|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7921 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

DIS doing well w/ Hulu and Disney+.

Not sure what Apple can do to improve their streaming subs. No enough engaging content although i liked Amazing Stories, Ghost Writer (my kids), and The Morning Show. I do like HBOMax. At the end of the day, it's a crowded cage match. Already getting to the point where keeping cable tv might make sense. |

|

|

|

|

|

#7922 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

Quote:

|

|

|

|

|

|

|

#7923 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Quote:

Makes sense as I get Netflix for free via T-Mobile. Then when I upgraded to a higher their account, they knock $12 or so off my bill. |

|

|

|

|

|

|

#7924 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

hood at 80, lol

|

|

|

|

|

|

#7925 |

|

"TRF" Member

Join Date: Aug 2010

Location: Clemson

Watch: G Shock

Posts: 608

|

I'm really curious. It seems the old way of thinking has gone out the window. I bought HOOD at 37, not a lot but now it has doubled in 2 days. I'm happy about that, but it also has me worried. It's not normal for the rate of returns we've been getting and it shows no signs of slowing down.

The truth is that stocks are only worth what someone will buy them for and it seems the appetite is endless right now. People laughed at AMC, but AMC stock is worth just as much as Boeing or Ford stock. What I wonder about is whether we are at the bottom of a new normal or the top of an old one. |

|

|

|

|

|

#7926 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

FSLY getting destroyed. From their press release:

“During the second quarter, we also managed through a significant outage that impacted our Q2 results and will have an impact on our Q3 and full year outlook. We have a couple of customers, one of them being a top 10 customer, that have yet to return their traffic to the platform. We also had several customers delay the launch of certain projects, which delayed the timing of traffic coming onto our platform.” Yikes… |

|

|

|

|

|

#7927 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

Coty and sabr options getting eaten alive. Delta variant really impacting my recovery portfolio.

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7928 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

Quote:

|

|

|

|

|

|

|

#7929 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

While I have zero proof, I think the big guys (namely institutions) are involved w/ HOOD’s recent “to the moon” run & getting more rich off it. It’s a popular IPO w/ too much cash & PR involved.

|

|

|

|

|

|

#7930 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

viacom with an earnings beat and some great news on top of that. hopefully this will be enough to get it rolling

ViacomCBS Partners With Sky to Launch Paramount+ in Europe https://finance.yahoo.com/news/viaco...110000717.html ‘South Park’ Creators Sign Massive New $900 Million Deal With ViacomCBS https://finance.yahoo.com/news/south...115249786.html |

|

|

|

|

|

#7931 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2010

Location: In the air

Posts: 679

|

time to get back in fsly??? maybe a little for a quick trade…seems it usually has a bounce

|

|

|

|

|

|

#7932 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

Pluto was a fantastic purchase. $340 million in 2019 and generates $1B revenue. VIAC longs are like abused spouses. Gets back the 6% dump from Tue DISCA earnings dump today and stays in for continued beatings. Lol |

|

|

|

|

|

|

#7933 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

|

|

|

|

|

|

#7934 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

yeah the tuesday dump made no sense to me because like i said i just don't see how disca should be compared to viac lol. i think this sky deal is huge and at this point it makes absolutely no sense that they're trading at 0.9 P/S

|

|

|

|

|

|

#7935 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2010

Location: In the air

Posts: 679

|

up almost $5 from the morning lows…I should of grabbed some, but was tied up this morning. No long term Commitment just a trade

|

|

|

|

|

|

#7936 | |

|

2024 ROLEX DATEJUST41 X2 Pledge Member

Join Date: Jun 2019

Location: FL

Posts: 381

|

Quote:

Yeah, it had a nice reversal this AM but anything more than a day would concern me. Doesn’t look like it will stay above the May low. Big gaps down with lower highs and lower lows… |

|

|

|

|

|

|

#7937 |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,788

|

I dumped MSTR at $716 today. Couldn’t deal with the volatility. Anyone else?

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7938 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

i don't blame you to be honest. i'm super long on btc though and even though i do actively monitor the price it doesn't phase me. leaps during the past few months have messed me up way more mentally lol

|

|

|

|

|

|

#7939 | |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,788

|

Quote:

I got in late April. Stayed through the dips and I’m just happy to have gotten my 5%. Lol Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#7940 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

WHAT A DAY TODAY, got blood flowing in all the right places.

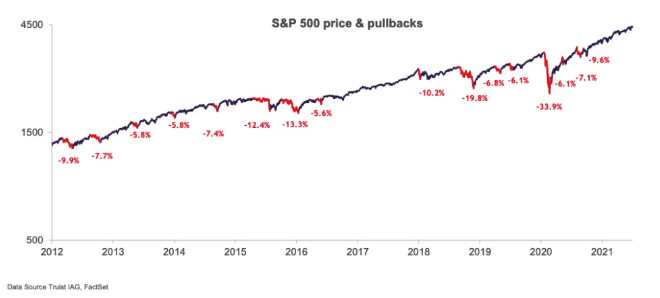

Saw this chart earlier today which I thought was interesting, highlights any 5% drop in the sp500 over the last 10 years. Note any of the 5% drop we saw a very quick reversal, which continue to makes the case why I always suggest to average down, especially when we saw small caps and recovery stocks getting hammered this month.  AUPH!! Finally a great ER, tomorrow is going to be a great day if AH plus 14% is any indication. Over 1M shares traded afterhours. 624% increase in revenue, building pipeline and certainly an improvement from last quarter. All of this bodes well for suitors looking to buy AUPH, the more momentum and revenue they generate the higher the BO price will be. A2 data out in October I believe, BO or not, this looks to finally garner the momentum we have been hoping for and will be Standard of Care treatment. Hopefully the sub $12 days are behind us. Big Pharma is not going to sit on the sidelines and let this miracle drug get snatched up by one of its rivals nor is Peter going to sell it cheap. Would like to see us back to $20, where we were on FDA approval, the fact we are 40% off that is absurd. Nice 6% days for both COTY and SABR today, was starting to run out of cash to average down.  but happy I averaged down after posting those ER slides yest for a nice gain today, I have found averaging down consistently has led to much higher total returns and also major wealth creation I see with ultra high net worth clients. COTY getting a nice run from REV ER yesterday. This quote is great insight into COTY expectations for mass cosmetics sales. Mass cosmetics make up 24% of the portfolio. “All of our segments grew over the prior year as consumers return to stores, counters, and salons – particularly our Revlon Color Cosmetics business, which is performing exceptionally well in the US Mass market. “ This was a BIG beat for REV and also EL that had a big beat reporting huge uptick in fragrance sales (COTY bread and butter). Putting general market sentiment aside, this should bode well for a runup into ER for COTY as we have seen the last few quarters. but happy I averaged down after posting those ER slides yest for a nice gain today, I have found averaging down consistently has led to much higher total returns and also major wealth creation I see with ultra high net worth clients. COTY getting a nice run from REV ER yesterday. This quote is great insight into COTY expectations for mass cosmetics sales. Mass cosmetics make up 24% of the portfolio. “All of our segments grew over the prior year as consumers return to stores, counters, and salons – particularly our Revlon Color Cosmetics business, which is performing exceptionally well in the US Mass market. “ This was a BIG beat for REV and also EL that had a big beat reporting huge uptick in fragrance sales (COTY bread and butter). Putting general market sentiment aside, this should bode well for a runup into ER for COTY as we have seen the last few quarters. Looking to build a starter position into LVS this week, down 25% this month and -32% ytd, I'll post a few slides and thoughts for people to do DD but they have their Macau and Singapore casinos re-opening in the next 6 weeks for a catalyst to the upside. Gambling, Vegas, Macau and casinos will be BOOMING after covid subsides. LEAPs are pretty inexpensive here, trading below pre-covid level, will need to see if there was any dilution during the last year. Was $60 last month, now $40, could be an interesting play and possibly oversold at these levels. Great to see some major green today.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7941 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Record breaking quarter for NET. Beat revenue, 53% YoY growth, added record number of large customers equivalent to signing 2 six-figure contracts daily with strong retention. Total of 125k+ paying customers.

Selling down slightly on low volume AH after running up 80% the past 3 months. The P/S ratio is high, no doubt. But, what many do not yet realize is that their addressable market is forecast to grow to $100B over the next 3 years (a 3x increase from today) - an investment in cloudflare is like an investment on the internet as a whole, the more it grows and the more services shift online, the more cloudflare is needed. It’s so much more than just CDNs, and the constant comparison to FSLY is not really reasonable as that’s just one small part of what cloudflare does as a whole. Likewise, AKAM is just one part of what NET does. Hopefully that point is starting to come across, as 12 months ago NET would have dumped in unison with FSLY or AKAM if they sold off from ER, but today it held up independently. Watching the price closely and will add more leaps on dips. |

|

|

|

|

|

#7942 | |

|

"TRF" Member

Join Date: May 2014

Real Name: Felix

Location: GMT +1

Watch: Yes!

Posts: 2,975

|

Quote:

|

|

|

|

|

|

|

#7943 |

|

"TRF" Member

Join Date: Oct 2016

Location: ct

Posts: 288

|

|

|

|

|

|

|

#7944 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

You are very welcome, happy to help, should note it looks like they sold both of their Vegas properties. They do own MBS in Singapore which is one of the highest EBITDA ran hotels/casinos in the world and some other great properties. Will see where the tree shakes, looks like heavy support in the high 30s. I will add a few more comments when I have the time.

Certainly open to anyone here that has thoughts on this industry, it is something I haven't looked under the hood on. Looking at MGM, WYNN and CZR too, appears LVS has sold off the most but also no online sportsbook where the others are catching up in competition. For everyone else on the SABR train, more good PR this morning from Simply Wallstreet on a 2yr DCF showing the stock is 40% undervalued from intrinsic value. I'm not particularly a fan of SW but their DCF model lets the numbers speak for themself. Turned positive today, nice day for Coty, Sofi and 20% move on AUPH which anyone else on that ride should be green now (esp if averaged down), seeing significant IV expansion in option chain.Stubborn patience paying off. https://simplywall.st/stocks/us/soft...40-below-their

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7945 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,333

|

@7sins thoughts on bbig? looks to be slowly bleeding every day and i've been averaging down through the dips. obviously the play here was to wait for the news so i have no intention of getting out for now but wondering how low it can go now. thinking maybe the bottom could be in the low 2s so i'm holding off for the past few days in case that does happen and i would just add there although i'm down about 40% now. not too worried yet because that -40% can swing to +100% in a day or two with the small market cap but if it goes down to low 2s it might be a bit of a problem lol

|

|

|

|

|

|

#7946 |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Thanks for AUPH. Was in SOLY also resulting in a BO 2X my original entry cost. Perhaps this will be another replay.

|

|

|

|

|

|

#7947 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Would love to hear people’s thoughts on VRCA. I do not own anything here yet. I am not so good at understanding how pharma small caps work and what factors generate these buyout pops, but the company seems intriguing with supposed upcoming FDA news in September. Their cantharidin product is interesting - the chemical has been around for ages, but their applicator could catch on.

|

|

|

|

|

|

#7948 | ||

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,343

|

Quote:

Quote:

Haven't seen an aggressive analyst note like this in awhile, personally I think $50 target on BO is pretty insane and would be a hard sell to an existing company's board at 250%+ current valuation. Anyways, just my thoughts, it started off as a small position for me I posted on here months ago, I've added everytime it went below $12 which ended up happening often and now have a very large 2023 position. Just my .02, it is small cap bio and will continue to be volatile.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

||

|

|

|

|

|

#7949 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

The biggest question that I think remains to be answered is what scenarios would call for Voclosporin use over cyclosporin. For example, even in lupus usually those patients will have multi organ disease, and if there’s one drug that treats everything that might get chosen over multiple drugs (of which voclosporin may be one) that target different things depending on the scenario and costs. Similarly, outside of lupus, it will be interesting to see what other conditions seem to do well with Voclosporin. For many inflammatory conditions, we tend to use prednisone (steroids) as a rescue treatment, but sometimes cyclosporin can be used as well given it’s fast onset. However, often this is just a short term bridge to long term therapy with some other targeted monoclonal antibody type drug like Humira, Stelara, Rituximab etc. So it will be interesting to see what scenarios Voclosporin will be used in, certainly conclusive answers to these aspects are still 5-10 years away at minimum. In any case, it’s certainly a drug with potential. I imagine some of the above will be aspects that will evolve over time, and will be questions that a potential buyout would take into account. |

|

|

|

|

|

|

#7950 | |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,245

|

Quote:

A buyout may be back on the table, most importantly at a price acceptable to PG and shareholders. Offers may have previously fallen through and the new data puts the negotiating strength back into AUPH's favor. Feeling much better about high 20s here in a year. And buyout just got more expensive for any suitors...throw out your low 20s estimate imo. Congrats to you and all the other AUPH owners on this ER! Thoughts on Heron?? I haven't heard much about HRTX recently but this is starting to look like another AUPH-like post approval play. I'm in with an initial position looking for an improved Zynrelef rollout and label. |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 4 (0 members and 4 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.