|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7051 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

I don't own it, but OTRK is getting absolutely crushed after guiding down; the stock is down 47%.

This was a stock darling that I had thought about entering but could never justify it. Terrible for current shareholders.

__________________

|

|

|

|

|

|

#7052 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Apple: All apple u.s. Stores are open as of today for the first time since march 2020

|

|

|

|

|

|

#7053 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

I believe they lost one of their largest customers in a pre-earnings PR. I don't know the details, but for a small company trying to grow that is huge news. |

|

|

|

|

|

|

#7054 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,095

|

Quote:

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

|

#7055 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

Markets rolling over, need to watch the 2:00 print

Traders were expecting a gap up with a down move and got caught. This needs to hold into the close or we could be headed lower

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#7056 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Huncho where you at on our RKT trade? Special dividend!! You planning to unload after it goes ex-div?

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7057 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

More great news for FDX as we continue that march back to $300 for those on that train with me, up $10 today hitting a wall at $265 and our April calls should be up close to 100%. Making up ground on our May 300C. Fantastic news for future revenue streams as they take majority market share of vaccine shipping. Note the article also references the millions of doses they already have shipped for Q4.

FedEx Prepares For COVID-19 Vaccine Volume Growth, Begins Shipping Newly Approved Vaccine FedEx Express, a subsidiary of FedEx Corp. (NYSE: FDX) and the world’s largest express transportation company, announced today that it has begun shipping the newly approved COVID-19 vaccine on behalf of McKesson Corp. to dosing centers throughout the United States. The company has shipped millions of COVID-19 vaccines since U.S. distribution began in mid-December 2020 and is prepared to scale up to accommodate anticipated growth in vaccine volume throughout the spring and summer. Nearly three months after COVID-19 vaccine distribution began, FedEx has shipped COVID-19 vaccines and supply kits to administration sites across all 50 states, Puerto Rico, the U.S. Virgin Islands, and Washington, D.C. COVID-19 vaccine volume is split evenly with FedEx moving approximately half the doses allocated by the federal government. "As vaccine production ramps up and more vaccines are approved, we expect to see a significant uptick in COVID-19 vaccine and supply kit volume moving through our network," said Don Colleran, president and CEO for FedEx Express. "As manufacturers obtain approval to ship COVID-19 vaccines with greater temperature ranges and varying dosing allotments, we anticipate more of these packages moving to more places through our global network." FedEx Express will transport the new COVID-19 vaccines and kits of supplies for administration of the vaccine, using its FedEx Priority Overnight® service supported by FedEx Priority Alert® advanced monitoring – the same process used for all COVID-19 vaccines packed out by McKesson Corp. and Pfizer Inc. In addition to widespread distribution throughout the U.S., FedEx is delivering COVID-19 vaccines to U.S. military bases overseas for the Defense Logistics Agency, and is working closely with the Canadian government and healthcare companies to ship COVID-19 vaccines to all 13 Canadian provinces and territories. https://finance.yahoo.com/news/fedex...151400955.html

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7058 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

|

|

|

|

|

|

#7059 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#7060 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#7061 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

|

|

|

|

|

|

#7062 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

I suspect VERY low OI at sub 200, not enough OI/interest to move it with the market and combined with it still being quite OTM is probably why you saw that today. Should see more movement as the price climbs and probably a bit of re-pricing to adjust tomorrow as well which is typical for low oi options. Showing IV at 36%.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7063 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

https://finance.yahoo.com/news/squar...230000134.html

SQ begins its financial services, thus the subsequent pop AH. Long here. https://www.investors.com/news/techn...earnings-meli/ MELI with solid earnings; not very concerned with the the earnings miss, as the growth numbers are unreal. Might see some short-term weakness but again, I'm a buyer of significant downward pressure.

__________________

|

|

|

|

|

|

#7064 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Not sure how long this will stay up before taken down. Cramer talking about manipulating the market when he was a HF manager.

https://youtu.be/W90V_DyPJTs |

|

|

|

|

|

#7065 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

https://twitter.com/TheMarkCooke/sta...14452410777600

SE continues to crush it; my highest conviction stock. Look past the earnings miss and look at the triple-digit growth and outstanding guidance. They are unstoppable.

__________________

|

|

|

|

|

|

#7066 | |

|

2024 Pledge Member

Join Date: Feb 2013

Real Name: Ryan

Location: DMV

Watch: LVc

Posts: 2,034

|

Quote:

Very happy to have reopened my position in this on the pullback after being stopped out a few weeks ago. This company can’t be stopped! Also long SQ. Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#7067 |

|

"TRF" Member

Join Date: Dec 2019

Location: Jacksonville AL

Posts: 2

|

I’m just here for the comments

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7068 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

PERI continues to under promise and over deliver trading at multiples lower compared to APPS, MGNI, KBNT, VERB and DMS(which just reported earnings miss.) https://finance.yahoo.com/news/perio...110000873.html |

|

|

|

|

|

|

#7069 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

rkt up 70% today, 7sins - your patience paid off lol (if you held through this morning)

|

|

|

|

|

|

#7070 | |

|

"TRF" Member

Join Date: Feb 2018

Location: Vancouver/Seattle

Posts: 400

|

Quote:

That being said, this ticker is getting beat down today. Market may still be in correction mode short term - this Friday's job numbers will be pretty important. |

|

|

|

|

|

|

#7071 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Quote:

Not concerned, however, as it is a core (actually my top) holding that I don't plan on selling over the next 3-5 years.

__________________

|

|

|

|

|

|

|

#7072 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Will you be expanding your portfolio to include Coupang when they go public?

|

|

|

|

|

|

#7073 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Quote:

Will definitely be something to keep an eye on though, as e-commerce will always be attractive to me. Thanks for this one.

__________________

|

|

|

|

|

|

|

#7074 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

|

|

|

|

|

|

#7075 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7076 |

|

2024 Pledge Member

Join Date: Jul 2017

Location: West Coast

Posts: 1,148

|

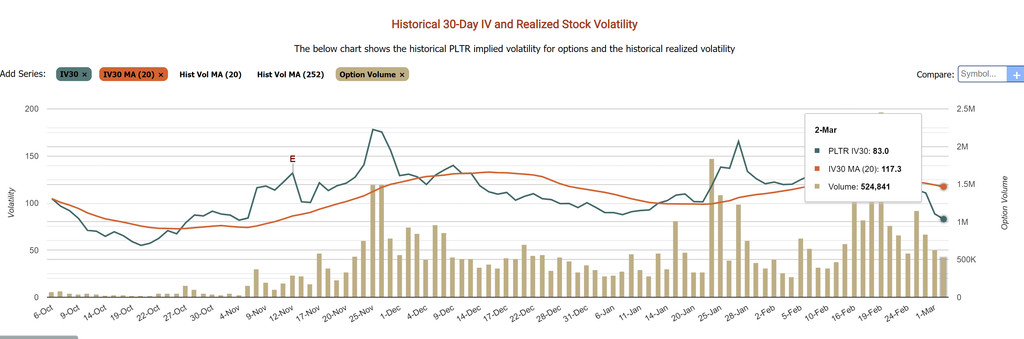

7sins do you think the IV crush on PLTR will go back up if we get a little run up here soon? Or prepare for the premiums to stay at these prices for awhile now that we are out of ER, maybe wait till around next ER? I know its all driven by the demand, so I would assume on a run they would shoot back up again or closer to the next ER?

|

|

|

|

|

|

#7077 | ||

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

Quote:

|

||

|

|

|

|

|

#7078 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Bought NKE calls today for July expiry. They haven’t moved much since their previous blowout earnings, and they are sitting right on the 100 day moving average. IV is still not bad at around 35%, and I expect share price (and IV) will run into earnings over the next few weeks.

Also bought SRAC. Speculative, but man what a cool company. Basically a space valet and space janitor all in one lol. |

|

|

|

|

|

#7079 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7080 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

The 200MA is at 120, and I'll average down if they get there over the next couple weeks. However, they've held and bounced on the 100MA pretty solid the past month, so I am not convinced they will go much lower unless there's an earnings miss or significant broader market sell-off. I'll likely liquidate a good portion of my calls pre-earnings though (I own shares as well, which I'm holding). |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.