|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7771 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

I will say, I have been watching those HZAC warrants (vivid seats) like a hawk every day. Waiting for an opportunity, volume is very low so if we can string together a week or two of broad market underperformance and it pulls back sub 1.50, I am going all in. Hoping I don't miss the train here. Quote:

Remember the days when people were excited about 10% annual returns?

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7772 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

It is indeed a bit of a crowded space, but there are a few things that I really like about Wheels Up. Here is a really fantastic write up about the whole industry and a bit of a focus on Wheels Up as well: https://www.forbes.com/sites/douggol...h=abfaf34520f5 In particular, I believe the digitization aspect for wheels up is second to none, and as a consequence it improves the business flow internally but also makes things easy for the consumer. Their partnership with DAL enhances this, as conceivably customers will be able to book privately through Delta - “here’s the business class seat, and here’s the private plane.” Basically showing the option to those who hadn’t considered it before and are just looking at tickets as they normally do. The membership component I think is also great (and a great add from the Amex side), where it helps to ensure flight availability and steady revenue. Most important though, Wheels Up is currently the second largest private aviation company behind NetJets, but their target consumer is very different and could potentially position them to capitalize on major growth. While NetJets is more focused on business travel and the ultra wealthy, Wheels Up is really targeting the entry-level consumer to private aviation - the single digit millionaire type who is maybe looking for a private short haul US flight to the SuperBowl or Daytona 500 with the boys, a weekend in Vegas, or a wedding anniversary getaway. They are pumping out a bigger social media presence and I can see it as an “instagramable” thing. I think their marketing will take them far. People show their watches, cars, rare bourbons, houses etc on Instagram, and the private jet getaway I think is easily incorporated into that, which Wheels Up has a strong handle on with their celebrity involvement. So between their technology, link with DAL, target market and aggressive marketing, I do think they have a nice moat forming that can position them nicely in the coming years. |

|

|

|

|

|

|

#7773 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Any insight as to why APPS dropped so much out of the blue?

|

|

|

|

|

|

#7774 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7775 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

The Public Warrants will become exercisable on the later of (a) 30 days after the completion of a Business Combination and (b) 12 months from the closing of the Initial Public Offering. The Public Warrants will expire five years from the completion of a Business Combination or earlier upon redemption or liquidation. Redemption of outstanding warrants is dependent on the underlying share price (as either >$18/share or >$10/share), but within 30 days of warrants being exercisable. I believe the initial IPO for the units was September 23, 2020. Given the premium on the warrants for a total cost of $13.50, was thinking about picking up shares here for $10. |

|

|

|

|

|

|

#7776 |

|

"TRF" Member

Join Date: May 2021

Location: SoCal

Posts: 5

|

Stunning how so much of this information and advice here is plain wrong.

|

|

|

|

|

|

#7777 |

|

"TRF" Member

Join Date: Aug 2011

Location: USA

Posts: 91

|

|

|

|

|

|

|

#7778 |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,895

|

You are free to correct whomever you like. Doubtful you will

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

#7779 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

Everybody is expected to do their own DD, nobody is giving financial advice here

|

|

|

|

|

|

|

#7780 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Jun 2019

Location: FL

Posts: 377

|

Quote:

If you thought this was anything close to “advice” then you should probably leave and hire a financial advisor. I personally appreciate those of differing backgrounds and expertise present their ideas. Please don’t be a troll…Or a dick. |

|

|

|

|

|

|

#7781 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Going to be an interesting week for oil after OPEC+ today announced NO deal putting pressure on oil supply. We are already paying over $5/gal here in Los Angeles, maybe Goldman's $100 oil forecast a few weeks back will become a reality.

(Bloomberg) -- Brent oil prices rose above $77 a barrel for the first time since 2018 after OPEC+ failed to reach an agreement on bringing back curtailed output, leaving the market with tighter supplies than expected. Futures rose as much as 1.2% in London. The group’s oil ministers were unable to reach a compromise, keeping current production limits in place for August and depriving the market from the extra barrels it needs as demand recovers from the pandemic. “As things stand now, this is quite a bullish scenario for oil prices,” TD Securities analyst Daniel Ghali said by phone. “We should see the energy market tighten up at a faster pace than we anticipated in recent months.” Talks on Monday followed a delay from last week as the Saudis stood firm about raising output starting in August and extending the OPEC+ agreement to the end of 2022, while the United Arab Emirates sought better terms for itself. The failure by the group to increase supply will further squeeze an already tight market, raising concerns over inflation. Most OPEC+ members backed a proposal to increase output by 400,000 barrels a day each month from August, and push back the expiry of the broader supply deal into the end of next year. To agree to an extension, the UAE sought to change the baseline that’s used to calculate its quota, a move that could allow it to boost daily production by an extra 700,000 barrels. Crude rose for a third month in June as widespread Covid-19 vaccinations have helped revive demand while OPEC+ has curbed supply. But prices at the highest in more than two years have raised worries over its impact on the global economy, and the White House is already voicing concern about rising gasoline prices. While demand signals are strong in Europe and the U.S., the virus is spreading again in parts of Asia, resulting in increased restrictions on movement. Morgan Stanley estimates global daily oil demand is set to increase by 3 million barrels from the May-June period to December. With little supply growth elsewhere, even the proposed increase from OPEC+ will likely keep the market in deficit. That will support Brent prices within the bank’s forecast range of $75 to $80 a barrel in the second half of this year.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7782 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

i'm surprised that the news from opec didn't have any positive effect on oil stocks but i feel like this sector is a minefield. i think i'll try to get in to some positions here this week but have very limited knowledge on it

and of course just when things were looking good with baba again, china tanks didi stock and brings it along lol, this was expected though and knew it was a gamble, still holding though. anyone here in any semiconductors? i spent the last few weeks averaging into a few |

|

|

|

|

|

#7783 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Mar 2013

Real Name: Kevin

Location: Cape Cod

Watch: Submariner 114060

Posts: 1,910

|

I’m looking for more help with setting up stop losses. The ones I set up earlier all expired. I have read around a little bit, very little, and get that I need to do my homework on what to set them at. I am wondering if people here have any sort of general rule of thumb?

I was thinking of setting it at 10% lower than the lowest price in the past month or so. With this strategy here is my worry. If the market goes down +10% and now I am liquid. I really won’t know what to do at this point. What if things start going back up do I just jump back in at let’s say a 5% real loss and let things go as they go? What if things continue to go down let’s say 20%, do I say, okay my friend you’ve just saved yourself from a 10% additional loss, it’s time to jump back in? Or is there perhaps a better percentage to us like 15%, although that seems like a pretty big loss. What do you guys do? |

|

|

|

|

|

#7784 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

What are you buying? Anyone brave enough to buy into INTC at these levels? Quote:

1. You can use a multi-leg stop loss, when you are down 10% sell xyz% of position, down 20% sell xyz% of position. I can't tell you what xyz is as that is dependent on each position and your conviction within it. Personally exiting 100% of a position on first leg down means you usually miss the bounce back, hence why to have a multi-leg. Again is case by case, if there is consequential news you believe the stock can not recover from, then you need to re-adjust. 2. You can combine a stop loss with a stop buy. IE you can sell a certain amount of your position at 10% loss, then buy a certain % of the stock at a 15% loss. This allows you to average down and essentially reduce your cost basis. IE a lot of us did this with FDX as it went from $300 down to $240 then back to $320. 3. The same can be said to lock in your gains, or at least a % of them as the stock/derivatives appreciate. Alternatively I have seen some investors use the 50MA and 200MA to set their stop loss at. Lots of options depending on what you feel most comfortable with. I know it isn't a concrete answer because there isn't one as it really depends on the stock, your conviction and what catalysts exist to move the stock higher? I do believe it is worth considering, on your high conviction trades, to continue to average down to lower your cost basis which leads to more upside should the stock recover.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7785 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

|

|

|

|

|

|

|

#7786 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Mar 2013

Real Name: Kevin

Location: Cape Cod

Watch: Submariner 114060

Posts: 1,910

|

Quote:

And thanks again for the multi-leg stop loss, as soon as I read it I remember reading it from you before. I can be a knucklehead. Thanks. Have a good week! Thanks everyone, my favorite thread! |

|

|

|

|

|

|

#7787 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Seems everything taking a beating apart from big tech. Still a positive long term outlook for me on reopening stocks like COTY, SABR, and a few small cap tech/energy stocks, so I will look to average down if this persists over the next few days and potentially look to trim some tech exposure as it continues to rise.

|

|

|

|

|

|

#7788 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7789 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

Quote:

|

|

|

|

|

|

#7790 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#7791 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Just my .02, it is a 2023 play (especially with just dipping their toes into Asia market and e-commerce) that has delivered YTD and look forward to seeing where we go when normalcy returns. I've learned way too much about makeup and cosmetics this year but looking forward to the next few quarters.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7792 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

My wife’s favorite makeup is It by L'Oréal. She won’t buy a COTY brand to support our leaps :(

|

|

|

|

|

|

#7793 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

Love it Love it

|

|

|

|

|

|

|

#7794 | ||

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

Quote:

|

||

|

|

|

|

|

#7795 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Dec 2010

Real Name: PaulG

Location: Georgia

Posts: 40,694

|

Alright, who did the big short at 2am this morning…or has Cozy Bear penned Warren Buffet’s account to do the bet?

Sent from my iPhone using Tapatalk Pro

__________________

Does anyone really know what time it is? |

|

|

|

|

|

#7796 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,322

|

|

|

|

|

|

|

#7797 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Dec 2010

Real Name: PaulG

Location: Georgia

Posts: 40,694

|

Risk-Off  Sent from my iPhone using Tapatalk Pro

__________________

Does anyone really know what time it is? |

|

|

|

|

|

#7798 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

New Wheels Up (ASPL, soon UP) partnership with Porsche:

https://www.prnewswire.com/news-rele...301327639.html |

|

|

|

|

|

#7799 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

Quote:

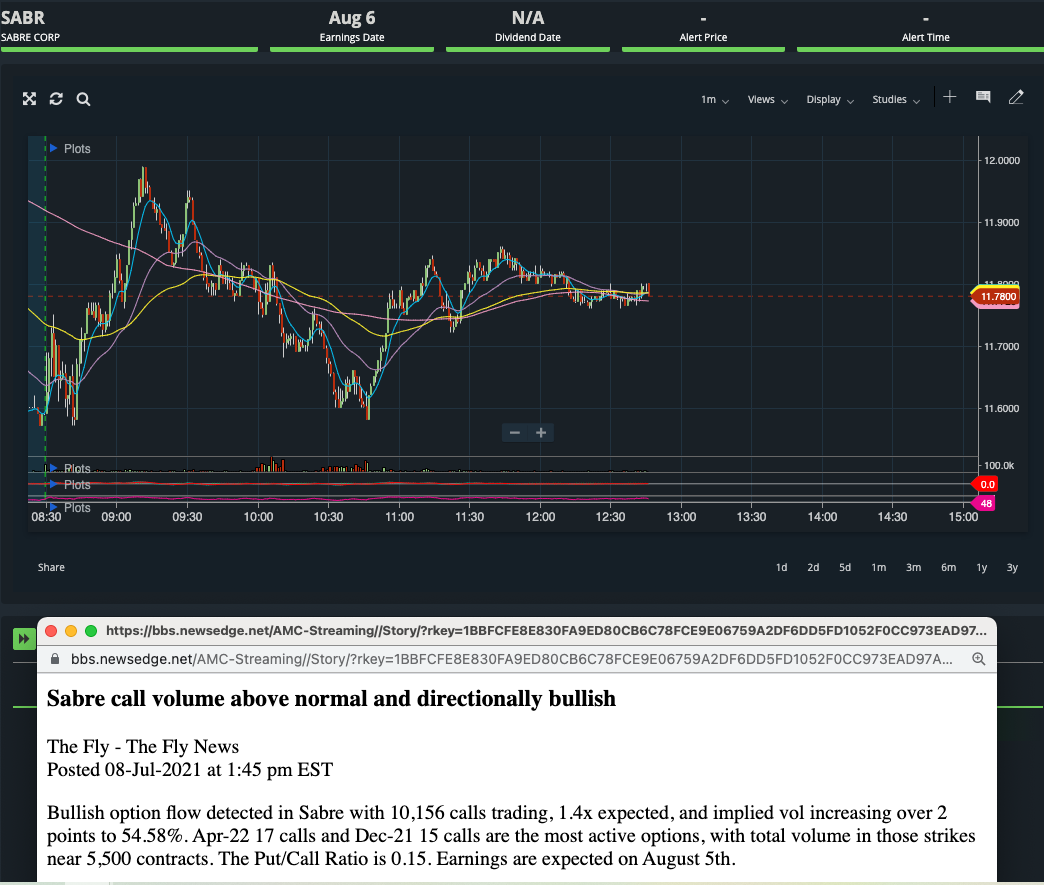

Some good news for us on SABR after a challenging day with delta fears rising.  That is directionally BULLISH with massive call buying and a very low put/call ratio, a positive sign to form for a reversal. The april 22 $10c took a beating today, starting adding there as it is these downward drafts where you can really make money. SABR is now NEGATIVE YTD, truly believe this is oversold given the rebound we are seeing in travel. Also began starter position in TBT jan 2023 $18C and will add if rates keep moving down, can't see rates staying sub 1.30%. Looking at June 2022 TBT chain as well, those are priced well with a decent runway. As always, just my .02 and some moves I am making, not financial advice by any means. If you don't subscribe to TheFly (stupid name) News, I would highly highly encourage you to. Great way to get updates along the day for opportunities and events happening behind the scenes. You have to sift through a bit of the inconsequential emails though. Lastly, been doing a ton of reading on delta variant, hospitalizations and the real impact this could have on travel as I add to my SABR and COTY positions. Few interesting things I found: "On Wednesday, the Delta variant became America’s dominant COVID strain. Yet it’s no cause for panic: The numbers — especially in Britain, which Delta hit hard — show it causes far fewer hospitalizations and deaths, while vaccines remain highly effective against it." "Yes, Delta, does appear more contagious than the Alpha variant about 50 percent more transmissible, which is why it’s outpaced Alpha there. The huge UK case spike didn’t lead to similar hospitalization or death spikes, so Britain’s back on track to lift regulations July 19." "The seven-day average of new UK cases is above 25,000, the highest since late January, when the weekly average had just dropped from a peak of 50,000. But only 2,000 COVID cases are hospitalized, vs. nearly 40,000 in January. Daily deaths average under 20, vs. more than 1,000 in January." "And while Delta caused a 10 percent rise in daily US cases late last month, COVID hospital admissions actually dropped." Anyways, the conclusions here I think are all similar, these are media tactics to say the delta variant is significantly worse. As we are seeing, it is much more contagious but significantly less deadly and leading to less hospitalizations. Also the data shows the uptick in cases are in cities/countries with very low vax rates. All in all, personally I think this is an over-reaction and why I think this is a bit oversold creating an opportunity to average down.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7800 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

That’s good info to know, appreciate it. TBH though, I don’t know how you were able to look that up with the Diablo in tow

|

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.