|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#9121 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,366

|

Quote:

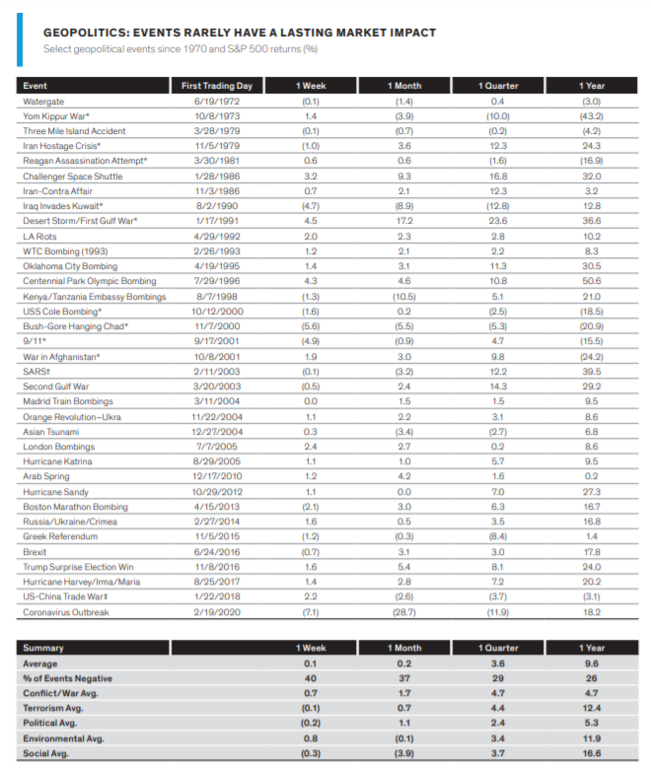

Below is a chart my firm put out yesterday, this takes a deeper dive to all wars and geopolitical events then subsequent returns. Key takeaway is that over time, geopolitical events and wars have little to no impact on the broad markets. This expands on the chart I posted a few days ago.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#9122 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,374

|

Quote:

|

|

|

|

|

|

|

#9123 |

|

2024 ROLEX DATEJUST41 X2 Pledge Member

Join Date: Sep 2018

Real Name: Bill

Location: Indiana

Watch: Explorer 214270

Posts: 6,646

|

Palladium continues to be a strong commodity right now. Much of it is mined in Russia.

__________________

“The real problem of humanity is we have Paleolithic emotions, medieval institutions, and godlike technology.” -Edward O. Wilson |

|

|

|

|

|

#9124 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Not complaining but why did NASDAQ swing so green today?

|

|

|

|

|

|

#9125 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,305

|

|

|

|

|

|

|

#9126 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,653

|

The Fed's trading desk (and partners) kicked into overdrive, perhaps? Seems they're very busy today as "due to technical difficulties, today’s Treasury outright purchase operation - scheduled for 10:10 AM - will be rescheduled. It is now scheduled to take place Friday, February 25, 2022 at 10:10 AM."

__________________

__________________ “Life should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'” -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#9127 |

|

"TRF" Member

Join Date: Nov 2018

Location: Europe

Posts: 3,251

|

I am always amazed how "cruel" the markets can be. In this case concluding "this Ukraine thing is basically over (within days if not 48 hours), a puppet may run the country afterwards (doesn't really matter), the sanctions won't come at a huge cost to the US, not much else to see here, let's move on".

|

|

|

|

|

|

#9128 | |

|

2024 Pledge Member

Join Date: Apr 2019

Real Name: Brad

Location: Purdue

Watch: Daytona

Posts: 9,111

|

Quote:

"The opposite of love is indifference" Harsh indeed.

__________________

♛ ✠ Ω 2FA Active |

|

|

|

|

|

|

#9129 | |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2007

Location: San Francisco, CA

Watch: Date & No Date

Posts: 10,857

|

Quote:

__________________

"You might as well question why we breathe. If we stop breathing, we'll die. If we stop fighting our enemies, the world will die." Paul Henreid as Victor Laszlo in Casablanca |

|

|

|

|

|

|

#9130 |

|

"TRF" Member

Join Date: Feb 2021

Location: MN

Posts: 293

|

I dunno what's up, but on a whim I took a punt and bought some FB/META and SOFI 2023 LEAPS (near the money) this morning as sort of a mid range play and was surprised to see what they did today. Wish I had bigger balls to dive into these things with more gusto, but I'm just hoping maybe they'll buy me a new watch in the next year!

|

|

|

|

|

|

#9131 |

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,653

|

Makes sense Laszlo. Like during 911 the Pres said keep shopping. Would be nice to see the velocity of M2 tic up more than a bit.

__________________

__________________ “Life should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'” -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

|

|

|

|

|

#9132 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Non-political answer & (I’m making this very simplistic) = many feel this will delay / lesson Fed hikes. So tech stocks & growth benefited. This is my take but i’m sure will someone here will have a far better answer. Investing is going to be violently volatile until further notice. |

|

|

|

|

|

#9133 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,366

|

Just my .02 with change to spare but I don't see how that is plausible, if the war continues, you have to expect commodity and oil prices to further rise. Which means that inflation will continue to rise and the FED will continue to raise rates to combat inflation. I agree some of the forecasts, such as JPM suggesting FED raises 9x this year is absurd but the FED will continue to march on at a similar pre-planned pace. Russia represents only 3% of the world's GDP, this war isn't going to send the global economy into recession and thus IMO, you won't see an overly dovish FED as they are battling inflation not recession. Well, not recession in the near future at least.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#9134 |

|

"TRF" Member

Join Date: Aug 2010

Location: Clemson

Watch: G Shock

Posts: 609

|

I think no one cares. Look how fast Afghanistan fell off the radar. Even in the Spring of 2020 during Covid, the market fell and went right back up. Any number of things have happened that would have sent the market into a tailspin a few years ago only last a week at most. We keep hearing buy the dip. I do believe that when the market falls for real it will be hard.

|

|

|

|

|

|

#9135 | |

|

"TRF" Member

Join Date: May 2013

Location: Vain

Posts: 5,949

|

Quote:

Gen Z and their stonk apps don’t care about geopolitics

|

|

|

|

|

|

|

#9136 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Quote:

Agreed. I was referring to the temporary 360 degree turnaround we saw today. Sorry for the Caps. Just copy & paste. “FED'S WALLER: IN THE AFTERMATH OF THE UKRAINE ATTACK, A MORE MODEST TIGHTENING MAY BE ACCEPTABLE.” |

|

|

|

|

|

|

#9137 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,374

|

today was absolutely wild. i had a feeling we would maybe close green or about even but never imagined a -450 to +450 swing for the nasdaq. futures don't look too great now though so not taking today's close for much

|

|

|

|

|

|

#9138 | |

|

"TRF" Member

Join Date: Jan 2010

Location: CT

Watch: 16710,116520,SLA19

Posts: 405

|

Talking Stocks 2.0

Quote:

Been digging into SOFI’s purchases. Their national bank charter will allow them to gain higher margin with access to cheaper money, Galileo and Technisys. Both of these purchases allow SOFI to generate outside revenue while lowering their overhead expense as they innovate in the fintech space. Technisys may have wanted SOFI stock instead of cash. (I would if I owned Technisys IMHO) Galileo’s digital payments platform enables critical checking and savings account-like functionality via its powerful open APIs, providing companies with an easy way to create sophisticated consumer and B2B financial services. The company’s offerings are accessible via mobile, desktop, and a physical debit card. Galileo’s APIs power functionalities including account set-up, funding, direct deposit, ACH transfer, IVR, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorization as well as dozens of other capabilities. Technisys is a custom software company for bank back-end processing hence the “AWS of banking” comparison. It will create a custom software that ties all the different SOFI software applications (banking, trading, loan application, insurance and credit card etc..) together into one. Kinda like SAP/Oracle enterprise softwares. Also, it can sell its services to other fintech companies like Amazon does with AWS and generate outside revenue. I think SOFI has all the right pieces. Bought more yesterday under $10. Stared at the $8.80 premarket but then started watching the news instead. Should have bought more at that price. SQ posted great quarterly results… |

|

|

|

|

|

|

#9139 | |

|

"TRF" Member

Join Date: Dec 2019

Location: Boston

Posts: 1,235

|

Quote:

|

|

|

|

|

|

|

#9140 | |

|

"TRF" Member

Join Date: Jun 2009

Real Name: Brian

Location: Northern Virginia

Watch: One of Not Many

Posts: 17,892

|

Quote:

50 bp is priced in and nothing has fundamentally changed. If we don't get 50 then the Fed will fall further behind and will be seen as not being serious about inflation

__________________

Vacheron Constantin Traditionnelle Complete Calendar, Glashutte PanoInverse, Glashutte SeaQ Panorama Date, Omega Aqua Terra 150, Omega CK 859, Omega Speedmaster 3861 Moonwatch, Glashutte Senator Exellence, Rolex 116710 GMT Master II BLNR, Breitling Superocean Steelfish, JLC Atmos Transparent |

|

|

|

|

|

|

#9141 |

|

"TRF" Member

Join Date: May 2014

Location: Planet Earth

Posts: 794

|

Thank me later… cBrain stock.

|

|

|

|

|

|

#9142 |

|

"TRF" Member

Join Date: Aug 2010

Location: Clemson

Watch: G Shock

Posts: 609

|

Looks like another roller coaster tomorrow. I’m guessing the market will do this for awhile. I’m guessing more social unrest around the world this spring.

Sent from my iPad using Tapatalk |

|

|

|

|

|

#9143 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2010

Location: In the air

Posts: 684

|

AUPH Down 20%??

|

|

|

|

|

|

#9144 |

|

2024 Pledge Member

Join Date: Jun 2015

Real Name: BMF

Location: California USA

Watch: FPJ UTC

Posts: 2,249

|

|

|

|

|

|

|

#9145 | ||

|

2024 Pledge Member

Join Date: Nov 2012

Real Name: Steven

Location: Glocal

Posts: 19,653

|

Quote:

Quote:

This will all pass once the press stops reporting on it, right?

__________________

__________________ “Life should not be a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside in a cloud of smoke, thoroughly used up, totally worn out, and loudly proclaiming 'Wow! What a Ride!'” -- Hunter S. Thompson Sent from my Etch A Sketch using String Theory. |

||

|

|

|

|

|

#9146 |

|

"TRF" Member

Join Date: Jan 2019

Location: North America

Posts: 2,305

|

|

|

|

|

|

|

#9147 |

|

"TRF" Member

Join Date: Nov 2019

Location: USA

Posts: 720

|

|

|

|

|

|

|

#9148 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

I’m having a rough day now…

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#9149 |

|

2024 ROLEX DATEJUST41 Pledge Member

Join Date: Nov 2010

Location: In the air

Posts: 684

|

Surprised at the ammount of stocks up….

|

|

|

|

|

|

#9150 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,374

|

Quote:

|

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.