|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7711 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

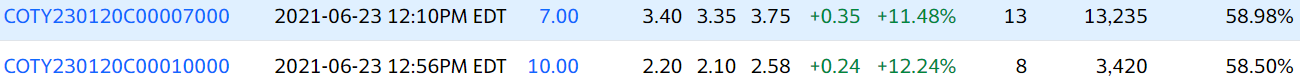

I also picked up COTY call leaps recently. Jan 20 2023 $12.

|

|

|

|

|

|

#7712 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

|

|

|

|

|

|

#7713 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Patience will be rewarded on everyone's COTY 2023 calls. Just remember 28% of COTY sales are in Western Europe and lockdowns have been extended into July. This means next quarter ER could be volatile, will add along the way and keep DCAing. By next year this should be an absolute homerun.

I was talking with Logo and he brought up a great point, that A LOT of makeup has expired and or has a limited shelf-life. That means it will need to be replaced as restrictions are lifted and normalcy returns. Looking for june 2022 option chain to open and will look to add there. LOTS of OI in those $15c Jan 2023 calls, almost 5 to 1 call to put ratio on the 2023 option chain which is encouraging.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7714 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,244

|

|

|

|

|

|

|

#7715 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

|

|

|

|

|

|

|

#7716 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

More great PR on Coty from Nasdaq writeup: https://www.nasdaq.com/articles/4-re...ers-2021-06-17

Similar to what I have been saying over the last few pages here. Looks like price suppression this week to keep it under $9 as options expire tomorrow, would expect the same tomorrow. Looking at adding further ITM 2022 calls depending where momentum goes but being cautious. Hoping we get back to $8 here if volatility picksup during traditional seasonal weakness. Quote:

Either way, I do not have a crystal ball and the stock could continue to rise right after lockup. Knowing my luck, Reddit will skyrocket the stock right after I trim. In the long run I am a HUGE believer in SOFI and think a $30PT is just the beginning in the next 12 months. That aside, there is nothing ever wrong with taking a gain. This is a fundamental part of my process, my warrants were purchased close to $4.50 and trade above $9. Never went broke taking 100% gains. I will trim 30% of my exposure to cash going into the end of the month. If the stock pulls back due to lockup, I will add to jan 2023 calls. If the stock shrugs off the lockup, I'm still participating with the rest of my remaining position. There will always be another 5-10% market pullback and I will add during that period to oversold options opposed to chasing momentum.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7717 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

|

|

|

|

|

|

|

#7718 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#7719 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

EDIT executed coty jan 2023 10C, low balled the bid and got in at 1.95 to bring my avg cost down. These are selling off disproportionately on the 2023 option chain. Will add if it keeps trending down.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7720 |

|

"TRF" Member

Join Date: Jun 2016

Location: USA

Watch: All Rolex

Posts: 6,976

|

I’d probably avoid financials if I was looking right now. James Gorman says his employees that don’t return to NYC deserve a pay cut. Also said can’t come into his NY offices without being vaccinated.

Seems more like a personal choice, since we ignore other public health crisis. The direct correlation between pay and status though, seems like a potential violation of American with disabilities act since pay is seemingly directly tied. Financials seem to move in unity. I’d take this as a negative to both talent recruitment (and retention) and potentially legally (may not be immediate, but long term). Personally looking at quality value and hard assets for personal holdings. And those that offer inflation pass thru to earnings. |

|

|

|

|

|

#7721 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Aug 2010

Location: NorCal

Watch: Yes!

Posts: 6,556

|

Trimmed some off the top here, as we have been running pretty strong on the growth side.

Just a bit to lock in some profit and anticipation of some ups and downs this summer.

__________________

|

|

|

|

|

|

#7722 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

lol COTY up almost 5% and my 2023 calls are stagnant. They'll catch up, but just funny to see the bid at 30 cents lower than yesterday's price for the option.

|

|

|

|

|

|

#7723 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

COTY and Sue did an exceptional job this morning at Jefferies conference. Also note, mask mandates around europe are being lifted, this will be a nice tailwind. No more masks in Spain https://www.reuters.com/world/europe...26-2021-06-18/ No more masks in Italy https://www.aljazeera.com/news/2021/...pandemic-slows No more masks in Switzerland https://www.reuters.com/world/europe...es-2021-06-23/ Etc etc you will see that trend to continue across all of Europe. Bodes well for the long run and we are firmly back above $9. Notably on very strong volume today. Still firmly believe we see volatility for Q2 ER and then real momentum pick backup in Q3 when all mandates are lifted and people are back out to full normalcy for an entire quarter. As you mentioned in our conversation, the fact a lot of makeup has expired during covid and needs to be replaced I think is something most people are overlooking, revenue next few quarters on YoY comps will be off the charts. For those on $SABR, they announced today an increase in expected Q2 revenue due to travel demand picking up as we have been anticipating for awhile now, moved quickly back above $14: https://finance.yahoo.com/m/9d9a073c...t-outlook.html

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7724 | |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Quote:

|

|

|

|

|

|

|

#7725 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7726 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Quote:

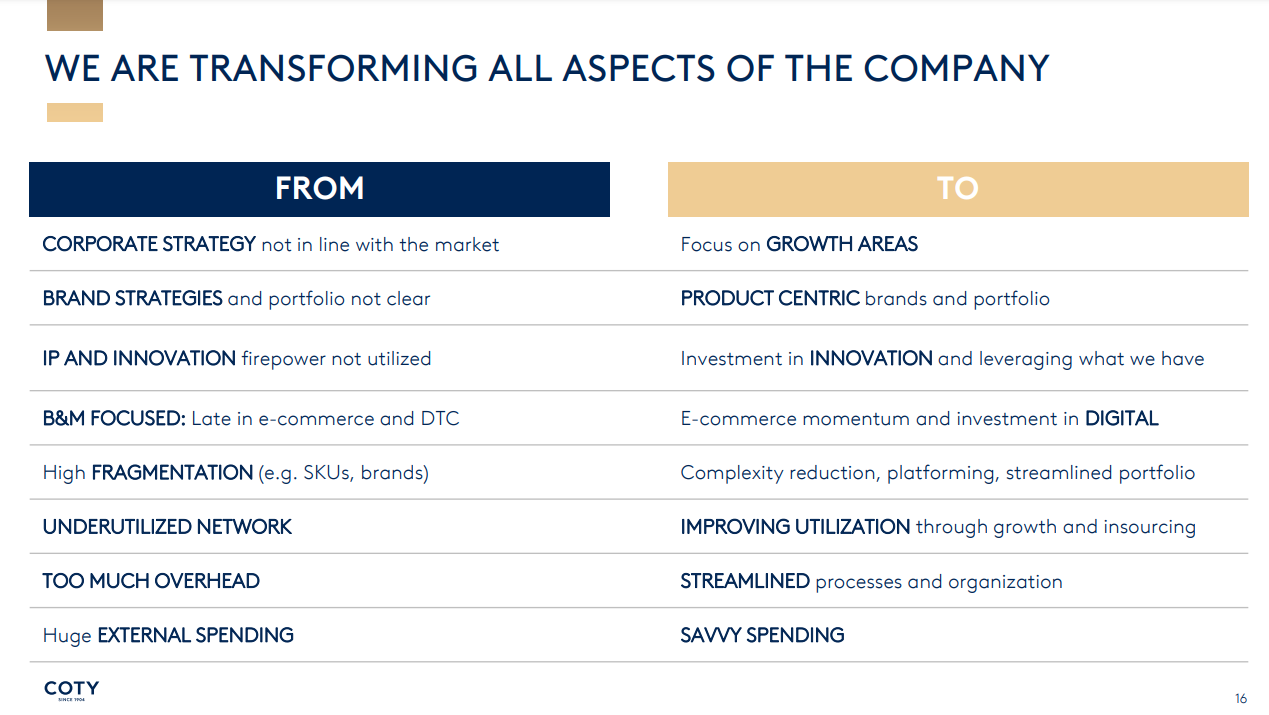

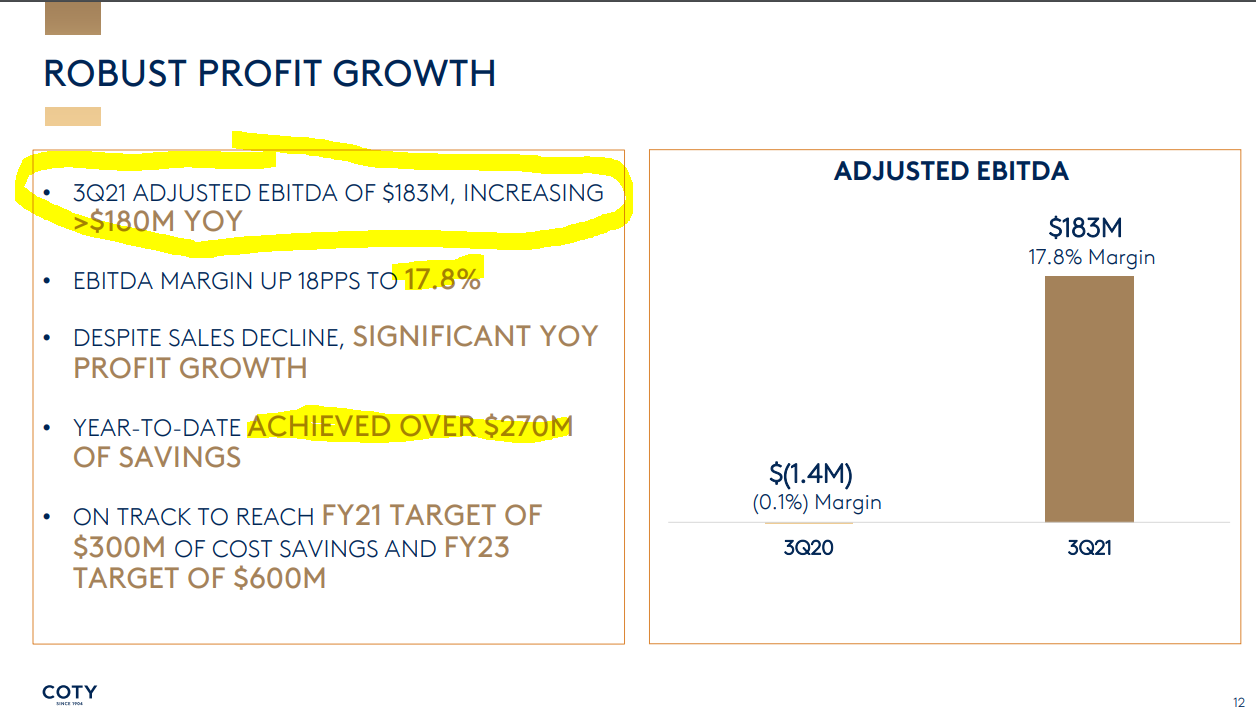

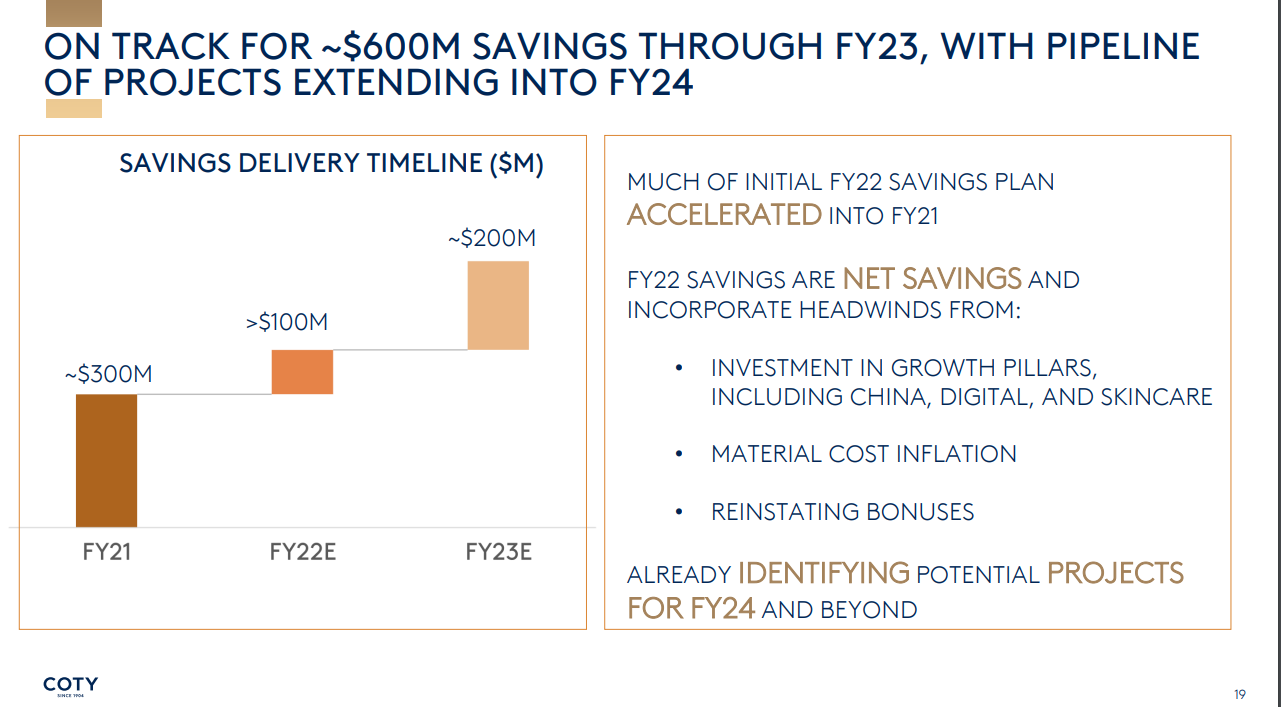

I know a lot of you are on this train. Reason SP has moved 8% in the last two days was their exceptional presentation at Jefferies earlier this week and really highlighted their turnaround story. This was updated from their last presentation I posted the slides from, the new slides I think are important are below. Most notably look at their transformation on turning the company around with their strategic initiatives, MASSIVE increase in YoY Margin and adj EBITDA (this is only going to grow), 300M savings this year and 600m savigs through 2023 projected. The street will also like their reducing debt focus. I think more importantly, looking at transformation, look at the 300bp increase in margin compared to 2019 when the economy was fully open. Hope you guys didn't miss this train, certainly wasn't shy about highlighting Coty when it fell after ER haha.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7727 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

Fortunately I was able to get in some $10c and $15c leaps when you mentioned it. Fortunately I was able to get in some $10c and $15c leaps when you mentioned it.

|

|

|

|

|

|

|

#7728 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

NKE absolutely CRUSHED earnings. I've been averaging into calls the past few months, as I believed all that China business a few months ago was just noise and an over-reaction. Would not be surprised to see new ATHs here very soon.

|

|

|

|

|

|

#7729 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

It was a great day indeed. Volume still low on the Jan 2023 $12c , so I expect even more to gain in the days ahead as they continue to catch up.

|

|

|

|

|

|

#7730 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

pretty big sell off for sofi, guessing in anticipation of a sell off from the unlock. good news is the warrants are finally caught up to the share price though so they're not as low as they were last time it was this price lol

|

|

|

|

|

|

#7731 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Sold all my calls at 350% gain. Figure it's not everyday a company the size of NKE has a 14% day, so I figured better to book the profit and look to add again later.

|

|

|

|

|

|

#7732 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,340

|

Did you mean SOFI? Coty is positive again today. Told yah SOFI would sell off into lockup expiration, I trimmed some warrants for a watch purchase but will look to add to LEAPS soon when the price settles. Down 7% SP on 2x normal daily volume in one hour. Will be fine in the long run, hope we get back to $15 to add more.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7733 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

Quote:

i'm also waiting til next week to start adding to leaps. will probably start if it drops to around 17 |

|

|

|

|

|

|

#7734 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,331

|

350% gain is great, i had a few of those i didn't take before and ended up losing money...hardest lessons learned tbh but i only got into this stuff last year

|

|

|

|

|

|

#7735 |

|

Banned

Join Date: May 2021

Real Name: Martin

Location: usa

Watch: 116610LN, 216570

Posts: 276

|

I'm not buying this weekend, rather let the new week begin, too much risk for me

|

|

|

|

|

|

#7736 |

|

Banned

Join Date: Sep 2018

Location: USA

Posts: 205

|

I was advised to buy COTY which I did, so will see the outcome in a few years.

|

|

|

|

|

|

#7737 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

Talking Stocks 2.0

Coty goes up SABR goes down and then vice versa. Itís actually quite comical to see these swings on my contracts.

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7738 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Just noticed an interesting $13.07 diff between Churchill Capital IV common shares and warrants. Merger vote set for 7/22. Just extremely volatile & seems Lucid really needs to show something (oh, I donít know maybe manufactured cars or even reviewer Ďdrivení events) for the stock to stay about $25.

In SOFI news, ďLock-up Pressures are Dwarfed by Bank Charter Upside Potential - Rosenblatt Reiterates Buy PT $30. We see a unique buying opportunity as a result of this recent selling and ahead of a potentially significant upside catalyst (bank charter approval). Pressure from early investors taking profits (and short-selling ahead of the lock-up expiration) are likely to weigh on the stock in the near term. However, we expect SOFI's bank charter approval process to conclude before year-end (adding >25% upside to our EBITDA estimates). Net/net, our base-case PT of $30 and downside case of $17 reflects asymmetrical risk/reward to the upside." I did some homework on HZAC. Vivid Seats might never surpass Stubhub but the SPAC shares & even warrants are definitely interesting at current prices. I talked to some buddies in the licensed ticket resell industry and each love Vivid. Looks to be worth it the risk at current levels |

|

|

|

|

|

#7739 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Curious re SOFI, not sure what the best play is here. Average into shares and sell calls, or buy otm leaps? The 2023 calls seem quite expensive.

|

|

|

|

|

|

#7740 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,301

|

Also, SABR loading zone in my opinion. That $1 price downgrade has now translated to a price drop of $1.50 in 3 days.

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.