to buy low. And all indications appear to point to further declines all around.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#23 |

|

"TRF" Member

Join Date: Aug 2010

Location: Clemson

Watch: G Shock

Posts: 608

|

This looks very similar to 2008-2009 in that the stock market is in a slow decline to an unknown bottom. I think we have a way to go best case. Europe is going to get bad in a number of ways and itís not go to fix itself for a long time. Unfortunately I predicted we would go below 30,000 hoping it would bounce back and we could all go back to drinking our Starbucks and wondering which Rolex we were going to buy next. Im not sure where to put money now.

Sent from my iPad using Tapatalk |

|

|

|

|

|

#24 | |

|

"TRF" Member

Join Date: Jul 2005

Real Name: Adam

Location: Philly Ďburbs

Posts: 5,632

|

Me too.

Quote:

__________________

Adam |

|

|

|

|

|

|

#25 |

|

"TRF" Member

Join Date: Sep 2018

Location: East Coast USA

Posts: 477

|

My financial advisor told me he doesn’t believe the s&p500 will drop much lower like 3200 or so. Thinks 3500 is more or less the bottom but obviously no crystal ball here, plus I have some pretty bad luck investing overall so don’t go by some moron on the internet.

But he called me yesterday to buy (SP500 etf) since I cashed out beginning of the year when I was concerned with the state of things. Said long term I can’t go wrong buying back in now and holding and I tend to agree with that instead of holding out much longer trying to time the market (even though that’s what I just did…) |

|

|

|

|

|

#26 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,454

|

Be sure to account for winter energy costs. Imho there's still not enough 'pain'... and market right now is easily manageable by the PPT. Once they lose control all bets are off.

That's when it might be time to jump back in imho.

__________________

__________________ ďLife should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'Ē -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#27 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#28 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#29 |

|

2024 Pledge Member

Join Date: Aug 2010

Real Name: H

Location: North Carolina

Watch: M99230B-0008

Posts: 5,672

|

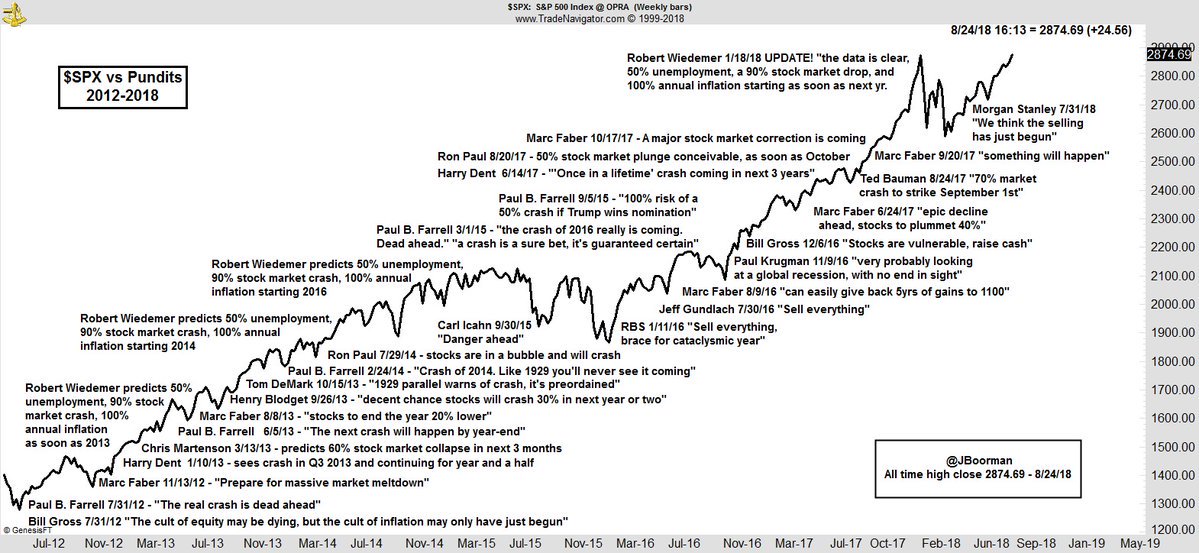

Hilarious. But does not stop them from spouting. And cashing in on spouting.

__________________

The King of Cool. The King of Cool.

|

|

|

|

|

|

#30 | |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,698

|

Quote:

Heíd like to start deploying capital in the next month or so. Slowly of course. Heís a bit riskier than I am. But we have different goals.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.