|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7561 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

I am not sure you will see BO discussed today (I suspect this eventually happens, near $30 but who knows at this point), I think more important is guidance and we will get our first look at script numbers for the quarter. Not sure if you saw last week but Cigna recently announced insurance coverage for Voclosporin which is another positive. Been adding here as much as I can in the 12s, pre-pfda approval prices. Fingers crossed aftermarket. IV is very high, great stock to write covered calls against and collect high premium.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7562 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

Quote:

Good luck to us later today! |

|

|

|

|

|

|

#7563 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Anyone buying gold/gold miners? In light of many other commodities pushing all time highs, gold seems to be quite the laggard.

|

|

|

|

|

|

#7564 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

averaged into viac over the day but amazingly it just kept going down

sq with a pretty big earnings beat but looks like it has already flattened out after hours... |

|

|

|

|

|

#7565 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

|

|

|

|

|

|

#7566 | ||

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

I posted a few weeks back on the gold double bottom then had a fake breakout to breakout over $1800/oz this week. Am in: GOLD - Barrick. Earnings two days ago and looks fine. NEM - Newmont. Newmont is the biggest with Barrick as second. NUGT - 2X gold derivative.. Hope the run is just starting. Quote:

I doubled down premarket and watched the sh!tshow all day. Donít care and will sleep well tonight. They did the same to Target after 4th qtr earnings. It took two weeks before the stock ran. Lesson here is buying/owning short term options = very risky. I will continue to sell puts and get paid while collecting dividends. |

||

|

|

|

|

|

#7567 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

Quote:

|

|

|

|

|

|

|

#7568 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Not too surprised, given they only had 48 days to sell the drug post approval. Definitely an over-reaction aftermarket. Over 250 patients in 2 months. This is also with coverage still growing and annualizes to over 1000 by year end - assuming no growth in uptake, which is unlikely. That is 97.5 million in revenue annualized and should move the SP as the year moves on, ER call was disappointing, can only blame so much on COVID. You planning to buy more tomorrow and DCA?

I am on board with you too, Jan 2023 $50C. The company has higher yearly revenue than marketcap lol, that dislocation is not sustainable and is severely undervalued. Even with an absurd about of debt, their assets and cash are still worth more than the current sp if the company liquidated everything. Not to mention the value of all their content, Netflix or Disney should just buy them out already. This will take some time to shake out but a good long term play.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7569 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

Auph... oof Iím gonna feel that in the morning

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7570 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

|

|

|

|

|

|

#7571 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

I haven't reviewed the data or listened to the call yet. Based on the aftermaket result I have very low expectations of hearing anything good. I'm down significantly on a relatively big position so not feeling particularly keen on chasing. Just have to reevaluate my thesis and see if I agree with your initial take that this may be an overreaction.

Ironically the lower the market cap the higher the probability of BO if the perception of value is there... |

|

|

|

|

|

#7572 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7573 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Nice day for our FDX calls, blowing past another ATH at $313, I continue to trim gains. COTY another ATH as well $10.26, I am locking in gains for their ER on Monday. Rather sit on the sidelines given what happened to EL ER last week and will buy back in on the dip.

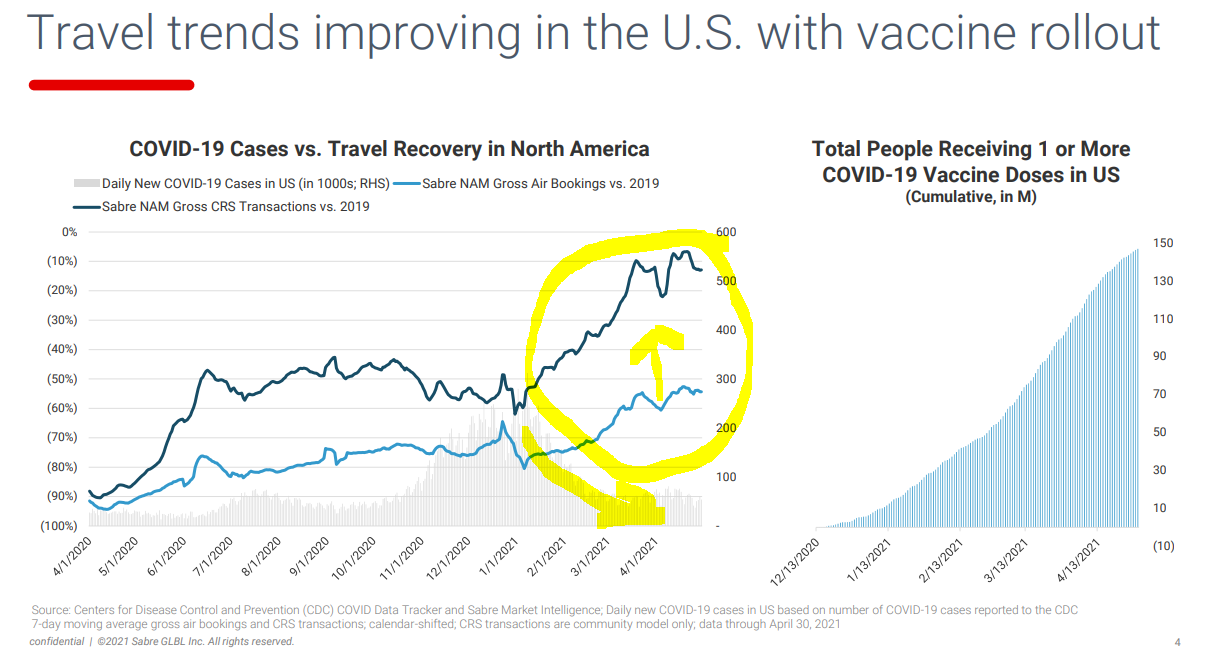

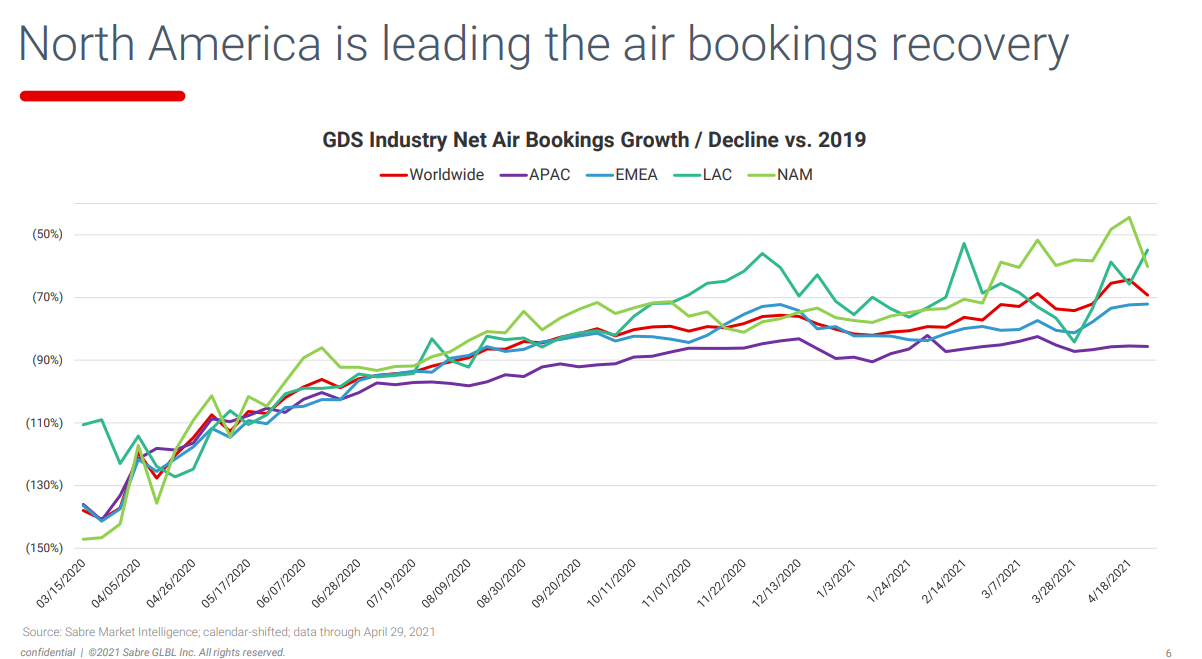

Hope you boys bought that dip on SABR I was pounding the table on, up 5.5% today, back to $13 and I suspect back to $15 over summer. Been spending a lot of time going through research, pulled a few slides from their ER for everyone on here that bode well for SABR and signal a positive trend in travel. They are THE player for North America and Asia bookings. I believe we will see travel trends pickup sooner here than in Europe due to the success of vaccinations - Amadeus is the main player in Europe and their stock has mostly recovered from COVID. I can only say this so many times, do not miss out on this, it will be back to $15 in the next few months and project at least 100-200% gains on 2023 $12c and $15c. Look at the correlation to the drop in covid cases, to gross bookins/transactions vs 2019 coupled with the RAMPANT uptick in vaccinations which will make more people travel sooner over Summer. I suspect this will be the biggest summer of travel in history.  Look at the increase in bookings growth from February to April in NA where SABR is 55% booking mix, that trend will continue and SABR will benefit  SABR is THE PLAYER in north america travel bookings, NA is leading the way and SABR will benefit the most of the total three players in this space (only one other is public and is overseas).  SABR's partnership with Google cloud has help transformed them into using better technology, they have onboarded many new clients during covid and transform their business to fully take advantage of travel recovery. STILL 40% OFF PRE COVID LEVELS AND THEY ARE LEANER AND BETTER POSITIONED NOW THAN PRE COVID.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7574 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

^ Do you know the mix of revenue between leisure and business for SABRE? Read that domestic business and international travel is a big portion of their revenue.

|

|

|

|

|

|

#7575 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

i sold coty as well but got out of it entirely, gonna reenter next week. hopefully that was the right decision lol

|

|

|

|

|

|

#7576 |

|

"TRF" Member

Join Date: Apr 2017

Location: NJ

Watch: 126600, 79220N

Posts: 255

|

Thanks as always for your insights 7sins! I sold out of FedEx today. Still took a loss as I didn't DCA enough but ended up in a wayyy better place than I was last week. It has gone up quite a bit and not sure how much further it can push in the next month or so.

Also, got out of Coty today with a nice gain and rolled AUPH into Jan calls (luckily I went very light on this one!). Still learning about options and have probably broken even in totality but will adjust my strategy moving forward to hopefully find a greater degree of success! |

|

|

|

|

|

#7577 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Sold all my cost basis in COTY, kept a few Jan 2022 $8 calls representing profits only. If they go up, great. If they go down, I’ll buy more at no loss to me.

|

|

|

|

|

|

#7578 | |||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

From CEO: "The other thing that I think is also helpful for people to understand is sort of what we're seeing on the domestic to international mix. Historically, on a precrisis basis, that has been 45% to 55% international. And what we have begun to see is that is in Q2 of 2020, we're at 70-30 mix, domestic to international. It has been improving because when you look at it, the international is more profitable for us. In the fourth quarter, it was a 60-40 mix. We've also, on a leisure corporate basis, have seen some trending in the right direction too. Historically, that has been 40% to 45% on a precrisis basis leisure, 50% to 55% on corporate. And again, in the Q2, we were sort of 75-25. In Q4, we were 70-30. So these are small incremental improvements that we actually see taking place." Quote:

Quote:

If they go down, roll to the $10C or 12C you will get more price sensitivity on the run back up. My plan is to enter back into 2023 $12c and $15c on a pullback. Still believe in this long term as their turnaround and transformation surprises to the upside.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|||

|

|

|

|

|

#7579 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Great idea, Iíll do that Monday. Thanks!

|

|

|

|

|

|

#7580 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,330

|

SoFi/IPOE merger got approved by the SEC. will be effective on 6/1

|

|

|

|

|

|

#7581 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

"$IPOE & @SoFi update: The S-4 SPAC merger is now effective with the SEC. We will start emailing & mailing proxy statements to shareholders of $IPOE (as of 4/29) to vote ahead of the shareholder meeting on 5/27. We intend to close the deal on 5/28 & start trading as $SOFI on 6/1."

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7582 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

Quote:

What did you end up doing with AUPH? After listening to the call I thought they said some pretty dumb stuff but the results didn't change my overall opinion. Bought a crap ton more at 10.05 today. |

|

|

|

|

|

|

#7583 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

I loaded up more Jan 2023 $12C and $15c to DCA, the $12C disproportionately sold off at one point today more, I was able to squeeze a lot of contracts near the bid even on a wide spread. Will be a wait and hold game, not too worried in the long run here.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7584 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

I bought TEI recently. Its a closed end fund with an announced increase in their dividend pay out. Trades at 9.56% discount to net asset value. 11.55% in dividends. https://www.cefconnect.com/fund/TEI |

|

|

|

|

|

|

#7585 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Morning everyone, looks like a great call selling out of COTY last week as I had anticipated a similar result after EL ER missed and Q1 for COTY down 10%. Now starting to build position back that COTY is down 8% today, took sold position from last week and will space out over this week back into Jan 2023 $10C and $12C. If it keeps bleeding will build $15C for more price sensitivity.

Another beating today for tech, some great opportunities to look at specifically TSM as it nears $110 and PYPL under $240.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7586 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7587 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

And holy FDX. My last few calls are just riding free in the wind with a stop loss and loving it. Will liquidate if we breech 320 this week though. Now, just need my small cap tech/green energy to rebound lol. |

|

|

|

|

|

|

#7588 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Quote:

I am mainly looking to fill a the passive income play within my portfolio. This is a play on emerging markets on vaccine production and distribution 3-4 months behind US timeline. Europe and Canada is next with Asia following. Something I donít have to look at and follow constantly. |

|

|

|

|

|

|

#7589 |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

|

|

|

|

|

|

#7590 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

If you're a growth investor (like I am), I know these are painful days. Fintwit is awash in negativity - but don't let it get you down, is all I can say.

A lot of the high flying names are down big, yet their businesses are at their best ever. I have reduced some exposure, as who knows when the pain will end, but I'm still holding onto about 10 names that I truly think will continue to lead into the future. Hang in there everyone!

__________________

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.