|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

#7681 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

Happy friday everyone, a few articles worth reading and thoughts behind the scenes.

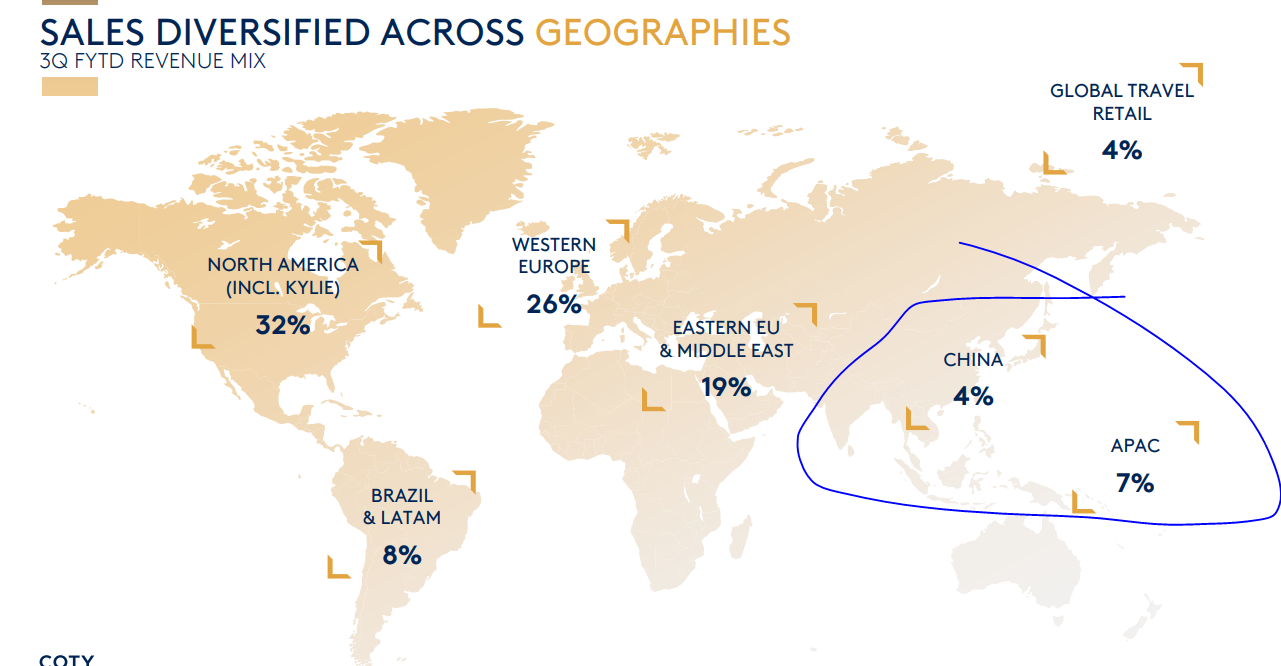

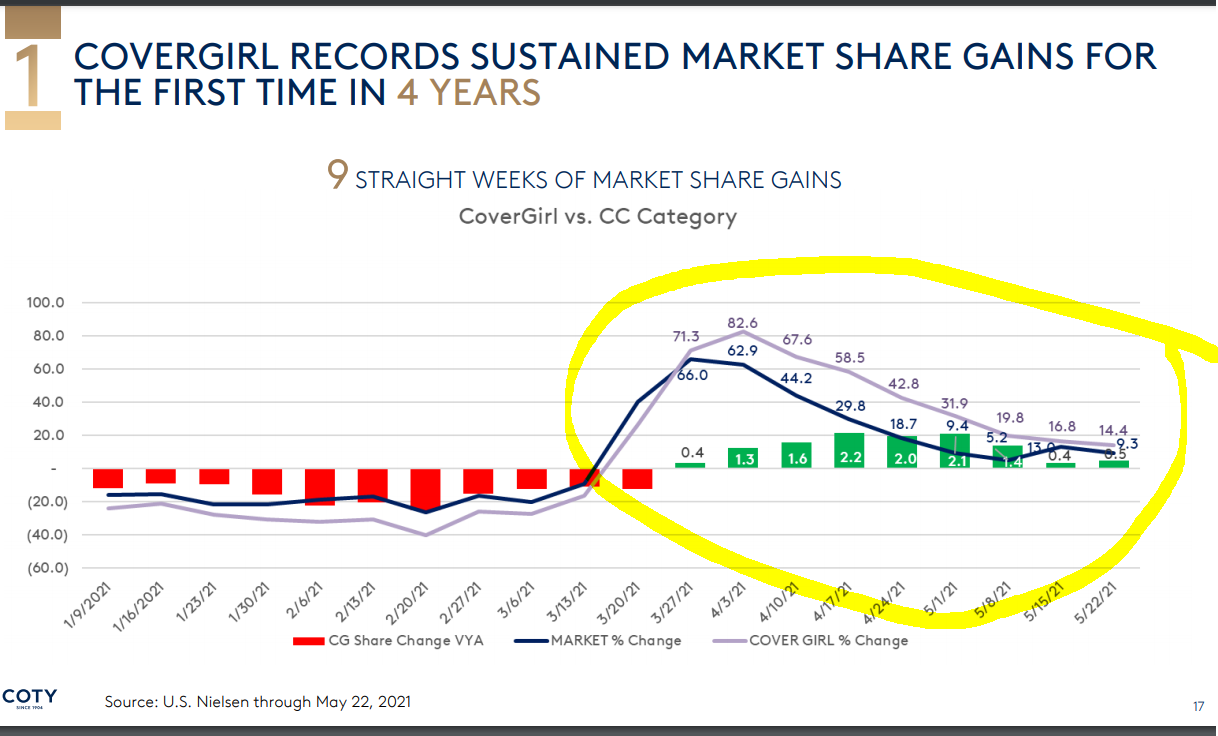

https://www.bloomberg.com/news/artic...-travel-surges This is clearly an article that highlights the improving trend and strength of $BA, which is to be expected as an essential duopoly. I've been following $BA very closely, waiting for it to pull back below $225. What I think the more important take away here is airlines are placing massive plane orders as they anticipate travel to surge. I would argue this is VERY good news for a company that does the infrastructure bookings for airlines, like, ahhem, $SABR. In addition, $SABR also does the infrastructure for hotel bookings. Air and hotel are their two largest segments with car rental bookings I believe third. Hilton sees RECORD bookings in line with travel surge that could make 2021 BIGGER than 2019. If you are not on this train you are missing out, I don't think $20 is out of the question for this year. https://thepointsguy.com/news/hilton...ings-big-2021/ CDC Travel Guidelines Relax for More than 100 Countries, AKA MORE PLACES FOR PEOPLE TO TRAVEL AFTER BEING LOCKED UP FOR 2 YEARS https://www.cntraveler.com/story/cdc...-100-countries Lastly, new upgrade on $COTY: Evercore just raised PT to $15. Coty seen having 70% upside with Cover Girl recovery taking hold • Evercore ISI notes that sales of mass makeup skyrocketed in April as mask mandates were lifted, with Coty's (NYSE:COTY) Cover Girl posting its first market share gain in years. • Cover Girl is viewed as crucial for Coty. While the line only accounts for 10% of the company's sales, Evercore says it register multiples of that in terms of investment sentiment. • Evercore says Coty is seeing a turnaround after shelf space losses ended in Q2 last year. Cover Girl is said to be modestly regaining distribution, while increasing its productivity with retailers. In addition, new Cover Girl users come from Maybelline, e.l.f. and Revlon within Walmart and Target stores - suggesting to Evercore that competitive price points and displays, and innovation are working. • Evercore ISI keeps an Outperform rating on Coty and price target of $15 (70% upside). The 52-week high on Coty is $10.49. • The most recent bull on Coty to pop up on Seeking Alpha is Value Investor Research with its view that Coty appears materially undervalued even under conservative assumptions. Sue presented at a conference yesterday and was EXCELLENT, I posted a few slides below that I thought stood out to me. With the aforementioned travel demand picking up and masks coming off, you better believe makeup and fragrance sales are going to substantially increase. Look at the charts below and their significant acceleration in growth but I think MORE importantly, re-branding to be a big player in luxury (look at their Gucci makeup sales) and turning around covergirl as well. A ship this size does not turn around over night but Sue is making HUGE progress. As I said a few pages ago to get our prior to ER than buy back in the 8s. We will be back in the 10s shortly, will be adding to my Jan 2023 $10c and $12C on the dips. Look at the accelerating growth moving 3 mos YoY to 1 mos YoY  HUGE HUGE opportunity to penetrate asia and grow sales, this was an initiative Sue just started  Look at the significant market share gains for cover girl, notice that this really picked up as the world started to re-open. Remember COTY has a large presence in Europe, as they re-open more, demand for makeup will increase.   Already making an impact in China with as aforementioned, much more room to grow.  I realize that is more than any of us want to learn about makeup but put that aside, look at the trends, look at YoY comps, look at the immense upside in their global expansion efforts. Further upside to come, Evercore PT at $15 as I mentioned earlier, that I think is very realistic by year end. Option pricing here on 2023 calls at $15 represent 200%+.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7682 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

Thanks for the info, how can you say no to all that.. I’m in! |

|

|

|

|

|

|

#7683 | |

|

"TRF" Member

Join Date: Aug 2013

Location: HK

Posts: 2,257

|

Quote:

|

|

|

|

|

|

|

#7684 |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,264

|

Thanks to all the contributors on this thread. I’ve learned a lot from all of you. Up 11% overall YTD which I’m very happy with. Have a great weekend!

Sent from my iPhone using Tapatalk |

|

|

|

|

|

#7685 |

|

"TRF" Member

Join Date: Jul 2007

Real Name: Mike

Location: Virginia, US

Watch: SD 16600

Posts: 4,309

|

That is a nice YTD return although it is below the S&P 500, Dow and Nasdaq YTD. The vast majority of people underperform the indexes including most professionals so you are not alone.

__________________

The fool, with all his other faults, has this also - he is always getting ready to live. - Epicurus (341–270 BC) |

|

|

|

|

|

#7686 | |

|

2024 Pledge Member

Join Date: Apr 2019

Real Name: Brad

Location: Purdue

Watch: Daytona

Posts: 9,084

|

Quote:

Wealthfront 8/10 risk passive portfolio for my 529 and IRA accounts is 11.6% this year. Zero effort. Zero fees paid other than vanguard minuscule ETF fees. I quit the trading hustle a few years ago when I realized I was at best breaking even vs SPY

__________________

♛ ✠ Ω 2FA Active |

|

|

|

|

|

|

#7687 |

|

"TRF" Member

Join Date: Jul 2007

Real Name: Mike

Location: Virginia, US

Watch: SD 16600

Posts: 4,309

|

Yes, when you factor in the fees/expense ratios many pay the underperformance just gets worse especially over the long haul.

__________________

The fool, with all his other faults, has this also - he is always getting ready to live. - Epicurus (341–270 BC) |

|

|

|

|

|

#7688 | |

|

"TRF" Member

Join Date: Jul 2013

Location: us

Posts: 3,264

|

Quote:

11.6% to be exact. I think its a little ahead of the Nasdaq. If AAPL would get going maybe I could catch the other indexes  . . Sent from my iPhone using Tapatalk |

|

|

|

|

|

|

#7689 |

|

"TRF" Member

Join Date: Jul 2007

Real Name: Mike

Location: Virginia, US

Watch: SD 16600

Posts: 4,309

|

My mistake, you're right on the Nasdaq. Plenty of time in the year for AAPL to make a move. Good luck.

__________________

The fool, with all his other faults, has this also - he is always getting ready to live. - Epicurus (341–270 BC) |

|

|

|

|

|

#7690 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

More than 2 million TSA screens on Friday, HIGHEST since pandemic hit. Don't fight the trend!!

https://www.usatoday.com/story/trave...ne/7666912002/ Quote:

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7691 |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,321

|

anyone here in baba or have any thoughts on it? been getting beat up since october due to all of jack ma's antics and controversies but now it's back to 2019 levels basically. i'm not a big fan of getting into chinese companies but opened a small position in it since it seems like it should be bottomed out

|

|

|

|

|

|

#7692 | |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,127

|

Cnbc reports Chinese economy to slow in second half

Quote:

|

|

|

|

|

|

|

#7693 | |

|

2024 Pledge Member

Join Date: Oct 2017

Location: nyc

Posts: 6,321

|

Quote:

|

|

|

|

|

|

|

#7694 |

|

"TRF" Member

Join Date: Jul 2010

Location: USA

Watch: Good ones

Posts: 8,127

|

No problem taking a flyer. I do so myself to a limited degree. As long as you are aware of the risks.

|

|

|

|

|

|

#7695 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

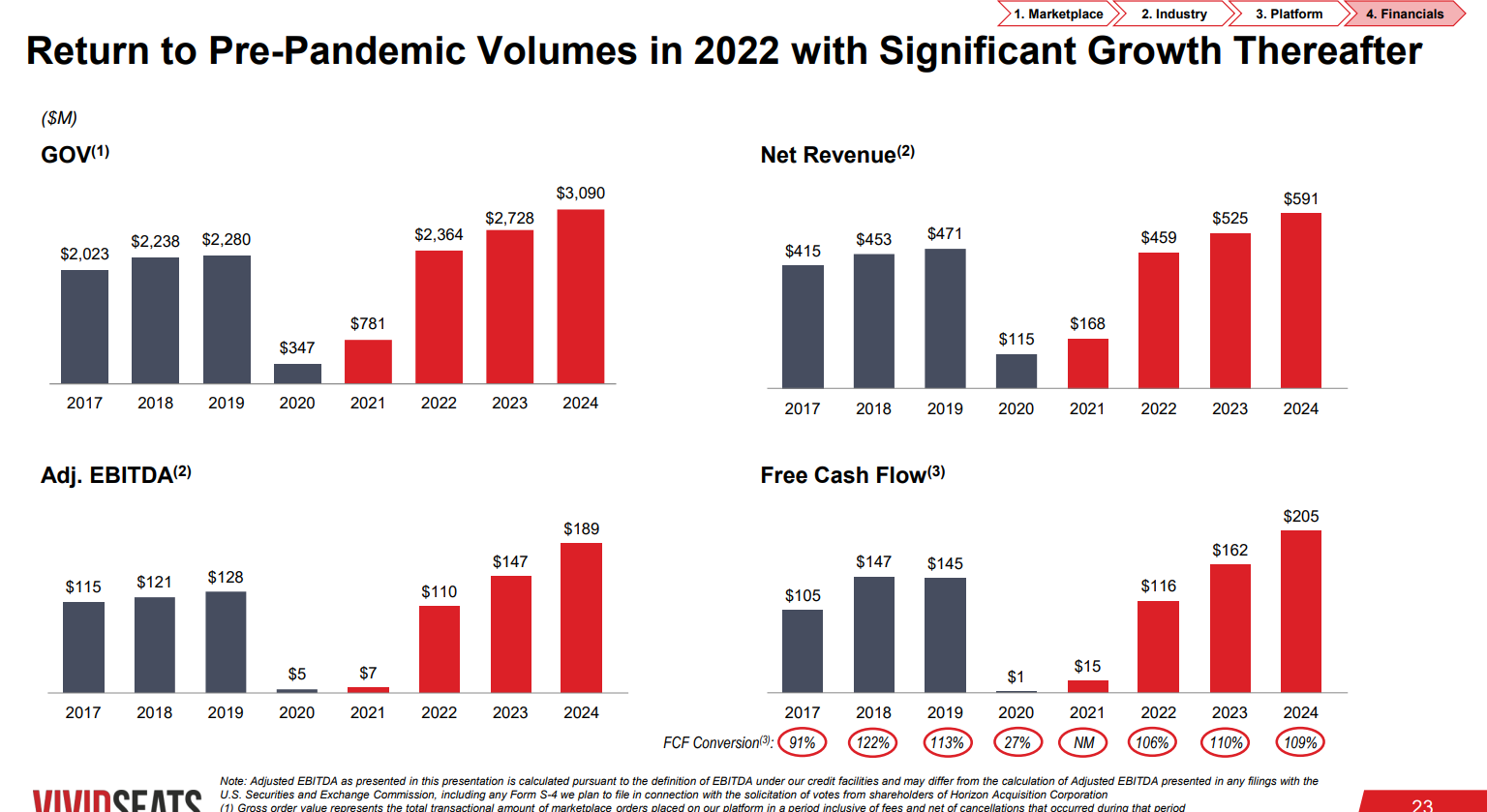

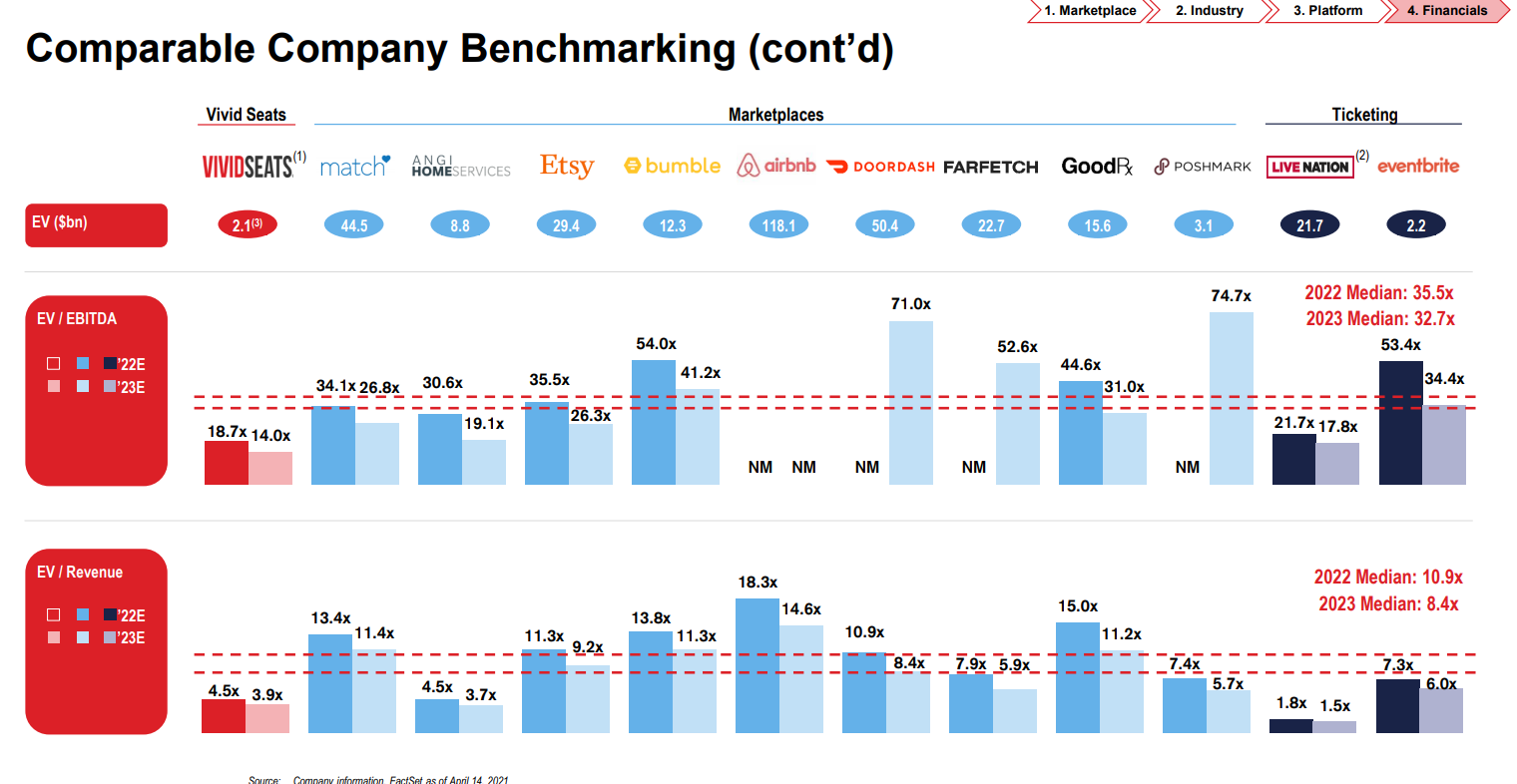

On vivid, $2b seems to be order value and rev at $450m for ‘22? I could be wrong, but would make a big difference in value. They also seems to estimate their growth at a lower pace than Livenation or eventbrite.

|

|

|

|

|

|

|

#7696 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

Quote:

So that begs the question, what would be a proper valuation and what marketshare do they take from peers like stubhub etc? Using bumble as a comparable benchmark was laughable. I think eventbrite is probably a fair comp and one of few that are publicly traded. Looks like vivid trading at about half the value on EV/EBITDA and EV/Revenue as compared to Eventbrite with roughly same EV.   I checked the SEC and looks like no updates besides the normal 8k/10k reports. Will keep this on the watch list and maybe buy warrants on the next market pullback and play the long game. Still surprised it is trading at the $10 floor, no premium what-so-ever. Could be interesting, especially the more I look into how EB has been trading on a relative basis over the last year (albeit low float low vol). Another positive is the founders are converting their Promote shares (zero cost aka free) into Warrants. So now they have much more vested interest in the success. A red flag is looking at EBITDA, look at 17-19, very little EBITDA growth at all then look at 30%+ EBITDA growth from 22-24. That seems a bit optimistic to me.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7697 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

Just for perspective, based on the numbers my company is running we have doubled our ticket sales April 2019 vs April 2021 and doubled our sales May 2019 vs May 2021. Out of those sales, the sales we have had through Vivid Seats have slightly more than doubled April 2019 vs April 2021 and more than tripled May 2019 vs May 2021. We are a large preferred seller of Vivid and I am sure other big players in the industry have seen similar numbers. Concert and sports tickets have have exceeded pre-pandemic demand for the past couple months and I am confident the trend will continue. And again, I think Ebay's sale of Stubhub back in 2019 is a good reference for the valuation of Vivid. I entered a position back when I originally posted this for HZAC warrants which are now up 24%. I will be holding throughout the merger which is planned to take place some time in Q4. My belief in Vivid is based off my expertise in the ticketing industry, so if there are any red flags I seem to be missing please feel free to share. |

|

|

|

|

|

|

#7698 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

Quote:

Do you think this trend would continue going forward as we see demand tick up, with only so many events/tickets to be sold, pushing prices up much higher and ultimately more revenue/better margins for Vivid? Should have took a bite of those warrants when you mentioned them, certainly has been a divergence as the SPAC price hasn't moved and warrants are steadily rising. Congrats on your success in this business and sharing insight to a marketplace I haven't thought much about.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7699 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

We are just one of Vivid's many preferred sellers but based off conversations with others in the industry everyone is benefiting from this pent up demand from Covid and seeing similar results. Many artists have been fighting to book dates for shows in the fall and into 2022. As new tours continue to be announced and previously announced events continue to take place Vivid will see continued revenue. The pandemic was definitely a massive hiccup for the industry but for the past 8 years I have been involved sales have been increasing every year. And it seems everyone's biggest worry of if people will still want to attend concerts in a post pandemic world has been wiped away. Happy to share and thanks for the kind words. We are a microcosm of the industry as a whole and investing in stocks is not my expertise but I hope this helps everyone make a more informed decision :) |

|

|

|

|

|

|

#7700 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

For vivid, as Whats the time pointed out, sales seem to be growing and taking market share from the big players seem to be on the horizon for that, unless they’re increasing their TAM as well. The only red flags for me currrently is in their investor deck where they’re using random comps (like the Bumble one you mentioned) and the fact that in their own optimistic estimates, they will have less yoy growth by 2023 than eventbrite or livenation (the only two relevant comps that they chose to have imo). Doesn’t really scream confidence to me. In terms of debt, I’m going to assume that $670m from hzac pays off all their debt outright for now. |

|

|

|

|

|

|

#7701 | |

|

"TRF" Member

Join Date: Nov 2017

Location: SoCal

Watch: Rolex & AP

Posts: 4,535

|

Quote:

That’s great information, thank you |

|

|

|

|

|

|

#7702 | |

|

"TRF" Member

Join Date: Dec 2020

Location: Los Angeles

Watch: GMT Meteorite Dial

Posts: 32

|

Quote:

Livenation, which owns Ticketmaster, and Eventbrite are both primary marketplaces for tickets (although Ticketmaster does partake in the secondary market as well through Ticketmaster Verified) Eventbrite makes money off the primary sale of tickets where Vivid makes money off commissions from both the person who sells a ticket as well as the person who buy a ticket. Vivid however will not receive 100% of the inventory that Eventbrite or Ticketmaster sold. |

|

|

|

|

|

|

#7703 |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

I used to be a StubHub Large Seller before eBay purchased them. I know the tix business pretty well and have friends who are ticket brokers. Will speak w/ them.

Now I’m very interested in Vivid Seats. Need to do some homework. Thanks fellas for posting about the HZAC SPAC. |

|

|

|

|

|

#7704 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

I can say first hand that Vividseats took the best approach to keep large sellers happy post-pandemic. This was mainly due to a policy that allowed large sellers to get paid out 14 days once orders were delivered to buyers as opposed to Stubhub and even Ticketmaster that would not pay until after the event!

With certain resell exchanges holding payouts for months this obviously incentivized many brokers to solely list their inventory on Vividseats so that they can maintain cashflow and continue to purchase more inventory. This lasted for a couple of months and I believe exchanges such as Stubhub have realized the damage done which is why they changed their policy just in the last 2 weeks to mirror that of Vividseats. I could see vividseats taking the concerts and sports resell sector by a storm. As of today my personal company has sold a little over 50% of its volume on vividseats while my other inventory is split amongst other exchanges i.e. Ticketmaster resale, seatgeek, stubhub, gametime, ticketnetwork, etc... I would like to add that I personally never delisted my inventory on other exchanges due to their payout policies but I know a lot of brokers that did because they did not want to wait months to get their money. Just my personal experience as a seller in this industry and definitely could be bias here. |

|

|

|

|

|

#7705 |

|

"TRF" Member

Join Date: Oct 2016

Location: ct

Posts: 288

|

still think the mega infinity squeeze happens in MSTR

Low Float: only 7 mil shares Buying up all the BTC and demand is insane when they raise money Possibly shell company for the FED to be buying bitcoin without alarming any other country Shorts around 20%+ Becoming a levered vehicle for Hedge funds Literally the most exciting stock I have EVER seen in my 20 + years. If BTC pops off this will have an epic run like we have never seen. Talk about putting all the chips on the table GOOD LUCK toss a couple bucks and let it ride, if BTC dies you lose a little amount. If btc rips to 400k you get 1-5X+ the returns due to shorts and low float. |

|

|

|

|

|

#7706 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

For those following along on SOFI, new coverage initiated (second one now) at outperform, PT $30 which is about 70% upside. I am hearing them be called the trinity with SQ and PYPL. Continues to be a great long term hold and interesting note below on the intiation. Small float today but I believe float is going to move significantly higher end of month which could create downside vol and add on the dips.

Also, for those with a quick few minutes, great short read on tech making a case it will go higher: https://money.yahoo.com/3-historic-p...133034044.html. I suspect we see some vol over the summer months. SoFi Technologies (NASDAQ: SOFI) just received its second formal analyst rating after completing its SPAC merger on June 1. As with the first rating, the second rating is a Buy, giving the company a perfect 10/10 analyst rating score. After the close Tuesday, Rosenblatt analyst Sean Horgan initiated coverage on the stock with a Buy rating and $30 price target. The next big thing in sports betting is here. Sporttrade is modeled after the financial markets, bringing price transparency, liquidity and reduced transaction costs to sports betting. Sign up here. Horgan said SoFi has a "powerful cost advantage over incumbents which will lead to dramatic disintermediation over the next 5-10 years, leaving substantial primary bank accounts, revenues, and market value up for grabs." According to the firm's research, challengers like SoFi have customer acquisition costs (CAC) typically ranging from $20-$50, versus up to $1,000 for traditional banks. The low cost is possible due to a de minimus physical footprint and viral marketing / P2P network effects as evidenced by the success of Cash App (SQ: Buy) and Venmo (PYPL: Buy), Horgan said. "The shift is already underway, as young people ask their parents to "Venmo them" some money," Horgan commented. "This is a much more powerful customer acquisition tool as compared to checking your bank balance or receiving promotional credit card offers in the mail. This is critical to the success we expect for challenger banks." While competition and consolidation are likely to follow for mobile-first banks, the big bank challenger banks face a “jump ball” opportunity to seize market share from the old guard, the analyst added. He sees SOFI as well-positioned to capture a significant amount of the value hanging in the balance. As for catalysts, the analyst sees the pending national bank charter as a "meaningful catalyst." The average price target between the two analysts is $27.50, suggesting 32% upside from the current levels.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

#7707 | |

|

2024 Pledge Member

Join Date: Apr 2015

Location: USA

Watch: 5 digit models

Posts: 1,515

|

Talking Stocks 2.0

Hi 7sin,

No concerns with further SOFI shares’ unlocking ? I’m also high on SOFI at current price levels & long term outlook Quote:

|

|

|

|

|

|

|

#7708 | |

|

"TRF" Member

Join Date: Mar 2011

Real Name: B.

Location: Beverly Hills, CA

Posts: 3,336

|

Quote:

Definitely a concern with shares unlocking, I think current float is 67m shares and it will be closer to 800M after unlocking. I have found share unlocks to be much more detrimental for companies that are grossly overvalued, like the play we did on $SNOW a few months back. Not so much the case here with SOFI and from my experience, share unlocks from IPOs have been more severe than SPACS. Typically they bounce back if they were not overvalued. The question is, when shares unlock, how many look to cash in and sell or hold (or do investors see more upside and not sell, new $30pt helps)? If more look to sell, I am not sure we can hold $22 levels. My personal plan is to trim about 30% of my warrants, should SOFI dip or pullback with the market, I will use that cash along with adding additional monies to 2023 leaps for SOFI. One could also buy one month puts, $20P are ~$1.15 as insurance protection against a long position should an unlock takes the wind out of its sails. SOFI is a long term hold for me and will look to add where I can.

__________________

Richard Mille RG RM030 || Richard Mille RM72ti || AP 26240 50TH Green Royal Oak Chrono || AP Royal Oak Blue JUMBO SS 15202ST || AP ROO Diver Green 15720ST || ♕ Rolex Platinum Daytona Diamond 116506 || Cartier Santos |

|

|

|

|

|

|

#7709 |

|

"TRF" Member

Join Date: Apr 2019

Location: SF Bay Area

Posts: 86

|

Just bought more COTY Jan 2023 $10C. Been watching it for a while and I couldn’t resist at the current price.

|

|

|

|

|

|

#7710 |

|

2024 Pledge Member

Join Date: May 2019

Location: California

Watch: 114060

Posts: 442

|

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | |

| Display Modes | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.