|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#1 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Gold coin suggestion

What is a good gold coin to invest in under $1000?

|

|

|

|

|

|

#2 |

|

"TRF" Member

Join Date: Apr 2015

Real Name: Jesse

Location: Los Angeles

Watch: TinTin!

Posts: 2,704

|

just get 1/2 oz of any bullion. i wouldn't worry about all the special editions, sealed and all that. it can be hard to get your money back out of those often times.

__________________

2 Factor Authentication Enabled

|

|

|

|

|

|

#3 |

|

2024 Pledge Member

Join Date: Jun 2020

Real Name: Goat

Location: Southwest Florida

Watch: 16613

Posts: 4,794

|

Gold coin suggestion

I wouldnít pay a dime more than current value for any quantity of gold or any other metal. (Unless itís on a watch or jewelry for the old lady)

Disclaimer- I donít do much trading in the precious metals market and have been burned selling in the past. Sent from my iPhone using Tapatalk |

|

|

|

|

|

#4 |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,367

|

Depends...what are your intentions for said coin?

|

|

|

|

|

|

#5 |

|

Banned

Join Date: Jan 2019

Real Name: Mark

Location: South Carolina

Watch: 126711CHNR

Posts: 511

|

You’ll pay a premium for AGEs but can get some of that premium back when you go to sell it...

American Gold Eagles |

|

|

|

|

|

#6 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Thank you!

|

|

|

|

|

|

#7 |

|

"TRF" Member

Join Date: Jul 2012

Location: California

Posts: 22

|

It depends. I’ll stick with the 4 listed below if you want to buy gold coins.

Canadian Maple, 24k pure gold with very low premium. Krugerrand, 22k very low premium. Most recognizable gold coin in the world. Downside not pure gold. Gold Eagle, 22k highest premium. Downside, 22k. Gold Buffalo, 24k highest premium. Downside, Maple is cheaper. But the Buffalo coin is very beautiful. I recommend getting 1oz coins as close to spot as possible. |

|

|

|

|

|

#8 | |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Quote:

Good stuff! I am selling some 1881-4 uncirculated Morgans and want to convert into gold. Sound advice in this thread |

|

|

|

|

|

|

#9 | |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,367

|

Quote:

You'll get none of those in 1 oz. under $1000 Maple Leaves, Krugerrands, and Buffaloes are all reportable....Eagles are not. Krugerrand is not pure gold, but still contains 1 troy oz. of gold. |

|

|

|

|

|

|

#10 | ||

|

TechXpert

Join Date: May 2012

Location: Earth

Posts: 23,491

|

Quote:

Quote:

|

||

|

|

|

|

|

#11 |

|

Banned

Join Date: Apr 2020

Location: here AND there...

Posts: 2,240

|

Under 1k?

none. fractionals always get charged a massive premium. if you have to, maybe something from mexico. I say save for at least a full ounce and get a bullion bar |

|

|

|

|

|

#12 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Yep, going to purchase at least 1oz as advised above. Again, great advice. Iím saving a copy of the thread for reference.

|

|

|

|

|

|

#13 | |

|

"TRF" Member

Join Date: Jun 2020

Location: michigan

Posts: 2,290

|

Quote:

The likelihood of silver outperforming gold at this point almost seems like a given, not to mention your morgans are becoming more and more collectible every year. I don't get dollar coins at melt like I used too |

|

|

|

|

|

|

#14 |

|

Banned

Join Date: Apr 2020

Location: here AND there...

Posts: 2,240

|

no one knows the future... Technical's DO SAY that silver does have the potential to outperform gold in terms of ROI percentage... Platinum might even be higher. Gold will be more stable and less volatile.

But none of these are really an investment I would get into as a ROI play... they are a Hedge play. Historically Gold is a horrible performer in terms of growth and ROI gain, but it's a wonderful preserver of wealth as a correlation to the US dollar. Gold can not even match the Sp500 for returns... and none of them hold a fraction against Bitcoin. |

|

|

|

|

|

#15 | |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Quote:

I fell into some inherited 1881-1884 uncirculated silver dollars that are selling for $350+. See below. New silver dollars are selling for $36 roughly. I donít want to have bulk silver laying around. Gold is easier to manage, at least the way I see it now. IMG_0461.jpg IMG_0460.jpg |

|

|

|

|

|

|

#16 |

|

Banned

Join Date: Apr 2020

Location: here AND there...

Posts: 2,240

|

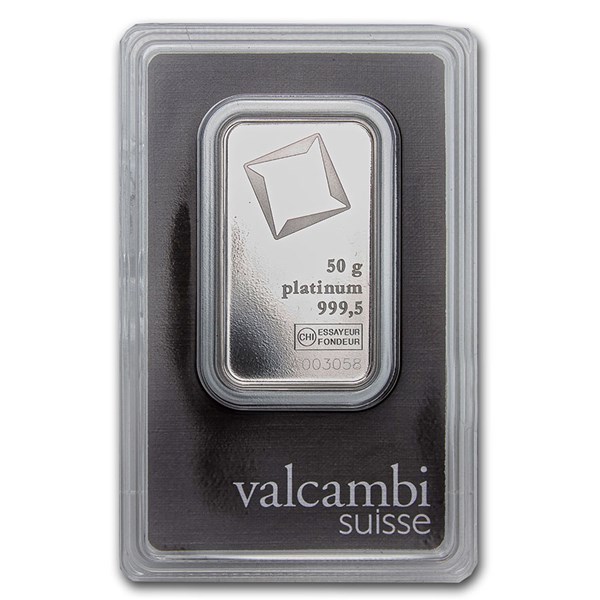

dont pay 35$ for silver these days... try and get it down to 26-27'ish and buy generic or bars of at least 10oz...

compare precious metal pricing. I just bought one of these to have another 50gm ring made...

|

|

|

|

|

|

#17 | |

|

"TRF" Member

Join Date: Jun 2020

Location: michigan

Posts: 2,290

|

Quote:

For the amount you intend on investing neither are going to be cumbersome to manage. Kilo bars of silver would be a great way to dip your toes in the bullion market. No matter what you decide to buy. The goal is to pay minimaly above spot for it. Preferably at spot, or when you've developed relationships with as many dealers as I have, you get it at wholesale cost which is generally 96% of melt. Golds a rich man's game though people will gladly pay a 5% premium. but the only times dealers are going to pay above is when the market is so hot the main bullion houses are on backorder. Best of luck with your Morgans, always wanted one but couldn't stomach the premium myself. They're special coins. If I lucked into those, I'd probably just hold them. The numismatic value of the CC hoard definitely fluctuates, but original government slabbed coins are a niche amongst themselves now as many were cracked open for grading throughout the years. I certainly have seen less and less in the wild every passing year. |

|

|

|

|

|

|

#18 | |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,367

|

Quote:

And there are sales tax exemptions on purchases over $2000, so think about maximizing your buy. |

|

|

|

|

|

|

#19 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

|

|

|

|

|

|

#20 |

|

"TRF" Member

Join Date: May 2013

Location: Vain

Posts: 5,938

|

Premiums are too high.

Dealers charge top dollar premiums on the ASK. Lowball on the BID. Spot or sometimes less (oh those are less desirable now...we have too many...can give you $$$ if it helps you out) PM dealers remind me of pawn shops in many ways. Pass on all that. |

|

|

|

|

|

#21 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Itís interesting to dig through these coins. Back in 1850ís this was the ticket

IMG_0465.jpg IMG_0466.jpg |

|

|

|

|

|

#22 | |

|

"TRF" Member

Join Date: Jul 2017

Location: California

Watch: Shiny One

Posts: 5,367

|

Quote:

|

|

|

|

|

|

|

#23 |

|

"TRF" Member

Join Date: Jun 2014

Location: mississippi river

Posts: 2,957

|

Gold sovereigns, Swiss 20 Francs, Mexican 5 and10 pesos. .900 pure .25oz/.20 oz/.13 oz /.26 oz

|

|

|

|

|

|

#24 |

|

"TRF" Member

Join Date: May 2011

Real Name: Martin

Location: Kenilworth , UK

Watch: The Bluesy!

Posts: 328

|

Interesting read guys, I have a couple of £100 and £50 coins and a British Guinea from 1794 which I am keeping safe to pass on to my daughter.

Cheers  Sent from my LYA-L09 using Tapatalk

__________________

"Time will continue to move forward, whether you choose to make something of it or not" |

|

|

|

|

|

#25 |

|

2024 Pledge Member

Join Date: Aug 2015

Real Name: Basil

Location: Athens, GR

Watch: BoctokKomandirskie

Posts: 2,874

|

|

|

|

|

|

|

#26 |

|

"TRF" Member

Join Date: Jul 2018

Real Name: Kent

Location: New Hampshire

Posts: 1,716

|

Gold coin suggestion

First question to ask is are you collecting coins/medallions or owning gold?

If you want to own gold buy gold from a reputable dealer. You will pay a little above spot. Very easy to sell. If you buy collectible coins you pay for the value of the gold and the coin. Harder to realize the value of the coin when you want to sell.

__________________

Rolex 116610 and 16220 You miss 100% of the shots you don't take |

|

|

|

|

|

#27 |

|

Banned

Join Date: Apr 2020

Location: here AND there...

Posts: 2,240

|

it depends on the desirability of that numismatic piece.

as a general rule, some of the federal reserve releases can be collectable over face, the 'made for the market' numismatic pieces are not nearly as much. this is why most serious collectors/stackers just stack for volume regardless mint or condition... the cheaper the better. |

|

|

|

|

|

#28 |

|

"TRF" Member

Join Date: Mar 2014

Location: New Jersey

Watch: Explorer II

Posts: 232

|

To the OP. I would be looking to visit a local coin shop or two. In my experience the best deals lie there. And with cash there is always a discount. And since you're in the US, I'd stick to US Pre-33 gold coins and gold eagles since they are extremely liquid and you will get a better price when its time to sell.

|

|

|

|

|

|

#29 |

|

"TRF" Member

Join Date: May 2017

Real Name: Dan

Location: USA

Watch: Tudor, Carl F. Buc

Posts: 1,580

|

Ended up selling some proof Morgan silver dollars and purchasing a Maple .9999. Sold the Morganís on eBay for a premium over the dealerís offer. Purchased the Maple thru a spot +3% dealer. No taxes in CA on currency purchases over $1500.

|

|

|

|

|

|

#30 |

|

"TRF" Member

Join Date: Mar 2014

Location: New Jersey

Watch: Explorer II

Posts: 232

|

Very nice. You did well at 3%.

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.