|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#9991 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

Still two feet in, dollar cost averaging all the way down to lower my cost basis, own now 100k+ shares and various options so it is a meaningful position for me. Patent issues should be settled soon and I think the resignation of these two execs are a good sign. Next ER is soon and will factor in their $30M EU approval payment from Otsuka. Been a wild ride, the joys of biotech investing.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#9992 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

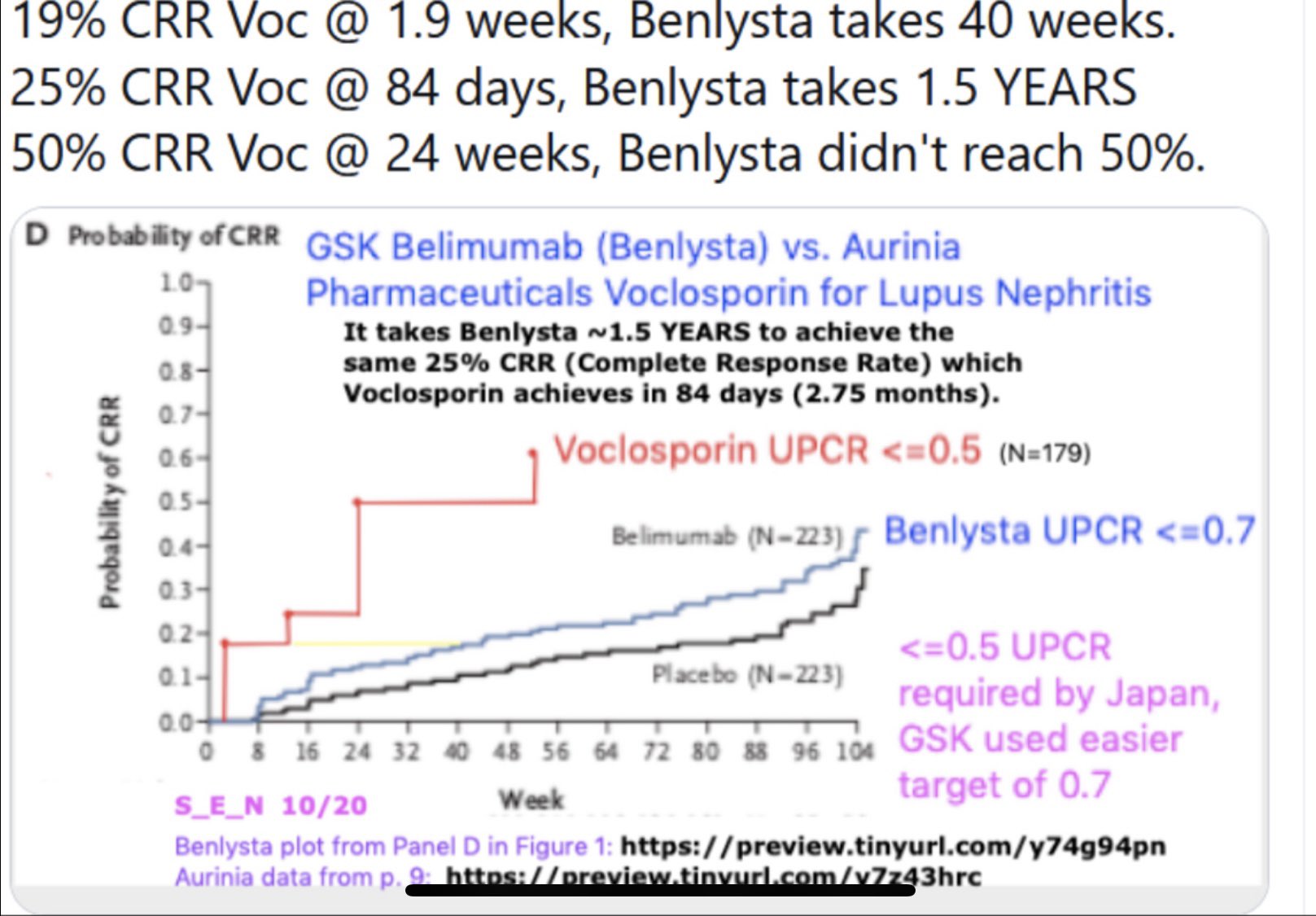

Not invested, haven’t looked into this stock in a while so some of this might be incorrect, but I have major questions regarding the cost of voclosporin. I believe it’s somewhere around 75k-90k/year, vs benlysta at ~45k/year (someone correct me if I’m wrong). I also recall the CEO had said they have margins of 97% or something crazy. Epidemiology suggests that patients with LN tend to be in a lower socioeconomic bracket (insurance questions). Outside of the US under funded healthcare models, there are also usually several hoops to jump through before getting access to novel agents at that price. Apart from this, while belimumab may not be quite as efficacious for rapid effects compared to voclosporin (though, there are no head to head trials to say one way or the other), belimumab is a good medicine for LN while also having significant benefits for organ systems outside of the kidney that are affected by lupus. When we are talking drugs that are this expensive, that is a major consideration and I wonder how much of the forward projections are based on an annual price that’s just not realistic to support the scale of adoption they need.

Here’s a link to a cost-benefit analysis for lupus nephritis only (full systemic lupus manifestations not considered). Voclosporin did not meet thresholds for willingness to pay in this study, but benlysta did: https://cjasn.asnjournals.org/content/17/3/385 |

|

|

|

|

|

#9993 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#9994 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#9995 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

I realize we can find articles to justify whatever we might be thinking. Articles on all things these days.

But this seems appropriate to me, based on my own thinking. Just because we used to do it a certain way, doesn’t mean that’s the way to do it now. https://www.yahoo.com/finance/news/i...100042271.html

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#9996 | |

|

"TRF" Member

Join Date: Feb 2019

Location: Santiago, Chile

Posts: 147

|

Quote:

Sent from the voices in my head and transcribed by their drinking buddy. |

|

|

|

|

|

|

#9997 |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

I’m going to be that guy…did this thread die as soon as the market got difficult?

I think most would benefit from a high quality active fund manager. The expense focus has devalued, but more important than ever to have someone that can dedicate their time fully. |

|

|

|

|

|

#9998 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

on todays episode of things you'd never think would be real -

$1.2T company loses 20% of its market cap in less than 1 min |

|

|

|

|

|

#9999 |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

Have to love when valuations are driven by emotions and inaccurate forecasts. Baked in revenue projections and earnings projections being focused on such a short-term period such as quarter over quarter, combined with beta in the hands of everyone in ETFs, does not do well for making efficient markets. Nowadays it's almost like even if you identify misevaluations, you have to fight the supply demand behavioral dynamic driven by mass beta in the hands of retail investors. Too much passive that just has to buy because of market cap and sell at the worst time to rebalance indices.

|

|

|

|

|

|

#10000 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

Quote:

|

|

|

|

|

|

|

#10001 |

|

"TRF" Member

Join Date: Aug 2018

Location: HK

Posts: 4,365

|

Maybe all the money went to fixed income and decided to sit in 3 and 6 month treasuries. So...much to do about nothing other than look at what watches to add to collection!

|

|

|

|

|

|

#10002 | |

|

"TRF" Member

Join Date: Feb 2019

Location: Santiago, Chile

Posts: 147

|

Quote:

Sent from the voices in my head and transcribed by their drinking buddy. |

|

|

|

|

|

|

#10003 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

https://www.yahoo.com/finance/news/l...191000969.html

https://news.yahoo.com/legendary-inv...123514315.html amazing. two experts in the field. two opposite viewpoints. granted Siegel, is clearly talking to long term investors. But wether long or short term, no one wants to buy high, when the prices could very well be dramatically lower in the very near future. time will tell.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#10004 | |

|

"TRF" Member

Join Date: Jan 2013

Real Name: SMD

Location: LGA/EWR/ORD

Watch: AP/PP

Posts: 3,661

|

Quote:

|

|

|

|

|

|

|

#10005 | |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

Quote:

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

|

#10006 |

|

"TRF" Member

Join Date: Jan 2013

Real Name: SMD

Location: LGA/EWR/ORD

Watch: AP/PP

Posts: 3,661

|

|

|

|

|

|

|

#10007 | |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

Quote:

Truly…it makes sense.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

|

#10008 |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

|

|

|

|

|

|

#10009 | |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

Quote:

|

|

|

|

|

|

|

#10010 |

|

"TRF" Member

Join Date: Aug 2018

Location: HK

Posts: 4,365

|

|

|

|

|

|

|

#10011 |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

I am actually grateful that the fed did not pivot.

All that talk about starting to slow down hikes was making me nervous. We need to be feeling the pain. Things need to change. If the markets go running again and everyone feels flush, folks are buying more and more with less and less supply. inflation will get worse. layoffs are coming. unemployment will rise. growth will stop. commercial industrial real estate bubble will pop. consumer debt is record high. savings is at record lows. folks are way underwater on many of the "things" they bought. things have to get worse before they get better.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

#10012 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Michael

Location: RTP, NC, USA

Watch: ♕& Ω

Posts: 5,095

|

Tuesday I found an email in one of my folders from December. It was a promo piece from The Motley Fool, the investment guys, with their top 5 recommendations.

For grins, I looked up the stock price for each in December and compared them to the current price. I am unaware of any splits. One went from 41 to 4. Another is unchanged. One went from 37 to 24. Another went from 49 to 17. And the last went private, I have no idea at what price. So there's that. I am waiting for the "buy" signal that we have reached bottom. Unfortunately, my ability to recognize the signal is impaired, or if you prefer, non-existent, so I guess I need to start buying now, and DCA. I'm not sure that I'm quite as negative as Seth is, in the post above, but the more I read it (I've reread it three times now) I'm starting to think that he has some good points. And some of the recent earnings announcements have included low forecasts. So maybe I won't start buying yet.

__________________

Enjoy life - it has an expiration date. Disclaimer: Please note that the avatar is not an accurate representation of how I look. The camera adds 10 pounds... |

|

|

|

|

|

#10013 |

|

"TRF" Member

Join Date: Aug 2019

Real Name: Phillip

Location: Right here

Watch: SD43 Daytona Blusy

Posts: 1,799

|

I don't think we're going back to a low interest rate environment as we've experienced in the past 15 years. As a result, I tend to watch closely at what the Fed does and says to give some forward guidance.

Listening to Powell's post rate increase speech and subsequent Q&A session yesterday, here is what I took away from him: - housing has been affected by rate hikes, but little else. - It's way too early to talk about a pause let alone a pivot, but we will talk about a slowing of rate increases in Dec. and then in Feb. but there is no stop to raising rates in the foreseeable future. - The tight labor market continues to be a problem for inflationary pressures and we don't know how that will change as the participation rate is low and the increase in supply of labor the analysts expected never materialized. - Fed funds rates may go into restrictive territory and if so, we don't know how long they will have to remain there to get inflation back down to 2% - It's going to take a while to get back down to 2% inflation rate. - If we over tighten and go into recession, we can always quickly lower rates as a measure to combat this Reading between the lines, there will be 2 more prints on inflation before their Dec. meeting and it sounds like the increase can be anywhere from .5 to 1%. |

|

|

|

|

|

#10014 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,146

|

Municipal bonds are viable now. Probably rates continue to go up for a bit. Not sexy.

|

|

|

|

|

|

#10015 | |

|

"TRF" Member

Join Date: Feb 2017

Location: USA <> BKK

Posts: 5,912

|

Quote:

people do realize that a large buying population of luxury goods are middle class people who want to exude what they believe to be a luxury lifestyle, right? some guys are constantly chirping that luxury goods markets will be unaffected in a recession, due to them being flush with cash anyhow, but it's quite opposite the truth. also re: some other posters, I'm essentially completely cash at this point still waiting on my tiered entry points. I think a couple more weeks will give a better outlook. I'm still of the theory there's some propping up continuing to happen until post Nov 8 |

|

|

|

|

|

|

#10016 | |

|

2024 Pledge Member

Join Date: Oct 2011

Real Name: Seth

Location: nj

Watch: Omega

Posts: 24,697

|

Quote:

I am with you on this. And I realize that I too am speculating. But I cannot imagine how this goes in any other way. I do think that watches will continue sliding along with literally everything else. I too am most cash. I am still invested, but minimally, and only top tier blue chip stocks. Some short term bonds, some gold. But I also sold a high ticket car, and I have my beach house and one of my rentals both in the process of being sold. I am raising as much cash as possible to put into the markets. slowly, over time. But I do not think we are there yet.

__________________

If happiness is a state of mind, why look anywhere else for it? IG: gsmotorclub IG: thesawcollection (Both mostly just car stuff) |

|

|

|

|

|

|

#10017 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,447

|

Speaking of liquidation, with the Japan Yen hitting lows, go long?

__________________

__________________ “Life should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'” -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#10018 |

|

"TRF" Member

Join Date: Aug 2018

Location: HK

Posts: 4,365

|

|

|

|

|

|

|

#10019 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#10020 |

|

"TRF" Member

Join Date: Jan 2015

Real Name: Wayne

Location: Canada

Posts: 4,356

|

AUPH today... wow!

I was looking at starting a position this week around $8 glad I held off |

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.