|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#8251 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Quote:

|

|

|

|

|

|

#8252 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

I can finally find more earnings with HZAC longs than loose change hidden in my couch  . Doubled my position at close yesterday so good to see that there with DFKG PIPE news today. Yes, I should have bought warrants at $1.90..... . Doubled my position at close yesterday so good to see that there with DFKG PIPE news today. Yes, I should have bought warrants at $1.90.....

|

|

|

|

|

|

|

#8253 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

BBIG Price Target = $40.00

Oct. 14, 2021 2:28 PM ETVinco Ventures, Inc. (BBIG) https://seekingalpha.com/instablog/2...e-target-40_00 this is way out there but no complaints... |

|

|

|

|

|

#8254 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#8255 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

|

|

|

|

|

|

#8256 |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,788

|

Talking Stocks 2.0

|

|

|

|

|

|

#8257 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

people are crazy and are actually expecting 50+. i feel like fair value is somewhere around 15 but if it does squeeze (hate that term) i can see it going a bit higher

|

|

|

|

|

|

#8258 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

I added another 300 at $7 just because it was under my avg for kicks and lol.. |

|

|

|

|

|

|

#8259 | |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,788

|

Quote:

Yeah, I feel the same. Figure I will get out before $15. Sent from my Apple privacy invasion product |

|

|

|

|

|

|

#8260 | |||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Been a good ride so far, I am guessing your avg blended price is near mine at ~1.51?

Quote:

Quote:

Quote:

Don't forget record date for Tyde shares is supposedly Monday, I would expect big volume into that. Also you have A LOT of people underwater who bought from $9-12 and expect selling pressure along the way. If we clear $12.50 I hope to see all of you in Vegas. Will trim a bit of my exposure at $10 and along the ride way up.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|||

|

|

|

|

|

#8261 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

|

|

|

|

|

|

|

#8262 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Did you notice that $112.74-$112.20-$112.90 between 1:30-2:30EST? Only took 200K TSM shares to drop that but 600K shares to bring it back up..

|

|

|

|

|

|

#8263 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

I didn't notice, great catch, I think you are right and it is probably MM's playing here for options tomorrow. Although we saw 11300 volume today for $115 strike tomorrow which I thought was peculiar. Strong volume though, unfortunate the float is so large but long term I think this is going to be a nice little trade for us.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8264 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Yay for BBIG! Waiting for the COTY train to come back around. Nice pop today!

|

|

|

|

|

|

#8265 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#8266 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

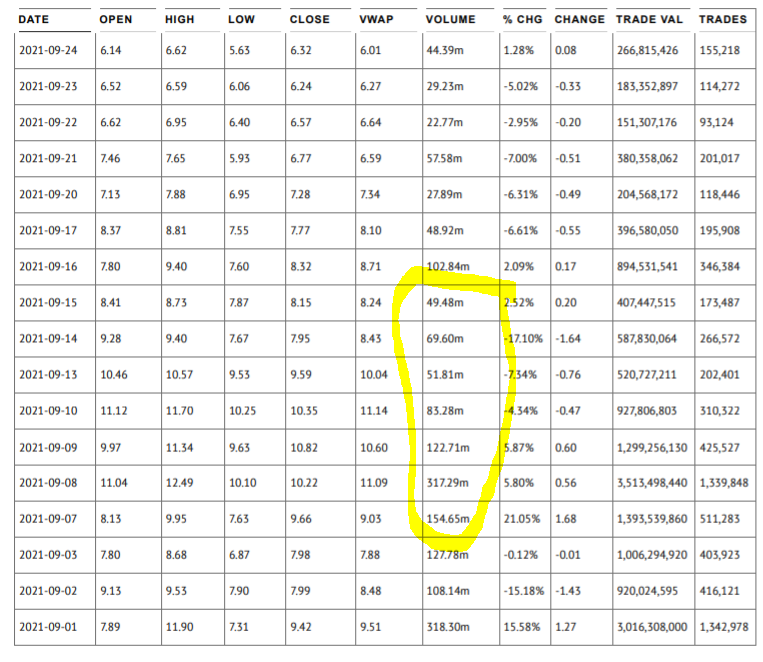

There was tremendous volume from $8-$12, 800M shares plus traded not including dark pools which is 10x+ float. I have to imagine a good portion of those individuals did not sell at a loss but as frantic as retail investors are, I suspect they bail when they breakeven, then new investors come in and like you said, when FOMO kicks in it will be interesting to see where it takes us. Plus investors like all of us who trim along the way but with enough momentum anything is possible. Personally I believe there is a lot of manipulation going on here, how can you move over 300M shares and only gain 5%. Imagine writing naked calls here :X

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#8267 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

Quote:

|

|

|

|

|

|

|

#8268 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

7ís book recommendation arrived last night.

Amazon had it. Will start tonight.

|

|

|

|

|

|

#8269 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

HZAC popped $0.85. 400K already from a 517K avg daily. Doubled my stake from yesterdays from that DKNG announcement.. Guess I should have bought more |

|

|

|

|

|

|

#8270 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

ďHorizon Acquisition Corp. Shareholders Approve Business Combination with Vivid Seats Inc.

NEW YORK, Oct. 15, 2021 (GLOBE NEWSWIRE) -- Horizon Acquisition Corporation (NYSE:HZAC) ("Horizon"), a publicly traded special purpose acquisition company, announced today that in an extraordinary general meeting on October 14, 2021, its shareholders voted to approve its proposed business combination (the "business combination") with Vivid Seats Inc. ("Vivid Seats"), one of the leading secondary ticketing marketplaces in the country. Approximately 95.5% of the votes cast at the meeting were in favor of the business combination. Horizon also announced today that in a special meeting of its public warrant holders, such holders voted to approve its proposed warrant agreement amendment. Approximately 99.9% of the votes cast at the meeting were in favor of the warrant agreement amendment. The business combination is expected to close on October 18, 2021, subject to the satisfaction of certain customary closing conditions. Following the consummation of the business combination, the common stock and warrants of Vivid Seats are expected to begin trading on the Nasdaq Global Market under the symbols "SEAT" and "SEATW," respectively, on October 19, 2021. ď |

|

|

|

|

|

#8271 | |||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

Quote:

I work on the fixed income side but I spoke to our equity trader because you raise good points. He said larger funds and institutions can actually create "synthetic" shares which would not be included in the float and that is why you can see high volume with little movement as they manipulate the price. Even today, 80m volume in two hours and only positive 263bp.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|||

|

|

|

|

|

#8272 |

|

"TRF" Member

Join Date: Dec 2012

Location: Rhode Island

Posts: 63

|

https://www.cstproxy.com/horizonacqu...L1/default.htm

I haven't gone through the entire document but the redlines seem to start on page 763. You still get paper docs? ;-) |

|

|

|

|

|

#8273 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Quote:

Many thanks! |

|

|

|

|

|

|

#8274 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

i've heard about synthetic shares but have to read up some more about it |

|

|

|

|

|

|

#8275 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

For those in COTY, some more good PR today below. I've been adding to my 7c here under $8 and rebuilding my position I sold in the mid 9s. I believe investor day is in 8 days in which I will be paying close attention to their guidance, I think this is going to be a great ER. I asked my gf below, who is super particular and knowledgeable in makeup (obviously less particular in the men she dates) and she said CoverGirl has completely changed the game and greatly improved over the last few years, she is seeing much more shelf space at stores too. Jefferies reported sales of the CoverGirl Clear Fresh Skin Milk Foundation increased 269% compared to last year after TikTok lifestyle influencer and Barstool Sports creator Brianna LaPaglia, who posts under the name Brianna Chickenfry, posted about the makeup. The Skin Milk foundation represented 8% of CoverGirl's recent sales gains, and has sold out online at Ulta and Amazon, according to Jefferies. On September 20, LaPaglia told her 1.3 million followers she spent seven years searching for a lightweight and affordable foundation, and eventually settled on CoverGirl Skin Milk. https://www.businessinsider.com/tikt...rocket-2021-10

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#8276 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#8277 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

I know we have spent a lot of time in this space researching, when you have a free minute and if you are open to it, I would love for you to take a look at YSG and let me know your thoughts. They are the COTY equivalent in China and number one in many categories with great growth and margin, although still losing money albeit getting closer to profitability. Bigger issue is it being a chinese stock which the headlines with Chinese stocks caused the price decline but to move from $24 to $3 seems quite oversold. Not like Xi is going to ban makeup and his current initiatives have nothing to do with this industry. Let me know your thoughts, stock is struggling to find a bottom but could pose for some potential great upside. I'll make a post with a few slides from their investor deck next week but I am really taking a deep dive here.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8278 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#8279 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

That was a great call! Thank you for that! I didn't avg down as much as I should have in the $137-$138's but a more than solid return nonetheless. That was a great call! Thank you for that! I didn't avg down as much as I should have in the $137-$138's but a more than solid return nonetheless.  Now I guess the only thing thats left to do is to start Mandala Mondays and Cincoro Sundays!

|

|

|

|

|

|

|

#8280 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

@7sins Following the TSM rabbit hole here and I like ASML so looking for your thoughts on a potential play.

ASML is the only manufacturer of equipment size of buses to print etchings on these 5 nm chips. Listen to minute 15:30. Maybe LRCX is going to get in on it as well. https://youtu.be/GU87SH5e0eI It appears that the world if going to build 55 new fabs in the world over the next 4 years. US maybe doubling their new fabs over the next 10 years. I think their order book is gonna be lengthy. ASML and LRCX both report their qtrs on Thu? |

|

|

|

|

| Currently Active Users Viewing This Thread: 4 (0 members and 4 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.